Dollar continues to trade mixed in today as markets are holding their bets ahead of tomorrow’s non-farm payrolls report. Data from US today are positive. Initial jobless claims dropped 1k to 230k in the week ended January 27. Challenger job cuts showed -2.8% yoy decline in planned layoffs. But, also despite yesterday’s slightly hawkish FOMC statement, there is no sign of sustainably buying in the greenback yet.

Elsewhere in the forex markets, Euro is trading as the strongest one as supported by optimistic economic outlook. Sterling follows closely as the second strongest today. Aussie is trading as the weakest one as dragged down by iron ore price. Iron ore attempted at 80 handle twice since last September but failed. For the near term, it could have peaked back in January.

UK May: A golden era in relationship with China

UK Prime Minister is in China visiting President Xi Jinping today. At a joint press conference, May said that UK and China are enjoying a "golden era" in the relationship. May wanted to "take further forward the global strategic partnership that we have established". Chinese Premier Li Keqiang promised yesterday to open up its markets to UK including agricultural products and financial services. And May is expecting business deals at up to GBP 9b to be signed during the visit.

Separately, May told reporters that "there’s a difference between those people who came prior to us leaving and those who will come when they know the U.K. is no longer a member of the EU." That is, EU citizens going to UK during and after the transition period will have difference rights than the prior ones. However, European Parliament’s chief Brexit spokesman Guy Verhofstadt insisted that "citizens’ rights during the transition is not negotiable."

UK PMI manufacturing dropped to seven month low

UK PMI manufacturing dropped to 55.3 in January, down from 56.2 and missed expectation of 56.5. That’s the lowest level since June 2017 but nonetheless, stayed well above long-run average at 51.7. Markit noted in the release that "the UK manufacturing sector reported an unwelcome combination of slower growth and rising prices at the start of 2018." However, "encouragingly, despite the slowdown, the latest survey is consistent with production rising at a solid quarterly rate of around 0.6% in January, with jobs also being added at a faster pace." But, "the trend in demand will need to strengthen in the near-term to prevent further growth momentum being lost in the coming months.’

ECB Praet: An ample degree of stimulus needed

ECB Chief Economist Peter Praet reiterated his cautious stance regarding stimulus exit. He said today that "we have not yet accomplished our mission: with inflation convergence proceeding only gradually, patience and persistence in our monetary policy remain warranted." And, "inflation developments remain subdued…and we are still some distance away from meeting the Governing Council’s criteria for a sustained adjustment in the path of inflation". Therefore, "overall, an ample degree of monetary stimulus remains necessary.

In an interview with Irish RTE broadcast, ECB Executive Board member Benoit Coeure talked about recent comments by US Treasury Secretary Steven Mnuchin’s comment that a weaker dollar is welcomed. Mnuchin’s comment triggered steep selloff in Dollar and in turn pushed Euro up. Coeure echoed ECB President Mario Draghi’s stance to "keep to what we’ve agreed in the relevant fora, which is we’re not targeting exchange rates". But he warned that if what the US is doing would affect ECB’s chance of meeting its own mandate of price stability, ECB could be forced to response. He said that "we’ve seen quite some volatility recently. If that kind of volatility would lead to an unwarranted tightening of our monetary policy, we would have to reassess and consider.

Release from Europe, Eurozone PMI manufacturing was finalized at 59.6 in January, unrevised. Germany PMI manufacturing was finalized at 61.1, revised down by 0.1. France PMI manufacturing was finalized at 58.4, revised up by 0.3. Italy PMI manufacturing rose to 59. Swiss PMI manufacturing rose to 65.3 in January. Swiss retail sales rose 0.6% yoy in December. SECO consumer confidence improved to 5 in January.

China Caixin PMI manufacturing showed resilience

China Caixin PMI manufacturing was unchanged at 61.6 in January, meeting expectations. The survey showed resilience in the small to mid-sized manufacturing sector in the country. Zhengsheng Zhong, director of macroeconomic analysis at CEBM Group, a subsidiary of Caixin, noted that "the manufacturing industry had a good start to 2018. Going forward, we should keep a close eye on the stability of the demand side."

Also from Asia pacific, Australia import price index rose 1.5% qoq in Q4. Building approvals dropped sharply by -20% mom in December. Japan PMI manufacturing was revised up by 0.4 to 54.8 in January.

