Sterling is trading as the weakest major currency today. Fresh selling is seen on strong comments from EU Brexit negotiator Michel Barnier. That came as European commission published its own draft Brexit withdrawal treaty. The document highlighted, in Barnier’s words "significant divergences" between UK and EU. Yen is trading as the strongest for the day, thanks to risk aversion. But Dollar is still the strongest for the week. The greenback was boosted by upbeat comments from Fed Chair Jerome Powell. Technically, EUR/USD is now finally pressing trend defining 1.2205 key support. This level will be the major focus in US session.

EC’s version of Brexit treaty shows significant divergences still exist.

European Commission published a 119-page documents as the draft withdrawal agreement on Brexit today. (The document is available here if you’re interested). EU chief negotiator Michel Barnier said that "if we want to succeed in these negotiations, and I want to succeed, we must accelerate." And he gave some strong words regarding the transition period and warned that it’s not a given. Barnier also insisted that the ECJ may "play a role in the interpretation and implementation of the withdrawal agreement whenever it refers to European law." Regarding the issue of Ireland, he said that a fallback option is for Northern Ireland to remain in the customs union and pay a consistent tax regime with the Republic of Ireland. But in that case, the UK will have no regulatory authority over the goods produced in Northern Ireland. Regarding the Brexit bill, the draft treaty requests the UK to make two payments per year to EU after 2020 to settle its financial obligations.

Ahead of her high profile speech regarding UK-EU relationship, UK Prime Minister Theresa May emphasized that the British people will "bring back control of our laws, our borders and our money." And she warned that the Labour’s push for customs union would be "be a betrayal of the British people.” She further added that while the UK wants to keep trade with EU "as easy as possible" a customs union would mean "we couldn’t do out own trade deals. So far, the differences between UK and EU are very clear. We’ll look forward to May’s speech to see whether she’s doing anything to close the gaps.

Dollar strong on hope for four hikes this year

While mainly maintaining the FOMC’s stance, the new Fed Chair Jerome Powell’s Congressional testimony before the House Finance Services Committee was interpreted as a hawkish one. Heightened speculations for three, or more, rate hikes this year were reflected in higher yields, the rise of the US dollar to highest in 3 weeks and pullback in risk assets, including equities.

In short, Powell’s assessment on US growth outlook was upbeat, describing growth and the employment market as strong. He also emphasized that fiscal policy, foreign growth, and financial conditions have turned from headwinds into tailwinds. Powell admitted that inflation remained low but affirmed that ‘some of the shortfall in inflation last year’, which were driven by ‘transitory influences’, should not repeat.

On the monetary policy outlook, the new Chair reiterated the gradual path to normalization. Yet, he added the Fed would ‘continue to strike a balance between avoiding an overheated economy and bringing PCE price inflation to 2% on a sustained basis". This appears to have signaled that the future rate hike path might steepen. More in Hawkish Powell Raises Hopes For Four Rate Hikes This Year.

Released from US, Q4 GDP growth was revised lower by 0.1 to 2.5% annualized. GDP price index was revised low re to 2.3%. From Canada, IPPI rose 0.3% mom in January, RMPI rose 3.3% mom.

Swiss KOF signals above average growth, Eurozone CPI slowed

Swiss KOF economic barometer rose to 108.0 in February, up from 107.6 and beat expectation of 106.0. KOF noted that "from a longer-term perspective, the early 2017 improved sentiment appears to continue. And, "in the near future the Swiss economy should continue to grow at rates above average."

Also from Europe, Eurozone CPI slowed to 1.2% yoy in February, down from 1.3% yoy, in line with expectation. Eurozone CPI core was unchanged at 1.0% yoy. German unemployment dropped -22k in February, unemployment rate was unchanged at 5.4%, Gfk consumer sentiment dropped 0.2 to 10.8 in March. French Q4 GDP grew 0.6% qoq. UK Gfk consumer confidence dropped to -10 in February, down from -9.

