Australian Dollar is lifted mildly today by business condition and confidence data and is trading broadly higher. Nonetheless, the forex markets are generally stuck in consolidation mode. Risk markets further stabilized overnight with DOW closed up 410 pts, or 1.7%, at 24601, responded positively to US President Donald Trump’s infrastructure plan. Japan Nikkei follow is s trading up 0.8% at the time of writing. The economic calendar remains rather light today. UK inflation data, in particular CPI, will be the focus.

Australia business confidence hit 9 month high

Australia NAB business confidence rose 2 points to 12 in January, hitting a 9-month high. Business condition index rose 6 points to 19. NAB chief economist Alan Oster noted in the release that "while forward orders have eased a little, they remain above average and capacity utilisation has been trending up which is a good sign for both future investment and employment."

RBA Ellis: Wage growth to be gradual

RBA Assistant Governor Luci Ellis said that wages are forecast to "pick up from here", but "not immediately and then only gradually". She added that "firms are increasingly using other creative ways to attract and keep staff without paying across-the-board wage rises." And, "they are especially reluctant to grant wage rises, because this would increase one of their most important costs." Meanwhile, Australia is still "a bit further behind" some other advanced economies and "it might take a bit longer for the turnaround in inflation to happen here than elsewhere."

Japan PM Abe no decision on Kuroda yet

It was reported over the weekend that BoJ Governor Haruhiko Kuroda will be given a rare second term and the nomination will be sent to the parliament later this month. However, Prime Minister Shinzo Abe told the parliament today that he hasn’t made the decision yet. Finance Minister, who’s now the longest serving one in the post, said that "speaking fluent English is one very important condition for the job," of BoJ Governor. Meanwhile, Kuroda repeated his stance today, saying that "powerful" monetary easing is still needed to support the economy. And Kuroda pledged to "continue to closely watch domestic and overseas market moves, as they could affect Japan’s economy and prices."

TNX could hit 3.5%

US 10 year yield closed higher by 0.028 at 2.857 yesterday but is limited below last week’s high at 2.884. Technically, TNX is still on track for 3.036 key resistance level, which is seen as a key junction for the long term trend. Fundamentally, there are increasing expectation of rising yields in the US. According to Philip Moffitt, Asia-Pacific head of fixed income in Goldman Sachs Asset Management, Fed could hike four times this year. In the background, as Fed shrinks its balance sheet, there will be a surge in supply in bonds. And together, Moffitt expects TNX hitting 3.5% is "not a very brave forecast".

AUD/USD Daily Outlook

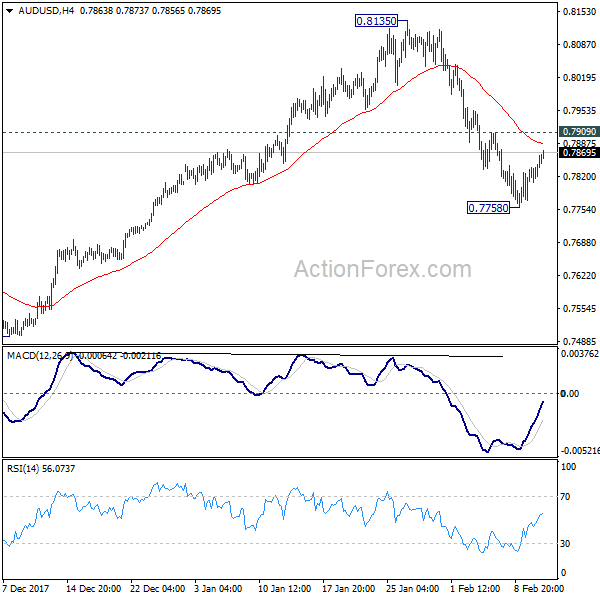

Daily Pivots: (S1) 0.7826; (P) 0.7844; (R1) 0.7880; More…

AUD/USD’s recovery from 0.7758 extends higher today but it’s staying below 0.7909 minor resistance. Intraday bias stays neutral and deeper decline remain in favor. Break of 0.7758 will extend the fall from 0.8135 to 0.7500 key support. At this point, there is no clearly sign of larger trend reversal yet. Hence, we’d look for strong support from 0.7500 to contain downside and bring rebound. On the upside, above 0.7909 minor resistance will turn bias back to the upside for retesting 0.8135 high.

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. It might still extend higher but we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption. On the downside, break of 0.7500 support will now be an important signal that such corrective rebound is completed.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Domestic CGPI Y/Y Jan | 2.70% | 2.70% | 3.10% | 3.00% |

| 0:30 | AUD | NAB Business Conditions Jan | 19 | 12 | 13 | |

| 0:30 | AUD | NAB Business Confidence Jan | 12 | 10 | 11 | 10 |

| 6:00 | JPY | Machine Tool Orders Y/Y Jan P | 48.30% | |||

| 8:15 | CHF | PPI M/M Jan | 0.20% | 0.20% | ||

| 8:15 | CHF | PPI Y/Y Jan | 0.90% | 1.80% | ||

| 9:30 | GBP | CPI M/M Jan | -0.60% | 0.40% | ||

| 9:30 | GBP | CPI Y/Y Jan | 2.90% | 3.00% | ||

| 9:30 | GBP | Core CPI Y/Y Jan | 2.60% | 2.50% | ||

| 9:30 | GBP | RPI M/M Jan | -0.70% | 0.80% | ||

| 9:30 | GBP | RPI Y/Y Jan | 4.10% | 4.10% | ||

| 9:30 | GBP | PPI Input M/M Jan | 0.60% | 0.10% | ||

| 9:30 | GBP | PPI Input Y/Y Jan | 4.10% | 4.90% | ||

| 9:30 | GBP | PPI Output M/M Jan | 0.20% | 0.40% | ||

| 9:30 | GBP | PPI Output Y/Y Jan | 3.00% | 3.30% | ||

| 9:30 | GBP | PPI Output Core M/M Jan | 0.20% | 0.30% | ||

| 9:30 | GBP | PPI Output Core Y/Y Jan | 2.30% | 2.50% | ||

| 9:30 | GBP | House Price Index Y/Y Dec | 4.90% | 5.10% |