Quick update: Dollar tries to rise further after ISM manufacturing beat expectation. But momentum remains indecisive.

Dollar is trying to ride on strong job data to extend recent rally. Initial jobless claims dropped 10k to 210k, lower than expectation of 226k. That’s the lowest level in nearly five decades since December 1969. Four week moving average dropped to 220.5k, also the lowest since 1969. Continuing claims rose 57k to 1.93m in the week ended February 17. Personal income rose 0.4% in January, above expectation of 0.3%. Personal spending rose 0.2%, in line with expectation. Headline PCE was unchanged at 1.7% yoy, core PCE unchanged at 1.5% yoy. Both met expectation. Also released, Canada current account deficit narrowed to CAD -16.4b in Q4. Focus will turn to round two of Fed Chair Jerome Powell’s testimony.

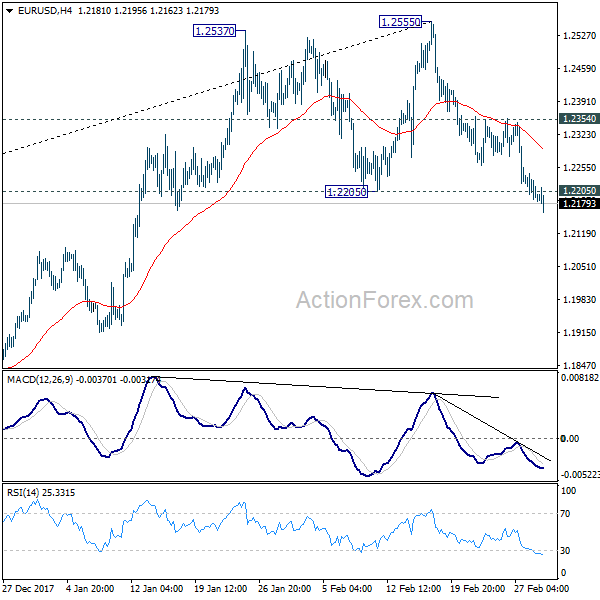

Technically, EUR/USD is trying to dip further away from 1.2205 key support, which indicates trend reversal. USD/CHF is also pressing equivalent level at 0.9469. For today, New Zealand Dollar is the strongest into US session, followed by Dollar. Aussie and Loonie are the weakest. For the week. Yen remains the strongest one, followed by Dollar. Canadian is the weakest, followed by Sterling and than Aussie.

EC Tusk warned friction inevitable for Brexit

European Council President Donald Tusk is meeting UK Prime Minister Theresa May in London today. May expressed her intention to make post Brexit trade "as frictionless as possible. Tusk responded by warning that "friction is an inevitable side-effect of Brexit." And ultimately, the post Brexit relationship between UK and EU would be determined by respective "red lines". Tusk added that "we acknowledge these red lines without enthusiasm and without satisfaction, but we must treat them seriously, with all the possible consequences."

EU published the draft Brexit treaty yesterday and the border of Irelands have sudden become the sticky point. Tusk said that he was "absolutely sure that all the essential elements of the draft" would be accepted by the 27 remaining EU members. And he added that that "until now, no one has come up with anything wiser than that" referring to the proposal of keeping Northern Ireland in EU’s customs union. But May has already warned that such proposal would "threaten the constitutional integrity of the UK" by creating a border down the Irish Sea." May will deliver her highly anticipated speech on Brexit tomorrow.

Released in European session, Eurozone unemployment rate was unchanged at 8.6% in January. PMI manufacturing was revised up by 0.1 to 58.6 in February. UK PMI manufacturing dropped to 55.2 in February, down from 55.3 but beat expectation of 55.0. M4 money supply rose 1.5% mom in January. Mortgage approvals rose to 67k in January. Swiss PMI manufacturing rose 0.2 to 65.5 in February. Retail sales dropped -1.4% yoy in January GDP grew 0.6% qoq in Q4.

BoJ Kataoka warned on premature stimulus exit

BoJ board member Goushi Kataoka urged that "to influence inflation expectations, it is essential that policy coordination between the government and the BOJ … is firmly ensured through action by both entities." And he noted that " there is still a long way to go before considering a change in monetary policy stance." He warned against premature stimulus exit as that could drag Japan back into deflation. Kataoka is the persistent sole dissenter in BoJ since joining last year, pushing for more aggressive easing.

Released from Japan, capital spending rose 4.3% in Q4, above expectation of 3.0%. PMI manufacturing was revised up by 0.1 to 54.1 in February. Consumer confidence dropped 0.4 to 44.3 in February.

Caixin China PMI manufacturing hit six-month high

The Caixin China PMI manufacturing rose 0.1 to 51.6 in February, above expectation of 51.3. The index focuses on small to mid-size manufacturers hit a six-month high. Zhengsheng Zhong, director of macroeconomic analysis at CEBM Group, a subsidiary of Caixin noted that "for now, the durability of the Chinese economy will persist. Looking ahead, whether demand generated from the beginning of work in March will gain strength will be key in determining China’s economic direction for 2018."

Australia private capital expenditure unexpectedly dropped -0.2% in Q4, comparing to expectation of 1.0% rise. However, that’s probably due to the large upward revision in the prior quarter, from 1.0% to 1.9%. New Zealand terms of trade dropped -0.2% qoq in Q4, below expectation of 0.5% qoq.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2173; (P) 1.2207 (R1) 1.2227; More….

