Dollar’s broad based selloff resumes today as traders hit the accelerator. The key factors behind are improving economic outlook in other major economies. At the same time US Treasury Mnuchin’s backing of a weaker dollar is triggering the acceleration. While economic data from Eurozone continued to be solid, it’s following Dollar as the second weakest one. Sterling emerges as the strongest one today as data suggest faster wage growth. Aussie and Kiwi come as second and third.

Mnuchin: A weaker dollar is good for us

US Treasury Secretary Steven Mnuchin s expressed that a weaker dollar is welcomed by the country. Mnuchin said in a press conference at the World Economic Forum in Davos that "obviously a weaker dollar is good for us as it relates to trade and opportunities." And, the short term movements are "not a concern of ours at all". He also added "longer term, the strength of the dollar is a reflection of the strength of the U.S. economy and the fact that it is and will continue to be the primary currency in terms of the reserve currency."

UK wage growth accelerating

UK jobless claims rose 8.6k in December above expectation of 2.3k. Claimant count rate also rose to 2.4%. ILO unemployment rate was unchanged at 4.3% in November. Average weekly earnings, including bonus, rose 2.5% 3moy. However, average earnings growth, excluding bonus, accelerate to 2.4%, up from 2.3%. Some economists perceived the data as confirming underlying upward pressure in wages. And considering improved Brexit prospects, there is prospect of BoE hiking more than once this year. But that’s subject to an early outcome in the Brexit deal, or at least the transition deal.

Eurozone PMIs suggests "super strong" Q1

Eurozone PMI manufacturing dropped to 59.6 in January, down from 60.6 and missed expectation of 60.3. However, Eurozone PMI services rose to 57.6, up from 56.6 and beat expectation of 56.4. Germany PMI manufacturing dropped to 61.2, down from 63.3 and missed expectation of 63.0. Germany PMI services rose to 57.0, up from 55.8 and beat expectation of 55.5. France PMI manufacturing dropped to 58.1, down from 58.8 and missed expectation of 58.6. France PMI services, however, rose to 59.3, up from 59.1, above expectation of 58.9.

Markit chief business economist, Chris Williamson noted in the release that if the January figures are maintained, they are consistent with "super-strong" Q1 growth at 1%. He said that "the Eurozone has got off to a flying start in 2018, with business activity expanding at a rate not seen for almost 12 years. The acceleration of growth pushes the survey data into territory consistent with the economy expanding at a super-strong quarterly rate approaching 1%,"

And, "with employment growing at the fastest pace for 17 years, an improving labour market should feed through to higher consumer spending, which should help further drive the economic upturn as 2018 proceeds, as well as higher wages. Price pressures are meanwhile running at their highest for almost seven years, accelerating further at the start of 2018. Higher oil prices have pushed up costs, but pricing power more generally has improved as demand outstrips supply for many goods, leading to a sellers’ market."

Japan PMI manufacturing hits near 4 year high

Japan PMI manufacturing rose to 54.4 in January, up from 54.0 and beat expectation of 54.3. The index has now stayed in expansionary region above 50 for the 17th consecutive month. January’s reading was also the highest since February 2014. IHS Markit economist Joe Hayes noted in the statement that "the strongest reading in the PMI since February 2014 was supported by quickened rates of output and employment growth."

Also from Japan, adjusted trade balance showed surplus of JPY 86.8b, below expectation of JPY 270b. Nonetheless, the set of data is pretty strong. Exports rose 9.3% yoy to JPY 7.3T, largest since September 2008. Exports to China, the biggest trading partner, jumped 15.8% yoy and hit record JPY 1.5T. Imports jumped even larger by 13.9% yoy.

GBP/USD Mid-Day Outlook

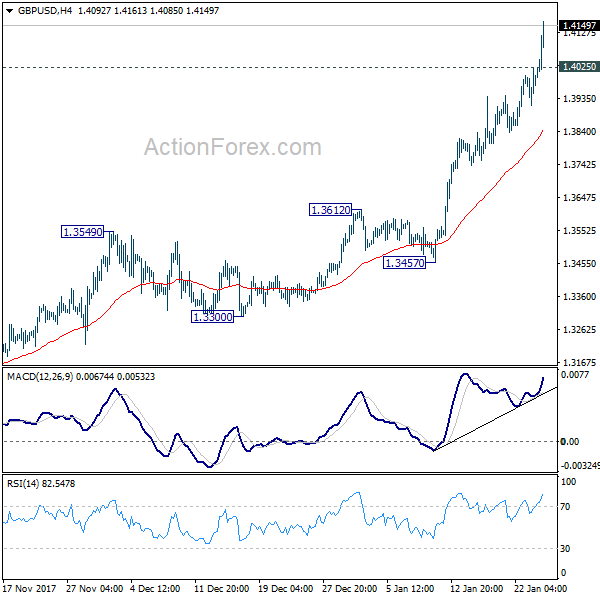

Daily Pivots: (S1) 1.3934; (P) 1.3980; (R1) 1.4046; More…..

GBP/USD accelerates to as high as 1.4161 so far today. Intraday bias remains on the upside for further rally. Firm break of medium term channel resistance will bring further upside acceleration to 100% projection of 1.2108 to 1.3651 from 1.3038 at 1.4581 next. On the downside, below 1.4025 minor support will turn intraday bias neutral and bring consolidation. But retreat should be contained well above 1.3612 resistance turned support to bring another rise.

In the bigger picture, sustained break of 1.3835 key resistance level indicates that rebound from 1.1946 is at least correcting the long term down from from 2007 high at 2.1161. In that case, further rise should be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. Medium term outlook will now stay bullish as long as 1.3038 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Dec | 30% | 0.10% | ||

| 23:50 | JPY | Trade Balance (JPY) Dec | 0.09T | 0.27T | 0.36T | 0.29T |

| 0:30 | JPY | PMI Manufacturing Jan P | 54.4 | 54.3 | 54 | |

| 8:00 | EUR | France Manufacturing PMI Jan P | 58.1 | 58.6 | 58.8 | |

| 8:00 | EUR | France Services PMI Jan P | 59.3 | 58.9 | 59.1 | |

| 8:30 | EUR | Germany Manufacturing PMI Jan P | 61.2 | 63 | 63.3 | |

| 8:30 | EUR | Germany Services PMI Jan P | 57 | 55.5 | 55.8 | |

| 9:00 | EUR | Eurozone Manufacturing PMI Jan P | 59.6 | 60.3 | 60.6 | |

| 9:00 | EUR | Eurozone Services PMI Jan P | 57.6 | 56.4 | 56.6 | |

| 9:30 | GBP | Jobless Claims Change Dec | 8.6K | 2.3K | 5.9K | |

| 9:30 | GBP | Claimant Count Rate Dec | 2.40% | 2.30% | 2.30% | |

| 9:30 | GBP | Average Weekly Earnings 3M/Y Nov | 2.50% | 2.50% | 2.50% | |

| 9:30 | GBP | ILO Unemployment Rate 3Mths Nov | 4.30% | 4.30% | 4.30% | |

| 14:00 | USD | House Price Index M/M Nov | 0.40% | 0.50% | ||

| 14:45 | USD | US Manufacturing PMI Jan P | 55 | 55.1 | ||

| 14:45 | USD | US Services PMI Jan P | 54.4 | 53.7 | ||

| 15:00 | USD | Existing Home Sales Dec | 5.72M | 5.81M | ||

| 15:30 | USD | Crude Oil Inventories | -6.9M |