The greenback emerged as a winner after most of the the event risks this week and is staying firm in Asian session. In particular, Euro’s selloff after just slightly less dovish than expected ECB provides much support to the Dollar. And the greenback paid little reaction while US President Donald Trump finally signed the tariff proclamation. US equities ended slightly higher overnight with DOW gaining 0.38%, but still kept below 25000 key handle. Nikkei follows and is trading up 0.8% at the time of writing, unbothered by BoJ rate decisions. The greenback will have look towards the final hurdle of the week, the non-farm payroll report.

Technically, yesterday’s rebound in the dollar index carries some significance. It argues that the pull back from last week’s high at 90.93 to 89.40 is a corrective move, and has completed. The immediately focus will be back to 91.01 key medium term resistance. As the index is defending long term fibonacci level of 50% retracement of 72.69 to 103.82 at 82.55, firm break of 91.01 will be a strong sign of trend reversal.

Trump signed tariff proclamation, but backed down from no exemption stance

Trump signed tariff proclamation, but backed down from no exemption stance

Trump finally signed the proclamations of 25% steel and 10% aluminum tariff yesterday. The new tariffs will take effect in 15 days. He said in the White House, surrounded by steel and aluminum workers, that “we have to protect and build our steel and aluminum industries, while at the same time showing great flexibility and cooperation toward those that are really friends of ours,”

But he backed down from his original position of no exemption. As Canada and Mexico are exempted, pending NAFTA negotiations outcome. And he opened the door for reduction in tariffs for countries that “treat us fairly”.

Trump added “I’ll have a right to go up or down, depending on the country, and I’ll have a right to drop out countries or add countries.” And, “we just want fairness. Because we have not been treated fairly by other countries.”

North Korea Kim to meet Trump on denuclearization

Separately, Trump agreed to meet with North Korean leader Kim Jong-un for nuclear talks. The news came after South Korean National Security Council chief Chung Eui-yong said Kim “expressed his eagerness to meet President Trump as soon as possible”. White House spokeswoman Sarah Huckabee Sanders said the meeting will be at “a place and time to be determined.”

Trump also tweeted “Kim Jong Un talked about denuclearization with the South Korean Representatives, not just a freeze,” “also, no missile testing by North Korea during this period of time. Great progress being made but sanctions will remain until an agreement is reached. Meeting being planned!”

Kansas City Fed George: Risks predominately to the upside

Kansas City Fed President Esther George said “risks to the outlook appear to be predominately to the upside.” And she urged that Fed should “carefully calibrate its policy to lean against a potential buildup of inflationary pressure or financial market imbalances.”The “predominately to the upside” description is in-line with her hawkishness. Other members generally see risks to be “roughly balanced”.

Draghi downplayed implication of easing bias removal

Surprising to most market participants, ECB dropped the easing bias in the forward guidance. While this had initially sent the euro slightly higher, it reversed as President Mario Draghi reinforced that the act was ‘backward looking’ and would not affect future monetary decision making. Policymakers remained confident over the growth outlook but again raised concern over weak inflation. As such, the updated economic projections saw upgrades in the growth but downgrades on inflation outlook. Going forward, the focus is on the tapering process of ECB’s asset purchases which stay at a monthly pace of 30B euro. Meanwhile, ECB’s forward guidance would gradually focus more on the interest rate path, and its relations with inflation. More in ECB Surprisingly Removed Easing Bias, Draghi Downplayed The Implication On Future Policy.

EC Tusk on Brexit: Ireland first and no financial services in the deal

European Council President Donald Tusk emphasized that the Irish border issue is a top priority in Brexit negotiation. He said that “if in London someone assumes that the negotiations will deal with other issues first, before moving to the Irish issue, my response would be: Ireland first.” And he warned that “as long as the UK doesn’t present such a solution” regarding a soft border in Ireland, it is very difficult to imagine substantive progress in Brexit negotiations”.

In addition, Tusk explained that “services are not about tariffs. Services are about common rules, common supervision and common enforcement to ensure a level playing field, to ensure the integrity of the single market and, ultimately, also to ensure financial stability. This is why we cannot offer the same in services as we can offer in goods. It’s also why FTAs don’t have detailed rules for financial services.” That is, financial services will be bluntly excluded from the Brexit deal.

No surprise from BoJ

BoJ left monetary policy unchanged today as widely expected. Short term policy rate is kept at -0.1%. BoJ will continue to purchase assets at a pace of JPY 80T per annum to keep 10 year JGB yields at around 0%. Goushi Kataoka dissented again, continued his push to lower yields on JGBs with maturities longer than 10 years.

In the statement, BoJ noted that the economy is “expanding moderately, with a virtuous cycle from income to spending operating”. And it expects such “moderate expansion” to continue. Core CPI is expected to “continue on an uptrend and increase toward 2percent”. Risks to the outlook include US policies, outcome and Brexit negotiation and geopolitical risks. BoJ maintained the pledge on “continuing expanding the monetary base.” until core CPI exceeds 2% and stays above in a “stable manner.

Japan household spending rose 2.0% yoy in January versus expectation of -0.8% yoy. M2 rose 3.3% yoy in February. Labor cash earnings rose 0.7% yoy versus expectation of 0.6% yoy.

From China, CPI jumped sharply to 2.9% yoy in February, up from 1.5% yoy and beat expectation of 2.4% yoy. PPI slowed to 3.7% yoy, down from 4.3% yoy and below expectation of 3.8% yoy.

