Dollar strengthens on Fed chair Jerome Powell’s prepared remarks for his first Congressional testimony. But the movements in the markets are slight. The markets are generally staying in consolidation mode. Indeed, Powell offered nothing new comparing to the Fed’s Monetary Policy Report released last week. Elsewhere, the Swiss Franc is trading as the strongest today while commodity currencies and Sterling are soft. Overall, the currency markets are quiet.

Fed Powell: To strike a balance in gauging monetary policy path

In his prepared speech to Congress, Powell said that "in gauging the appropriate path for monetary policy over the next few years, the FOMC will continue to strike a balance between avoiding an overheated economy and bringing PCE price inflation to 2% on a sustained basis." He added that "the FOMC views the near-term risks to the economic outlook as roughly balanced but will continue to monitor inflation developments closely,"

Regarding the economy, "while many factors shape the economic outlook, some of the headwinds the U.S. economy faced in previous years have turned into tailwinds." Also, "the robust job market should continue to support growth in household incomes and consumer spending, solid economic growth among our trading partners should lead to further gains in U.S. exports, and upbeat business sentiment and strong sales growth will likely continue to boost business investment."

Powell also down played recent financial market volatility and said "we do not see these developments as weighing heavily on the outlook for economic activity, the labor market and inflation,"

Released from US, trade deficit widened to USD -74.4b in January. Durable goods orders dropped sharply by -3.7% in January, ex-transport orders dropped -0.3%. Wholesale inventories rose 0.7% mom in January.

Bundesbank Weidmann: Asset purchase could end this year

Bundesbank President Jens Weidmann, a known hawk, said today that ECB "gradually and dependably reduce the degree of monetary policy accommodation when the outlook for price developments in the euro area permits us to do so." He added that "if the upswing continues and prices rise accordingly, in my view, there is no reason why the Governing Council should not end the net purchases of securities this year." He emphasized that policy normalization will "take a long time", and policy will "remain very expansive even after the end of net bond purchases." Weidmann’s comments were very different from ECB President Mario Draghi’s.

Draghi sounded cautious again in his comments yesterday. He warned that "given the uncertainty surrounding the measurement of economic slack, the true amount may be larger than estimated, which could slow down the emergence of price pressures." And therefore, the "right blend" of stimulus measures is still needed. Nonetheless, he said "these factors should wane as the economic expansion continues and unemployment further declines." "The relationship between growth and inflation remains largely intact, even if it has temporarily weakened in recent years to the extent that the speed of adjustment in inflation towards our aim has been affected." But he remained confident that " headline inflation will resume its gradual upward adjustment, supported by our monetary policy measures."

Eurozone business climate dropped to 1.48 in February, down from 1.54 but beat expectation of 1.47. Economic confidence dropped to 114.1, down from 114.7 and beat expectation of 114.0. Industrial confidence dropped to 8.0, down from 8.8, met expectations. Services confidence rose to 17.5, up from 16.7, beat expectation of 16.3. Consumer confidence was finalized at 0.1, unrevised. The confidence indicators remain at historically high level, despite a dip. Also from Eurozone, M3 rose 4.6% yoy in January. German CPI slowed to 1.4% yoy in February, down from 1.6% yoy, missed expected of 1.5% yoy.

EU to publish draft Brexit treaty

EU will publish their own draft of Brexit withdrawal treaty tomorrow. The 100-page document is set to ignore UK Prime Minister Theresa May’s request to extend the transition period. That also comes just two days before May’s scheduled high-profile speech on future trade relationship with EU. It’s believed the EU’s document will be solely from EU’s perspective for the negotiation ahead. Meanwhile, it draws criticism from UK that EU is only trying to push its agenda, rather than producing something that reflects the positions of both sides.

Separately, French President Emmanuel Macron said that a customs union is "a possible option" for post Brexit relationship. But he emphasized that it’s "not full access to the the single market". That’s seen as a response to UK Labour leader Jeremy Corbyn’s push for the customs union.

BoE Deputy Governor Sam Woods said today that the central bank was putting a "huge premium" on the government agreeing a Brexit transition deal with EU. And he urged that avoiding chaos in insurance markets due to Brexit is a "top priority" for the BoE. Also, he added that BoE will not "go soft" on enforcing EU capital rules for insurers. Woods also said that there was "no convincing evidence" to show that EU rules hurt profitability nor growth of the sector.