BoJ Kuroda to have confirmation hearing on March 2

BoJ Governor Haruhiko Kuroda said today that monetary policy normalization would be "very gradual" one it’s started. Kuroda will have his confirmation hearing at the parliament on March 2, for renewing his five year term. Separate hearing is scheduled for the two BoJ deputy governor nominees, on March 5. The two nominees include Masazumi Wakatabe, a Waseda University academic and an advocate of aggressive easing, and BOJ Executive Director Masayoshi Amamiya, a veteran central banker known for shaping monetary policy.

Japan retail sales rose 1.6% yoy in January versus expectation of 2.5% yoy. Japan industrial production dropped -6.6% mom in January versus expectation of -4.2% mom. Housing starts dropped -13.2% yoy in January.

NAB forecasts one RBA hike in 2018, instead of two

In Australia, the National Australia Bank lowered its RBA interest rate forecast for the year. NAB now expects only one RBA hike this year, instead of two. The bank said in its report that "weak wages growth and slow progress reducing unemployment means it is now less likely that the RBA will raise rates twice in 2018." It explained that "while total wages did increase a touch 0.55%, there was no acceleration in private wages growth." Nonetheless, "wage increases are overdue" and " tightness in employers’ ability to find suitable labour, may finally see private sector wages start to moderately edge up." And, "we now see the RBA raising rates only once in late 2018 with November 2018 as the most likely start date for a gradual RBA rate hiking cycle." However, there is still a change for RBA to stand pat depending on data flow.

New Zealand business confidence stayed pessimistic

New Zealand ANZ business confidence improved to -19.0 in February, up from -37.8. That is, a net 19% of business were pessimistic about the year ahead. ANZ noted in the release that "a slower housing market, a small dip in net migration, difficulty finding credit and already-stretched construction and tourism sectors are making acceleration hard work from here." Meanwhile, "strong terms of trade and a positive outlook for wage growth are providing a push." And, "the rebound in business confidence is consistent with our belief that while no longer at top speed, this business cycle has legs yet. In particular, incomes are set to be supported by the strong terms of trade and higher wage growth."

GBP/JPY Mid-Day Outlook

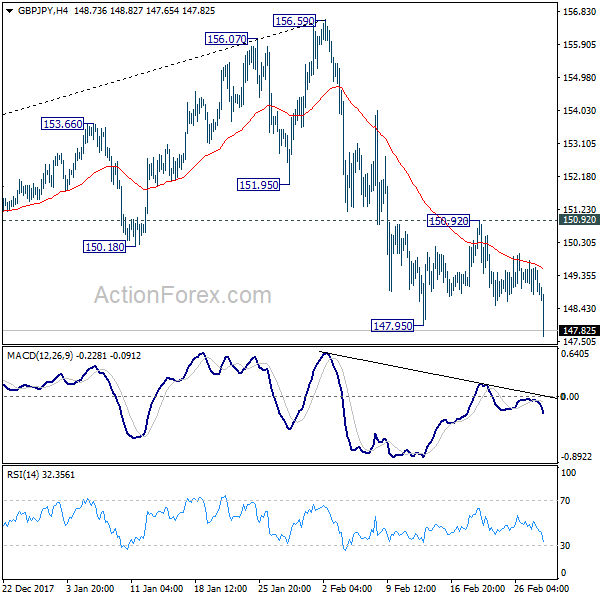

Daily Pivots: (S1) 148.80; (P) 149.30; (R1) 149.78; More…

GBP/JPY’s fall resumed from 156.59 by breaking 147.95 support. Intraday bias is turned back to the downside. Current fall should target 146.96 support next. Considering bearish divergence condition in daily MACD, firm break of 146.96 will be another sign of medium term trend reversal. On the upside, break of 150.92 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