Looking ahead, wage growth the key the watch in NFP

Looking ahead, the economic calendar is rather busy today. Non farm payroll report from the US will be a major focus. Markets expect NFP to show 205k growth in February. Unemployment rate is expected to drop further to 4.0%. Other employment related data showed ADP grew solidly by 235k. ISM manufacturing employment jumped from 54.2 to 59.8. ISM services employment, on the other hand, dropped from 61.6 to 55.0. Overall, there is no sign pointing to downside surprise in the headline NFP number. But again, wage growth is the key to watch. Average hourly earnings are expected to rise 0.2% mom. Wage growth and its impact on inflation will be the key to whether there will be a fourth Fed hike this year.

Elsewhere, Canada will also release employment data. Earlier in European session, UK trade balance, productions will be featured. Germany will release trade balance and industrial production too.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9448; (P) 0.9484; (R1) 0.9546; More…

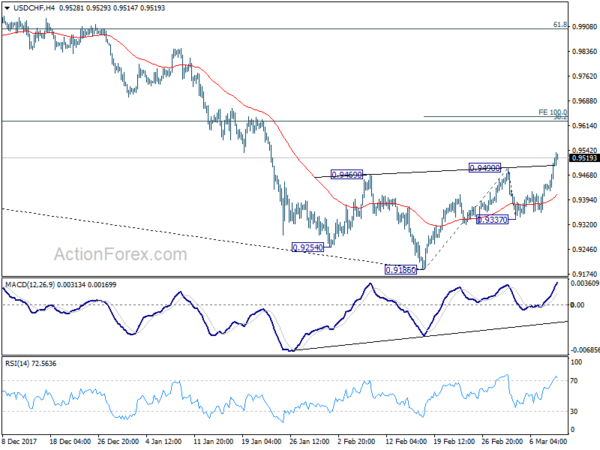

USD/CHF’s rebound from 0.9186 accelerates to as high as 0.9533 so far today. The strong break of 0.9490 resistance indicates near term reversal. This is supported by bullish convergence condition in 4 hour MACD. Also, there is a head and shoulder bottom pattern (ls: 0.9254, h: 0.9186, rs: 0.9337). Intraday bias is now on the upside for 100% projection of 0.9186 to 0.9490 from 0.9337 at 0.9641 first. On the downside, break of 0.9337 minor support is needed to indicate completion of the rebound. Otherwise, near term outlook will be cautiously bullish even in case of retreat.

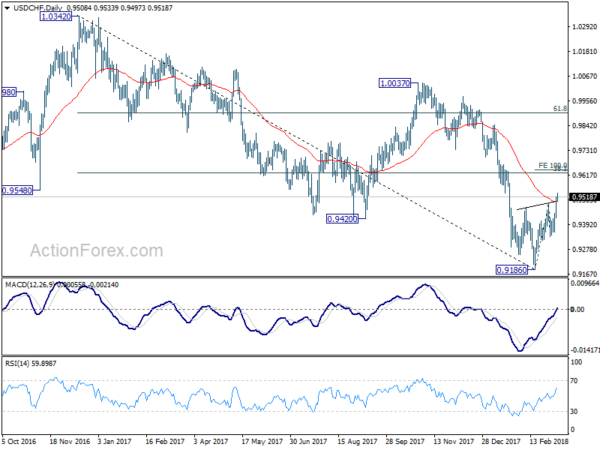

In the bigger picture, fall from 1.0342 is seen as a medium term down trend. Current development is raising the chance that it is completed. But there is no confirmation yet. Focus will now be back on 38.2% retracement of 1.0342 (2016 high) to 0.9186 (2018 low) at 0.9626. Sustained break there will add much credence to the case of trend reversal and target 61.8% retracement at 0.9900 and above). However, rejection from 0.9626 will maintain medium term bearishness for another low below 0.9186.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| JPY | BOJ Monetary Policy Statement | |||||

| 23:30 | JPY | Overall Household Spending Y/Y Jan | 2.00% | -0.80% | -0.10% | |

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Feb | 3.30% | 3.30% | 3.40% | |

| 00:00 | JPY | Labor Cash Earnings Y/Y Jan | 0.70% | 0.60% | 0.70% | |

| 01:30 | CNY | CPI Y/Y Feb | 2.90% | 2.40% | 1.50% | |

| 01:30 | CNY | PPI Y/Y Feb | 3.70% | 3.80% | 4.30% | |

| 07:00 | EUR | German Trade Balance Jan | 21.1B | 21.4B | ||

| 07:00 | EUR | German Industrial Production M/M Jan | 0.60% | -0.60% | ||

| 09:30 | GBP | Visible Trade Balance (GBP) Jan | -12.0B | -13.6B | ||

| 09:30 | GBP | Industrial Production M/M Jan | 1.50% | -1.30% | ||

| 09:30 | GBP | Industrial Production Y/Y Jan | 1.80% | 0.00% | ||

| 09:30 | GBP | Manufacturing Production M/M Jan | 0.20% | 0.30% | ||

| 09:30 | GBP | Manufacturing Production Y/Y Jan | 2.80% | 1.40% | ||

| 09:30 | GBP | Construction Output M/M Jan | -0.50% | 1.60% | ||

| 12:00 | GBP | NIESR GDP Estimate Feb | 0.40% | 0.50% | ||

| 13:30 | CAD | Net Change in Employment Feb | 21.0K | -88.0K | ||

| 13:30 | CAD | Unemployment Rate Feb | 5.90% | 5.90% | ||

| 13:30 | USD | Change in Non-farm Payrolls Feb | 205K | 200K | ||

| 13:30 | USD | Unemployment Rate Feb | 4.00% | 4.10% | ||

| 13:30 | USD | Average Hourly Earnings M/M Feb | 0.20% | 0.30% | ||

| 15:00 | USD | Wholesale Inventories M/M (JAN F) | 0.70% | 0.70% |