The global markets turned into consolidative mode, digesting recent losses. DOW attempted to rebound to 25293.96 but closed down -0.08% at 24893.35. Nikkei is trading up 0.35% at the time of writing but lacks follow through momentum. An important development to watch is that 10 year yield closed sharply higher by 0.076 at 2.845. Monday’s high at 2.862 is now back in radar. And a strong break there will release recent up trend in yields, and could prompt another round of selloff in stocks. In the currency markets, Yen remains the strongest major currency for the week and is back pressing this week’s low against Europeans. Dollar follow as the second strongest and has picked up from momentum overnight. New Zealand Dollar trades broadly lower after RBNZ stands pat and maintained a neutral stance. The Kiwi is so far the weakest one for the week.

RBNZ stands pat and maintained neutral stance

RBNZ left the Official Cash Rate unchanged at 1.75% today as widely expected. Kiwi tumbled as the central bank maintained a dovish stance. The accompanying statement noted that "monetary policy will remain accommodative for a considerable period. Numerous uncertainties remain and policy may need to adjust accordingly." RBNZ Governor Grant Spencer tried to talk down the recent global stock market crash.. He said in the press conference that "the bond market didn’t really react, it’s more of an equity market phenomenon. And now it’s settled down, so that’s not really going to have a long term effect." However, Spencer also warned that "it’s been a warning sign because that volatility shows how nervous the market is about…the normalization of interest rates."

Separately, RBNZ Assistant Governor John McDermott said in a Reuters interview that "Core inflation is sitting a little bit below the midpoint… it still needs a little shove to get it towards the midpoint. That strategy hasn’t changed." He reiterated RBNZ’s "neutral stance". And he added that "there is a significant probability that the next rate move could be an increase sometime in the future, and there’s also a substantial probability that the next move could actually be a cut."

Following up on NZD/USD, the decline from 0.7435 short term top extends to as low as 0.7181 so far today. It’s on track to 55 day EMA (now at 0.7170). Sustained break there will confirm completion of the rebound from 0.6779 and pave the way to retest this low. Overall, medium term range trading is expected to continue inside 0.6779/7557 for a while.

Fed Williams: Economy can clearly handle gradual hikes

San Francisco Fed President John Williams said yesterday that "the economy clearly can handle gradually rising interest rates." And, he’s "not really worried about the downside risks of the economy slowing too much." Also, regarding recent market crash, Williams said " I don’t see any of the movements in asset prices of late to fundamentally change my view of the economy." He reiterated his expectation for three or four interest rate hikes this year. Chicago Fed President Charles Evans said that rising wages and inflation expectations suggested that inflation might be on the up. And, "if we get to that point and have more confidence that inflation is moving up sustainably, then further rate increases would be warranted,"

German grand coalition reformed

German Chancellor Angela Merkel formally announced the reformation of grand coalition yesterday, after marathon negotiation with SPD. Merkel said in a press conference that the agreement would create "the good and stable government that our country needs and that many in the world expect from us". Martin Schulz will step down as SPD leader and enter the government as Foreign Minister. Schulz is known for his pro-EU stance and his push for turning EU into a "United States of Europe". Another SPD member Olaf Scholz will likely take up the job of Finance Minister. But some analysts noted that Scholz is in the liberal wing of SPD and he’s not too different from Wolfgang Schaeuble.

BoE Super Thursday: Voting and forecasts to watch

BoE rate decision and Inflation Report will be the biggest focus of today. There are rising speculations that BoE could pull ahead the next rate hike, to as soon as May. Traders will be very eager to get any hints on that. The vote split will be the first thing to watch. Markets generally expect an unanimous vote to keep interest rate unchanged at 0.50%. Any dissent and push for hike will show some impatience in the MPC. And, if someone would dissent, known hawks Ian McCafferty and Michael Saunders will be the likely candidate.

The Inflation Report will also bear much significance. Back in November, BoE projected 2018 GDP growth to be at 1.7%, CPI to slow to 2.4% and Bank Rate to be at 0.7% by the end of the year. There could be an upgrade in growth forecast as Brexit negotiation has finally entered into the second phase. But the key will be on whether BoE still expect CPI to slow from current 3.0% to 2.4%. And just a slight change in rate forecast could prompt much volatility in the Pound.

On the data front

Japan current account surplus narrowed to JPY 1.48T in December. China trade surplus narrowed sharply to CNY 136b, or USD 20.3b in January. Australia NAB business confidence dropped to 6 in Q4. German will release trade balance in European session while ECB will release monthly bulletin. Later in the day, Canada will release housing starts and new housing price index. US will release jobless claims on a Thursday as usual.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.2204; (P) 1.2305 (R1) 1.2364; More….

