The Asian markets are rather quiet with Japan on holiday. Dollar and Yen are paring back some of last week’s gains. Meanwhile, Euro and Aussie are recovering. It now looks like EUR/USD is holding on to 1.2222 key support for the moment. Elsewhere in the Asian Pacific markets are steadily mixed with Hong Kong HSI trading up 1%, South Korea KOPSI up 1.1%, China SSE down -1.3% at the time of writing. The economic calendar is light today, with Swiss CPI as the main feature. Speeches of UK MPC member Ian McCafferty and Gertjan Vlieghe will catch some attention.

UK May planning a series of speeches on Brexit

In the UK, a series of speeches are planned by Prime Minister Theresa May and her cabinet officials in the coming weeks regarding Brexit. International Development Secretary Penny Mordaunt said that "what the public want is, they want the vision and they want some meat on the bone," and, "and that’s what they are going to get." The topic of whether to stay in the EU customs union heated up in the past two weeks. EU negotiator Michel Barnier warned on Friday that a transition deal is not a given and that prompted selloff in the Pound. Locally, May is facing objections from Brexiteers on staying the custom union. And, Mordaunt said that May could face defeat in the House of Commons regarding the kind of Brexit that she wants, if "she’s not careful".

ECB concerned with US political influence on exchange rate

ECB Governing Council member Ewald Nowotny said the central bank is "certainly concerned about attempts by the United States to politically influence the exchange rate." And he added "that was a theme of economic discussions in Davos, where the ECB addressed this, and it will certainly be a theme at the upcoming G20 summit." Regarding the US economy, Nowotny said that President Donald Trump "started with a good inheritance" from the pervious government. And the current low unemployment, robust growth and tame inflation stem from Trump’s predecessor, not his own policies.

German Merkel defended her painful concessions

German Chancellor Angela Merkel defended her concessions to the SPD for reforming the grand coalition. The concessions include handing the finance minister foreign ministry. She described those as "painful" concessions and she "understand the disappointment" of her conservatives. In particular, the government’s strict fiscal discipline enforced by former finance minister Wolfgang Schaeuble could be loosen up. But Merkel said that "we have also approved the policies and the finance minister cannot simply do as he likes." Also, she emphasized that "we need to show the we can start a new team".

Looking ahead

Inflation and GDP data will be two key focuses this week. Swiss, UK and US will release CPI. Japan and Eurozone will release GDP. In addition, Australia employment will also be watched. Here are some highlights for the week:

- Monday: Swiss CPI

- Tuesday: Japan PPI, machine tools orders; Australia NAB business confidence; Swiss PPI; UK CPI, PPI

- Wednesday: Japan GDP; New Zealand inflation expectation; German GDP; Eurozone GDP; US CPI, retail sales, business inventories

- Thursday: Australia employment; Eurozone trade balance; US PPI, Empire State manufacturing, Philly Fed manufacturing, industrial production, NAHB Housing index

- Friday: New Zealand manufacturing index; UK retail sales; Canada manufacturing sales; US housing starts and building permits, import prices, U of Michigan sentiment

EUR/USD Daily Outlook

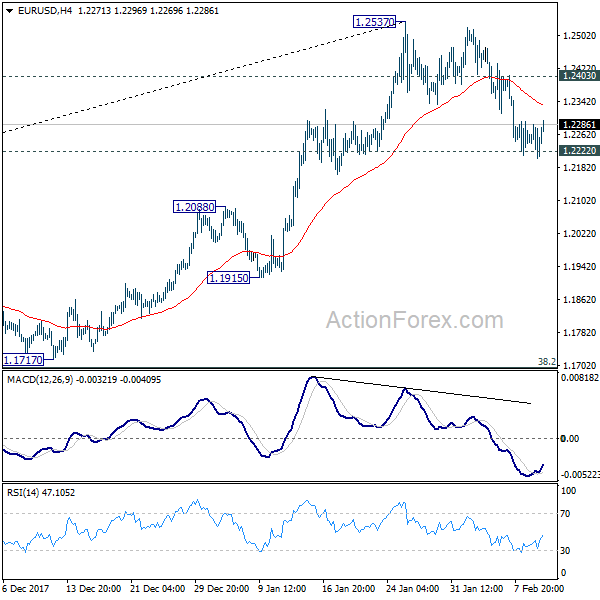

Daily Pivots: (S1) 1.2208; (P) 1.2248 (R1) 1.2290; More….

EUR/USD continues to draw support from 1.2222 and recovers today. Intraday bias stays neutral with focus on 1.2222. Sustained break there should confirm rejection from 1.2516 key fibonacci level, as well as near term reversal, on bearish divergence condition in 4 hour MACD. That could also signal completion of medium term up trend from 1.0339. In that case, near term outlook will be turned bearish for 38.2% retracement of 1.0339 to 1.2537 at 1.1697. On the upside, though, above 1.2403 minor resistance will revive bullishness and turn focus back to 1.2537.

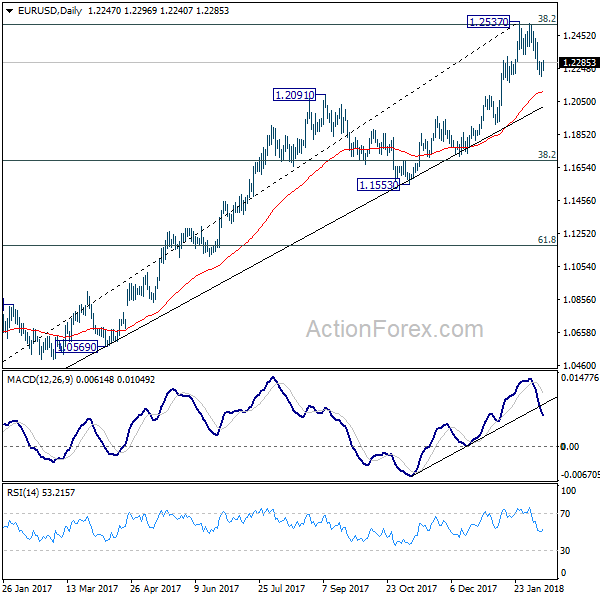

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact. Hence, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:15 | CHF | CPI M/M Jan | -0.20% | 0.00% | ||

| 08:15 | CHF | CPI Y/Y Jan | 0.80% | 0.80% | ||

| 19:00 | USD | Federal Budget Balance Jan | 50.2B | -23.2B |