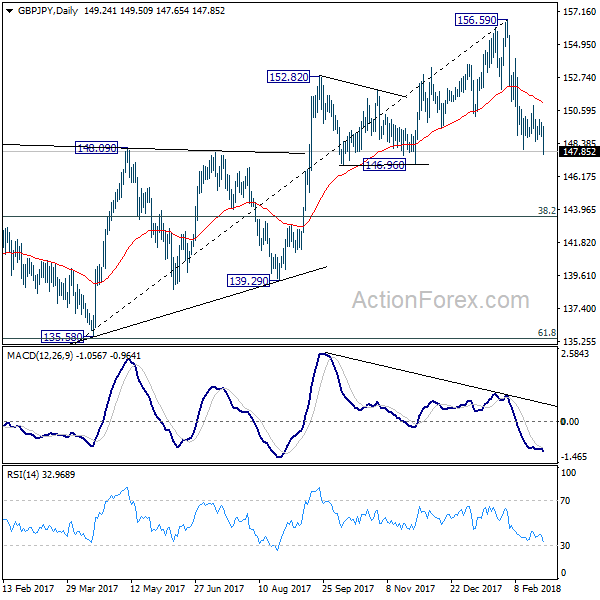

In the bigger picture, the case for medium term reversal continues to build up on loss of medium term momentum as seen in weekly MACD. Also, firm break of 146.96 will indicate rejection by 55 month EMA (now at 154.60) and add to that case of reversal. In that case, deeper fall would be seen to 38.2% retracement of 122.36 to 156.59 at 143.51 and then 61.8% retracement at 135.43. Meanwhile, break of 156.59 will extend the rise from 122.36 to 61.8% retracement of 195.86 to 122.36 at 167.78.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y Jan | 1.60% | 2.50% | 3.60% | |

| 23:50 | JPY | Industrial Production M/M Jan P | -6.60% | -4.20% | 2.90% | |

| 00:00 | NZD | ANZ Business Confidence Feb | -19 | -37.8 | ||

| 00:01 | GBP | GfK Consumer Confidence Feb | -10 | -10 | -9 | |

| 00:01 | GBP | BRC Shop Price Index Y/Y Feb | -0.80% | -0.60% | -0.50% | |

| 01:00 | CNY | Manufacturing PMI Feb | 50.3 | 51.2 | 51.3 | |

| 01:00 | CNY | Non-manufacturing PMI Feb | 54.4 | 55 | 55.3 | |

| 05:00 | JPY | Housing Starts Y/Y Jan | -13.20% | -4.70% | -2.10% | |

| 07:00 | EUR | German GfK Consumer Confidence Mar | 10.8 | 10.9 | 11 | |

| 07:45 | EUR | French GDP Q/Q Q4 P | 0.60% | 0.60% | 0.60% | |

| 07:45 | EUR | French GDP Y/Y Q4 P | 2.50% | 2.40% | 2.40% | |

| 08:00 | CHF | KOF Leading Indicator Feb | 108 | 106 | 106.9 | 107.6 |

| 08:55 | EUR | German Unemployment Change Feb | -22K | -17K | -25K | |

| 08:55 | EUR | German Unemployment Rate Feb | 5.40% | 5.40% | 5.40% | |

| 10:00 | EUR | Eurozone CPI Estimate Y/Y Feb | 1.20% | 1.20% | 1.30% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Feb A | 1.00% | 1.00% | 1.00% | |

| 13:30 | CAD | Industrial Product Price M/M Jan | 0.30% | 0.50% | -0.10% | |

| 13:30 | CAD | Raw Materials Price Index M/M Jan | 3.30% | 1.80% | -0.90% | |

| 13:30 | USD | GDP Annualized Q/Q Q4 S | 2.50% | 2.50% | 2.60% | |

| 13:30 | USD | GDP Price Index Q4 S | 2.30% | 2.40% | 2.40% | |

| 14:45 | USD | Chicago PMI Feb | 64.6 | 65.7 | ||

| 15:00 | USD | Pending Home Sales M/M Jan | 0.50% | 0.50% | ||

| 15:30 | USD | Crude Oil Inventories | -1.6M |