The broader markets responded very negatively to US President Donald Trump’s push for steel and aluminum import tariffs. DOW closed down -420 pts or -1.68% at 24608.98, breaking key near term support at 24792.99. S&P 500 lost -36.16 pts or -1.33% to close at 2677.67, breaking equivalent support at 2697.77. NASDAQ, the relatively stronger one recently, also dropped -92.45 pts or -1.27% to close at 7180.56, confirming failure below 7505.77 record high. Treasury yields also suffered with 10 year yield dropping -0.064 to 2.80. It looks like TNX has already topped below 3% handle. Asian markets follow with Nikkei losing over -500 pts or -2.3% at the time of writing. Hong Kong HSI is down -430 pts or -1.4%.

It once looked like Dollar is finally reversing the down trend as dollar index hit as high as 90.93. But it ended lower at 90.32 after failing to break through 91.01 key resistance. EUR/USD’s breach of 1.2205 key support proved to be brief as it’s now back at 1.2275. While more downside is in favor in EUR/USD with 1.2354 resistance intact, the bearish case is clearly dampened. Similarly, USD/CHF breached 0.9469 resistance but failed to sustain above there, now trading at 0.9400. More weakness is indeed seen in USD/JPY, which broken 106.37 minor support and should be heading back to 105.54 low. But overall in the currency markets, Yen is trading as the strongest one for the week, followed by Dollar. Canadian Dollar is the weakest one, followed by Sterling and then Aussie.

Chain reactions, retaliation and political uncertainty for Trump’s tariffs

Trump told steal and aluminum industry executive that he will impose tariffs of 25% on steel and 10% on aluminum yesterday. And he plans to make the formal announcement next week. Trump also emphasized that the tariffs with apply to all countries. If there is exemptions, all other countries would request similar treatment. And that would also just open a back door for imports through the exempted country.

Accord to data of IHS Global Trade Atlas, in 2017, Canada was the top supplier of steel to the US, with 16% share. It’s followed by Brazil (13%), South Korea (10%), Mexico (9%), Russia (9%), Turkey (7%), Japan (5%), Taiwan (4%), Germany (3%) and India (2%). China is outside of top 10 at 11.

The stock markets reaction showed broadly speak, Trump’s move is not welcomed. Heavy steel and aluminum companies like Boeing and Ford Motors would be heavily hit. And the impact would likely spread further to other sectors. Secondly, there is serious threat of retaliation by his trade partners. US is already in NAFTA renegotiation with Canada and Mexico, who are the country’s top and fourth largest steel supplier.

More importantly, we believed that markets were hit by political uncertainties within Trump’s camp. The Politico reported that Trump’s top economic adviser Gary Cohn spent a frantic 24 hours with others trying to stop Trump on the move on tariffs. Cohn has been on the brink of leaving Trump last year following the latter’s comment regarding a white supremacist march in Charlottesville. But it’s reported Cohn stayed for the main reason to stop Trump from starting trade war.

Fed Powell: Don’t get behind the curve

In the second round of his Congressional Testimony, Fed Chair Jerome Powell said that “there is no evidence the economy is overheating.” And, while the unemployment rate at 4.1% is “at or near or even below” the figure of full employment, there is no evidence of a “decisive move up in wages”. He added that “nothing in that suggests to me that wage inflation is at a point of acceleration.” To Powell, risks are “more two-sided” at this early stage of recovery. But he emphasized that “the thing we don’t want to have happen is to get behind the curve.” Hence, Fed will continue to “gradually raise interest rates” and that’s the “appropriate path.”

Regarding trade, Powell said it as a “net positive” for the US economy with some winners and some losers. But he also said “the tariff approach is not the best approach. The best approach is to deal directly with the people who are affected rather than falling back on tariffs.”

Fed Dudley: Protectionism is a dead end

Separately, New York Fed William Dudley said that even if Fed will hike four times this year, “it would still be gradual”. He also warned that “raising trade barriers would risk setting off a trade war, which could damage economic growth prospects around the world.” And, “in the longer term it would almost certainly be destructive.” He added that there will be “often backfire” of retaliation, higher consumer costs, higher production costs and lowered competitiveness. And, “the expectation that higher trade barriers would save jobs ignores these critical second-round effects.” He emphasized that “there are many approaches to dealing with the costs of globalization, but protectionism is a dead end.”

No major policy shift at ECB March meeting

Reuters quoted unnamed sources saying that ECB will likely discussion a minor tweak in the communication in the March 8 meeting next week. But there will not be any major policy shift. One source said that “there is general concern about market volatility and inflation has been heading down so it’s clearly not the right time.” And, “the easing bias could easily go but even that might have to wait.” And that source expressed concern that “there is fear about signaling too much and increasing market volatility.”

Meanwhile, according to a Reuters poll of 80 economist taken between February 26-28, Eurozone GDP growth is expected to average 2.3% this year and 2.0% next. Inflation would average 1.5% this year and 1.6% next, staying well below ECB’s 2% target. Over 70% of economists expected ECB to announce ending of the asset purchase program at or before June meeting. 90% expected ECB to keep interest rates unchanged for many months after ending asset purchases. And, 70% of 51 economists who answered a separate question noted that Eurozone’s growth momentum has peaked.