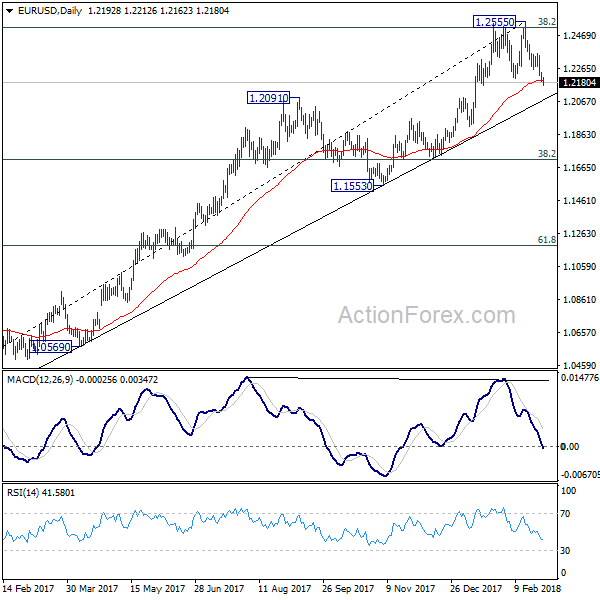

As noted before, the break of 1.2205 key support is taken as a tentative sign of trend reversal, after being rejected by 1.2516 key fibonacci level. Intraday bias remains on the downside for deeper fall. Sustained trading below 1.2205 will confirm and target 38.2% retracement of 1.0339 to 1.2555 at 1.1708. On the upside, above 1.2354 minor resistance will dampen this bearish case and bring retest of 1.2555 high instead.

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Hence, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive. Firm break of 1.5553 support will add more medium term bearishness. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Terms of Trade Index Q/Q Q4 | -0.20% | 0.50% | 0.70% | 1.30% |

| 23:50 | JPY | Capital Spending Q4 | 4.30% | 3.00% | 4.20% | |

| 00:30 | AUD | Private Capital Expenditure Q4 | -0.20% | 1.00% | 1.00% | 1.90% |

| 01:30 | JPY | PMI Manufacturing Feb F | 54.1 | 54 | 54 | |

| 01:45 | CNY | Caixin PMI Manufacturing Feb | 51.6 | 51.3 | 51.5 | |

| 05:00 | JPY | Consumer Confidence Index Feb | 44.3 | 44.8 | 44.7 | |

| 06:45 | CHF | GDP Q/Q Q4 | 0.60% | 0.50% | 0.60% | 0.70% |

| 06:45 | CHF | GDP Y/Y Q4 | 1.90% | 1.70% | 1.20% | |

| 08:15 | CHF | Retail Sales Y/Y Jan | -1.40% | 1.10% | 0.60% | 0.70% |

| 08:30 | CHF | PMI Manufacturing Feb | 65.5 | 64.1 | 65.3 | |

| 08:45 | EUR | Italy Manufacturing PMI Feb | 56.8 | 58 | 59 | |

| 08:50 | EUR | France Manufacturing PMI Feb F | 55.9 | 56.1 | 56.1 | |

| 08:55 | EUR | Germany Manufacturing PMI Feb F | 60.6 | 60.3 | 60.3 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Feb F | 58.6 | 58.5 | 58.5 | |

| 09:30 | GBP | Mortgage Approvals Jan | 67K | 62K | 61K | 62K |

| 09:30 | GBP | M4 Money Supply M/M Jan | 1.50% | 0.40% | -0.60% | |

| 09:30 | GBP | PMI Manufacturing Feb | 55.2 | 55 | 55.3 | |

| 10:00 | EUR | Eurozone Unemployment Rate Jan | 8.60% | 8.60% | 8.70% | 8.60% |

| 13:30 | CAD | Current Account Balance (CAD) Q4 | -16.4B | -17.8B | -19.3B | -18.6B |

| 13:30 | USD | Personal Income Jan | 0.40% | 0.30% | 0.40% | |

| 13:30 | USD | Personal Spending Jan | 0.20% | 0.20% | 0.40% | |

| 13:30 | USD | PCE Deflator M/M Jan | 0.40% | 0.40% | 0.10% | |

| 13:30 | USD | PCE Deflator Y/Y Jan | 1.70% | 1.70% | 1.70% | |

| 13:30 | USD | PCE Core M/M Jan | 0.30% | 0.30% | 0.20% | |

| 13:30 | USD | PCE Core Y/Y Jan | 1.50% | 1.50% | 1.50% | |

| 13:30 | USD | Initial Jobless Claims (24 FEB) | 210K | 226K | 222K | 220K |

| 14:30 | CAD | RBC Canadian Manufacturing PMI Feb | 55.6 | 55.9 | ||

| 14:45 | USD | US Manufacturing PMI Feb F | 55.3 | 55.8 | 55.9 | |

| 15:00 | USD | Construction Spending M/M Jan | 0.00% | 0.20% | 0.70% | 0.80% |

| 15:00 | USD | ISM Manufacturing Feb | 60.8 | 58.7 | 59.1 | |

| 15:00 | USD | ISM Prices Paid Feb | 74.2 | 70 | 72.7 | |

| 15:30 | USD | Natural Gas Storage | -71B | -124B |