USD/CAD Daily Outlook

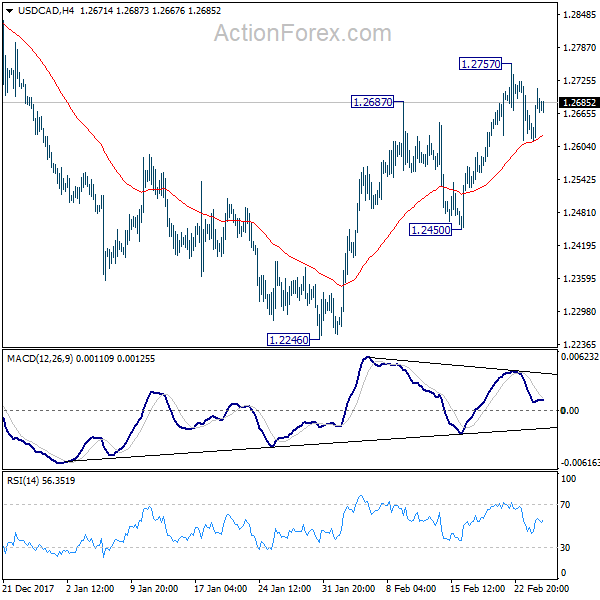

Daily Pivots: (S1) 1.2628; (P) 1.2670; (R1) 1.2725; More….

USD/CAD is staying in tight range below 1.2757 and intraday bias remains neutral first. On the upside, above 1.2757 will resume the rebound from 1.2246 and target a test on 1.2919 key resistance. We’d be cautious on strong resistance from there to limit upside. On the downside, below 1.2450 will turn bias back to the downside for 1.2246 support.

In the bigger picture, the rebound from 1.2246 is mixing up the medium term outlook. Nonetheless, USD/CAD is staying below falling 55 week EMA (now at 1.2771), hence, the bearish case is in favor. That is, fall from 1.4689 is not completed yet. Sustained break of 1.2061 key support will carry larger bearish implication and target 61.8% retracement of 0.9406 to 1.4689 at 1.1424. However, firm break of 1.2919 will revive the case of medium term reversal and turn outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance Jan | -566M | -2710M | 640M | 596M |

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Jan | 4.60% | 4.60% | 4.60% | |

| 10:00 | EUR | Eurozone Business Climate Indicator Feb | 1.48 | 1.47 | 1.54 | 1.56 |

| 10:00 | EUR | Eurozone Economic Confidence Feb | 114.1 | 114 | 114.7 | 114.9 |

| 10:00 | EUR | Eurozone Industrial Confidence Feb | 8 | 8 | 8.8 | 9 |

| 10:00 | EUR | Eurozone Services Confidence Feb | 17.5 | 16.3 | 16.7 | 16.8 |

| 10:00 | EUR | Eurozone Consumer Confidence Feb F | 0.1 | 0.1 | 0.1 | 1.4 |

| 13:00 | EUR | German CPI M/M Feb P | 0.50% | 0.50% | -0.70% | |

| 13:00 | EUR | German CPI Y/Y Feb P | 1.40% | 1.50% | 1.60% | |

| 13:30 | USD | Fed Powell’s Congressional Testimony | ||||

| 13:30 | USD | Advance Goods Trade Balance Jan | -74.40B | -72.3B | -72.3B | |

| 13:30 | USD | Wholesale Inventories M/M Jan P | 0.70% | 0.30% | 0.40% | 0.60% |

| 13:30 | USD | Durable Goods Orders Jan P | -3.70% | -2.50% | 2.80% | |

| 13:30 | USD | Durable Goods Ex-Transport Jan P | -0.30% | 0.40% | 0.70% | |

| 14:00 | USD | House Price Index M/M Dec | 0.30% | 0.40% | 0.40% | 0.50% |

| 14:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Dec | 6.30% | 6.30% | 6.40% | |

| 15:00 | USD | Consumer Confidence Index Feb | 126 | 125.4 |