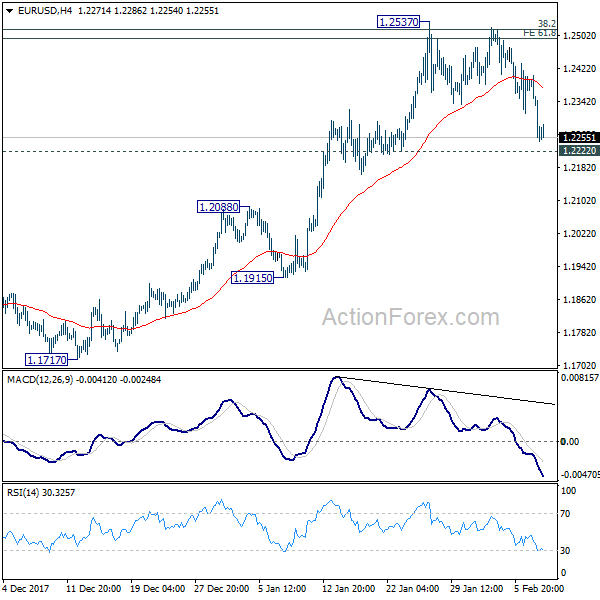

EUR/USD drops to as low as 1.2245 so far. Downside acceleration as seen in 4 hour MACD is raising the chance of trend reversal. But we’d prefer to see decisive break of 1.2222 support to confirm. Sustained break of 1.2222 will indicate rejection from 1.2494/2516 key fibonacci level, on bearish divergence condition in 4 hour MACD. That could also signal completion of medium term up trend from 1.0339. In that case, near term outlook will be turned bearish for 1.2091 resistance turned support first.

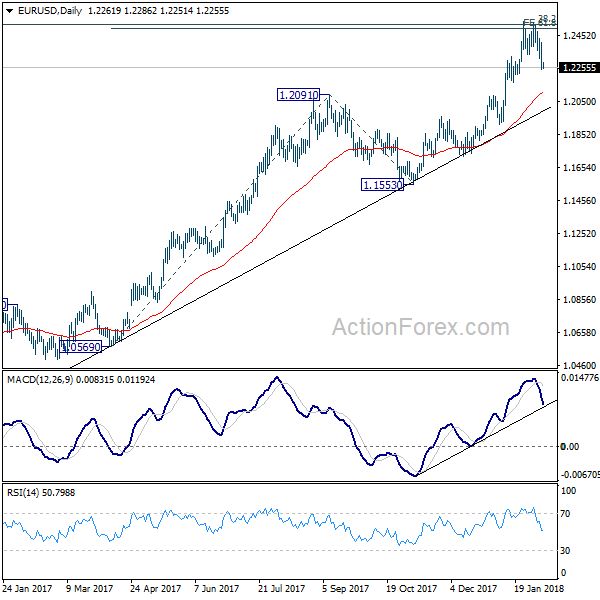

In the bigger picture, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. But key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 is looking vulnerable. Sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862. Nonetheless, rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 20:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% | 1.75% | |

| 23:50 | JPY | Current Account (JPY) Dec | 1.48T | 1.66T | 1.70T | |

| 0:01 | GBP | RICS House Price Balance Jan | 8.00% | 5.00% | 8.00% | |

| 0:30 | AUD | NAB Business Confidence Q4 | 6 | 7 | 8 | |

| 2:00 | CNY | Trade Balance (CNY) Jan | 136B | 325B | 362B | |

| 3:45 | CNY | Trade Balance (USD) Jan | 20.3B | 54.9B | 54.7B | |

| 5:00 | JPY | Eco Watchers Survey Current Jan | 53.6 | 53.9 | ||

| 7:00 | EUR | German Trade Balance Dec | 21.0b | 23.7b | ||

| 9:00 | EUR | ECB Economic Bulletin | ||||

| 12:00 | GBP | BoE Rate Decision | 0.50% | 0.50% | ||

| 12:00 | GBP | BoE Asset Purchase Target Feb | 435B | 435B | ||

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | ||

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | ||

| 12:00 | GBP | BoE Inflation Report | ||||

| 13:15 | CAD | Housing Starts Jan | 211K | 218K | ||

| 13:30 | CAD | New Housing Price Index M/M Dec | 0.20% | 0.10% | ||

| 13:30 | USD | Initial Jobless Claims (3 FEB) | 236K | 230K | ||

| 15:30 | USD | Natural Gas Storage | -99B |