Dollar recovered mildly overnight with treasury yield. The dollar index is now back at 101.25, comparing to this week’s low at 100.26. 10 year yield closed at 2.389, comparing to this week’s low at 2.313. 30 year yield closed 2.985 after touching 3.000, but recovered from this week’s low at 2.913. Stocks were mixed as major indices were bounded in tight range with DJIA closed down -0.11% at 19804.72 and S&P 500 up 0.18% at 2271.89. Fed chair Janet Yellen said that it "makes sense" to gradually raise interest rate. And she warned that "waiting too long to begin moving toward the neutral rate could risk a nasty surprise down the road – either too much inflation, financial instability, or both." And more importantly, "in that scenario, we could be forced to raise interest rates rapidly, which in turn could push the economy into a new recession." Yellen also pledged to "closely follow" with economic policies and factor them into Fed’s policies.

Fed’s Beige Book economic report showed that the economy continued to expand modestly through the end of last year. There were signs of tightening in labor markets are "district reports cited widespread difficulties in finding workers for skilled positions; several also noted problems recruiting for less-skilled jobs." Also, "most districts said wage pressures had increased." And across the country, "pricing pressures intensified somewhat."

BoC left key interest rate unchanged at 0.50% as expected yesterday. The Canadian dollar was weighed down by comments from BoC governor Stephen Poloz that "a rate cut remains on the table". And he noted that "BoC has room to maneuver if downside risks materialize." And he highlighted that "most importantly what we have is heightened uncertainty about trade policies in particular." The markets took Poloz’s comments as a message that BoC will not follow Fed to hike interest rate this year. And the central bank will be on hold at least till 2018.

ECB rate decision will be the main focus today. The central bank is expected to leave monetary policies unchanged. Elsewhere, New Zealand business NZ manufacturing index rose to 54.5 in December, building permits dropped -9.2% mom in November. Australia employment rose 13.5k in December but unemployment rate rose to 5.8%. UK RICS house price balance dropped to 24 in December. Swiss will release PPI in European session. US will release jobless claims, housing starts and Philly Fed survey. Canada will release manufacturing shipments.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3114; (P) 1.3192; (R1) 1.3347; More…

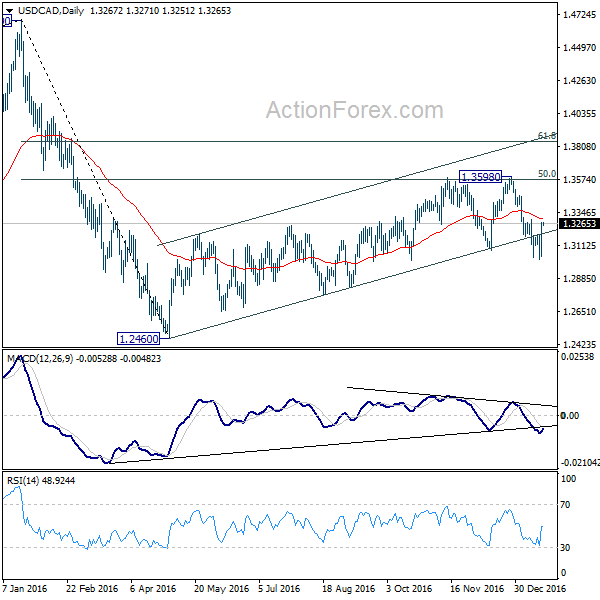

USD/CAD’s rebound and break of 1.3189 resistance suggests short term bottoming at 1.3017 on bullish convergence condition in 4 hour MACD. More importantly, it should have invalidated the case of double top reversal. Instead, price actions from 1.3588 could just be a three wave consolidation pattern that completed at 1.3017 too. Intraday bias is back on the upside for 1.3598. Break there will extend the whole rise from 1.2460 to next fibonacci level at 1.3838. Meanwhile, break of 1.3017 will revive the case of near term reversal and target 1.2460.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg is still in progress and could target 61.8% retracement of 1.4689 to 1.2460 at 1.3838. As rise from 1.2460 is seen as a corrective move, we’d look for reversal signal above 1.3838. Meanwhile, break of 1.3017 will likely start the third leg to 1.2460 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ Manufacturing Index Dec | 54.5 | 54.4 | 54.5 | |

| 21:45 | NZD | Building Permits M/M Nov | -9.20% | 2.60% | 2.00% | |

| 0:00 | AUD | Consumer Inflation Expectation Jan | 4.30% | 3.40% | ||

| 0:01 | GBP | RICS House Price Balance Dec | 24% | 30% | 30% | 29% |

| 0:30 | AUD | Employment Change Dec | 13.5k | 10k | 39.1k | |

| 0:30 | AUD | Unemployment Rate Dec | 5.80% | 5.70% | 5.70% | |

| 8:15 | CHF | Producer & Import Prices M/M Dec | 0.20% | 0.10% | ||

| 8:15 | CHF | Producer & Import Prices Y/Y Dec | 0.10% | -0.60% | ||

| 9:00 | EUR | Eurozone Current Account (EUR) Nov | 29.3B | 28.4B | ||

| 12:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | ||

| 13:30 | CAD | International Securities Transactions (CAD) Nov | 10.23B | 15.75B | ||

| 13:30 | CAD | Manufacturing Shipments M/M Nov | 1.00% | -0.80% | ||

| 13:30 | USD | Initial Jobless Claims (JAN 14) | 251k | 247k | ||

| 13:30 | USD | Housing Starts Dec | 1.19M | 1.09M | ||

| 13:30 | USD | Building Permits Dec | 1.22M | 1.20M | ||

| 13:30 | USD | Philly Fed Manufacturing Index Jan | 16 | 21.5 | ||

| 15:30 | USD | Natural Gas Storage | -151B | |||

| 16:00 | USD | Crude Oil Inventories | 4.1M |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box