AUD/USD Mid-Day Outlook

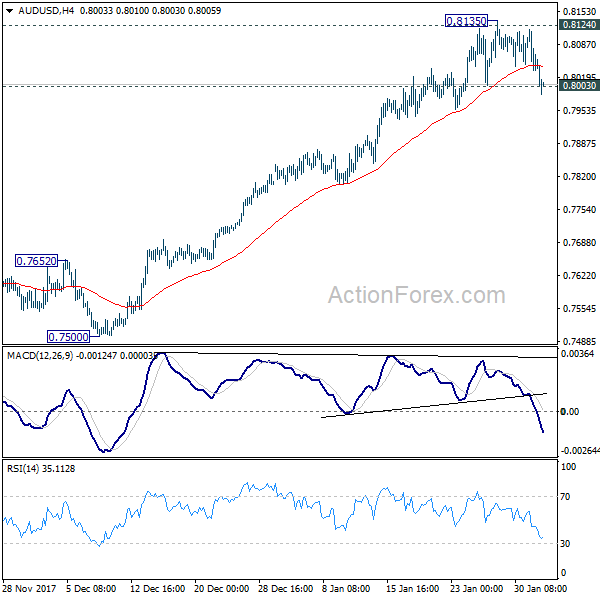

Daily Pivots: (S1) 0.8021; (P) 0.8069; (R1) 0.8104; More…

AUD/USD’s decline today and break of 0.8003 minor support suggests that a short term top is formed at 0.8135, on bearish divergence condition in 4 hour MACD. That also came after failing to sustain above 0.8124 resistance. Intraday bias is turned back to the downside for 55 day EMA (now at 0.7851). At this point, we’d expect strong support from there to bring rebound. But sustained trading below the EMA will bring retest of 0.7500 key near term support. On the upside, sustained break of 0.8124 will resume whole medium term rebound from 0.6826 and target key fibonacci level at 0.8451.

In the bigger picture, current development suggests that medium term rebound from 0.6826 is still in progress and could be resuming. Such rise could target 38.2% retracement of 1.1079 (2011 high) to 0.6826 (2016 low) at 0.8451. As such rise is seen as a corrective move, we’d expect strong resistance from 0.8451 to limit upside and bring reversal. Break of 0.7500 support will indicate that the medium term trend has reversed.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Import price index Q/Q Q4 | 1.50% | 1.50% | -1.60% | |

| 00:30 | AUD | Building Approvals M/M Dec | -20.00% | -7.60% | 11.70% | 12.60% |

| 00:30 | JPY | PMI Manufacturing Jan F | 54.8 | 54.4 | ||

| 01:45 | CNY | Caixin PMI Manufacturing Jan | 51.5 | 51.5 | 51.5 | |

| 06:45 | CHF | SECO Consumer Confidence Jan | 5 | 2 | -2 | |

| 08:15 | CHF | Retail Sales Y/Y Dec | 0.60% | 1.50% | -0.20% | |

| 08:30 | CHF | PMI Manufacturing Jan | 65.3 | 64.1 | 65.2 | |

| 08:45 | EUR | Italy Manufacturing PMI Jan | 59 | 57.3 | 57.4 | |

| 08:50 | EUR | France Manufacturing PMI Jan F | 58.4 | 58.1 | 58.1 | |

| 08:55 | EUR | Germany Manufacturing PMI Jan F | 61.1 | 61.2 | 61.2 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Jan F | 59.6 | 59.6 | 59.6 | |

| 09:30 | GBP | PMI Manufacturing Jan | 55.3 | 56.5 | 56.3 | 56.2 |

| 12:30 | USD | Challenger Job Cuts Y/Y Jan | -2.80% | -3.60% | ||

| 13:30 | USD | Nonfarm Productivity Q4 P | -0.10% | 1.10% | 3.00% | 2.70% |

| 13:30 | USD | Unit Labor Costs Q4 P | 2.00% | 1.00% | -0.20% | -0.10% |

| 13:30 | USD | Initial Jobless Claims (JAN 27) | 230K | 236K | 233K | 231K |

| 14:45 | USD | Manufacturing PMI Jan F | 55.5 | 55.5 | ||

| 15:00 | USD | Construction Spending M/M Dec | 0.40% | 0.80% | ||

| 15:00 | USD | ISM Manufacturing Jan | 58.6 | 59.7 | ||

| 15:00 | USD | ISM Prices Paid Jan | 69.5 | 69 | ||

| 15:30 | USD | Natural Gas Storage | -288B |