UK PM May to set out five tests for Brexit deal

UK Prime Minister Theresa May will deliver her high profile speech regarding UK-EU relationship today. Accord to the extracts by her office, May would seek “broadest and deepest possible agreement – covering more sectors and co-operating more fully than any Free Trade Agreement anywhere in the world today.” And, “rather than having to bring two different systems closer together, the task will be to manage the relationship once we are two separate legal systems.”

May is expected to set out five “tests” for the deal with EU. They are:

- That any deal must respect the referendum result

- That any deal must not break down

- That any deal must protect jobs and security

- That any deal must be “consistent with the kind of country we want to be” – modern, outward-looking and tolerant

- That any agreement must bring the country together

However, so far, there is no information on how May would handle the issue of the border of the Irelands. Would it be a hard border that violate what May has promised in the join report back in December? Or would it be a “common regulatory area” as EU proposed? Or would May come up with something creative?

On the data front

New Zealand building permits rose 0.2% mom in January. Japan unemployment rate dropped sharply to 2.4% in January, monetary base rose 9.4% yoy in February, Tokyo CPI rose to 0.9% yoy. Looking ahead, German retail sales and import price will be released in European session. Eurozone will also release PPI. UK construction PMI will be featured. Later in the day, main focus will be on Canada GDP.

EUR/USD Daily Outlook

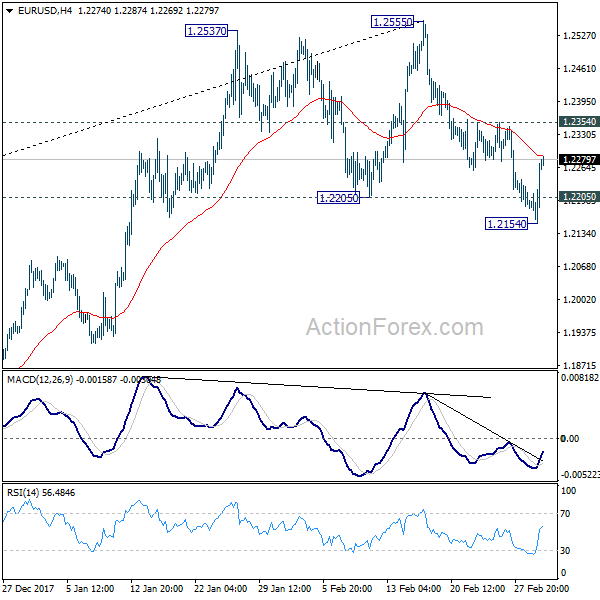

Daily Pivots: (S1) 1.2173; (P) 1.2207 (R1) 1.2227; More….

Despite dipping to 1.2154, EUR/USD could not sustain below 1.2205 key support and recovered. Intraday bias is turned neutral first. With 1.2354 resistance intact, we’re still favoring the case of trend reversal. That is, EUR/USD has topped at 1.2555 and was rejected by 1.2516 key fibonacci level. But sustained trading below 1.2205 is needed to confirm. Break of 1.2154 should send EUR/USD lower to 38.2% retracement of 1.0339 to 1.2555 at 1.1708. On the upside, above 1.2354 minor resistance will invalidate this bearish case and bring retest of 1.2555 high instead.

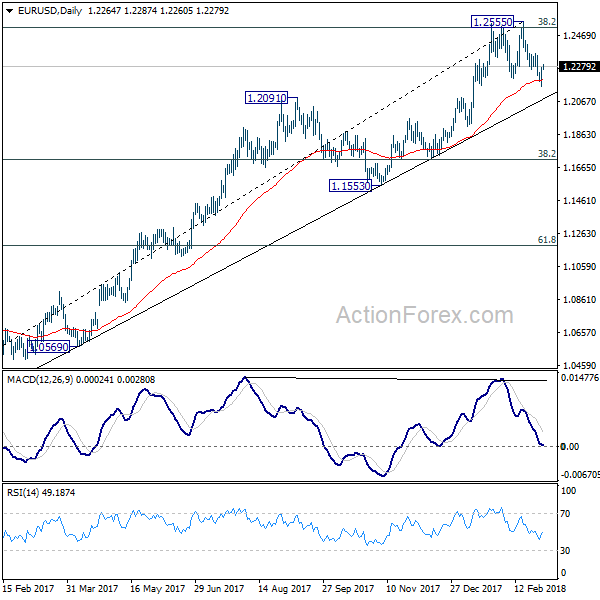

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Hence, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive. Firm break of 1.5553 support will add more medium term bearishness. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Jan | 0.20% | -9.60% | -9.50% | |

| 23:30 | JPY | Jobless Rate Jan | 2.40% | 2.80% | 2.80% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Feb | 0.90% | 0.80% | 0.70% | |

| 23:50 | JPY | Monetary Base Y/Y Feb | 9.40% | 9.20% | 9.70% | |

| 7:00 | EUR | German Retail Sales M/M Jan | 0.70% | -1.90% | ||

| 7:00 | EUR | German Import Price Index M/M Jan | 0.40% | 0.30% | ||

| 9:30 | GBP | Construction PMI Feb | 50.5 | 50.2 | ||

| 10:00 | EUR | Eurozone PPI M/M Jan | 0.40% | 0.20% | ||

| 10:00 | EUR | Eurozone PPI Y/Y Jan | 1.60% | 2.20% | ||

| 13:30 | CAD | GDP M/M Dec | 0.10% | 0.40% | ||

| 15:00 | USD | U. of Mich. Sentiment Feb F | 99.5 | 99.9 |