Dollar weakens broadly in early US session despite solid employment data. In particular, USD/CAD leads the way with Canadian GDP meeting forecasts. The greenback will look into Janet Yellen’s last FOMC announcement today. But it’s unlikely for Dollar to get any support from there. The key level to watch is 1.25 handle in EUR/USD. It’s close to 1.2494/2516 cluster fibonacci level. A firm break there would likely prompt broad-based selloff in Dollar.

US ADP report showed 234k growth in private sector jobs in January, versus expectation of 183k. Employment cost index rose 0.6% in Q4, meeting consensus. From Canada, GDP grew 0.4% mom in November, meeting forecasts. IPPI dropped -0.1% mom in December while RMPI dropped -0.9% mom.

It is widely expected that no change would be made in Yellen’s last FOMC meeting as Fed chair. The market focus is on the Fed’s economic outlook and whether there are hints on the rate hike path. Notwithstanding the fact that inflation has remained soft, the robust employment market, with unemployment rate below the Fed’s long-term target, should have anchored the Fed’s confidence over the economic outlook. Fed could make an hawkish tweak in the statement the pave the rate for a March hike. Fed fund futures are already pricing in over 70% chance of that.

ECB Coeure: Not going to be too hasty on stimulus exit

ECB Executive Board member Benoit Coeure said today that the asset purchase program "of course will not last forever". But he emphasized that "there is also a very wide agreement in the Governing Council … that we have to be patient and prudent because we are not yet where we want to be in terms of inflation." He added that "we are not going to be too hasty". Also, there were speculations that ECB could be soon ready to tweak its communications. But Coeure said that "we are having a discussion on having a discussion" only and "its meta monetary policy".

Release from Eurozone, CPI slowed to 1.3% yoy in January, down from 1.3% yoy and met expectation. CPI core rose to 1.0% yoy, up from 0.9% yoy, also met expectations. Eurozone unemployment rate was unchanged at 8.7% in December. Germany unemployment dropped -25k in January versus expectation of -20k. Germany retail sales dropped -1.9% mom in December, versus expectation of -0.4% yoy.

Also from Europe, Swiss UBS consumption indicator rose 0.2 to 1.69 in December. UK Gfk consumer confidence rose to -9 in January. BRC shop price index dropped -0.5% yoy in January.

Australia CPI picked up but missed expectations

Australia CPI accelerated to 1.9% yoy in Q4, up fro Q3’s 1.8 yoy. However, this came in weaker than expectations of 2.0% yoy. On RBA’s other inflation measures, the trimmed mean CPI stayed unchanged at 1.8%, missing consensus of 1.9%. The weighted median CPI rose to 2.0% from 1.9% in the third quarter. This exceeded expectations of 1.9%. The set of inflation data gives no pressure for RBA to hike any time soon. And indeed, recent rally in Aussie’s exchange rate could give some downward pressure to inflation in near term ahead. And, there is still a lack of evidence of pick up in wage growth.

China manufacturing PMI slipped to 51.3

From China, official manufacturing PMI slipped -0.3 point to 51.3 in January, comparing to consensus of 51.5. Non-manufacturing PMI added 0.3 point to 55.3, beating expectations of 55. Note the government’s PMI estimates cover large corporations while the one compiled by Caixin/ Markit covers medium to small firms. Traders should interpret China’s economic data with caution as the accuracy is under question. HSBC complained about the country’s lack of transparency and withdrew from being the partner of Markit in compilation of China’s PMI data in 2015. Meanwhile, several provincial and local governments including Inner Mongolia and Tianjin have admitted exaggerating the economic data earlier this month.

BoJ Iwata: Some distance to 2% inflation

BoJ Deputy Governor Kikuo Iwata said today that the "powerful" monetary easing should be maintained. He noted "the economy is expanding moderately but prices remain weak." And, "there’s some distance to 2 percent inflation." And he called for "government steps, as well as appropriate monetary policy, are necessary to achieve price stability with sustained economic growth." BoJ released summary of opinions from the January meeting. One member said that recent surge in market expectation of stimulus exit would be "undesirable".

Released from Japan, consumer confidence was unchanged at 44.7 in January. Housing starts dropped -2.1% yoy in December. Industrial production rose 2.7% mom in December.

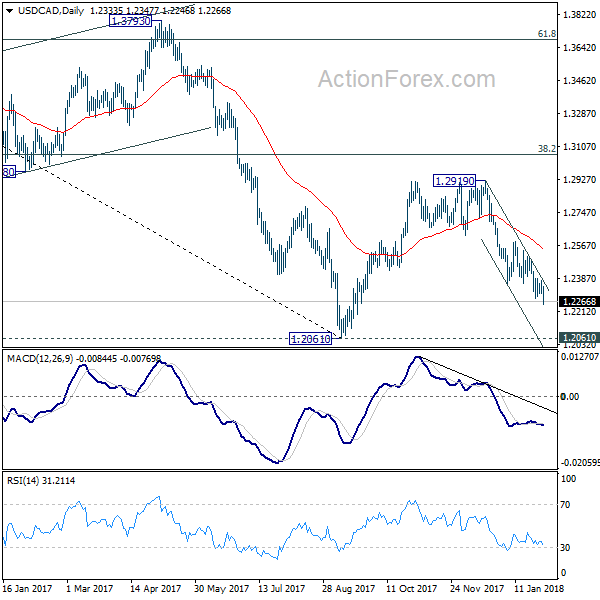

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.2304; (P) 1.2341; (R1) 1.2375; More…

USD/CAD drops to as low as 1.2246 so far and break of 1.2281 indicates fall resumption. Intraday bias is turned back to the downside. Fall from 1.2919 should target a test on 1.2061 low. On the upside, however, break of 1.2390 resistance will indicate near term bottoming. That would be accompanied by bullish convergence condition in 4 hour MACD.

In the bigger picture, rebound from 1.2061 is likely completed completed at 1.2919, rejected by 55 week EMA and kept below 38.2% retracement of 1.4689 to 1.2061 at 1.3065. The development also suggests that long term fall from 1.4689 is not completed yet. Decisive break of 1.2061 low will target 61.8% retracement of 0.9406 to 1.4689 at 1.1424. This will now be the favored case as long as 1.2919 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BOJ Summary of Opinions | ||||

| 23:50 | JPY | Industrial Production M/M Dec P | 2.70% | 1.50% | 0.50% | |

| 00:01 | GBP | GfK Consumer Confidence Jan | -9 | -13 | -13 | |

| 00:01 | GBP | BRC Shop Price Index Y/Y Jan | -0.50% | -0.40% | -0.60% | |

| 00:30 | AUD | CPI Q/Q Q4 | 0.60% | 0.70% | 0.60% | |

| 00:30 | AUD | CPI Y/Y Q4 | 1.90% | 2.00% | 1.80% | |

| 00:30 | AUD | CPI RBA Trimmed Mean Q/Q Q4 | 0.40% | 0.50% | 0.40% | |

| 00:30 | AUD | CPI RBA Trimmed Mean Y/Y Q4 | 1.80% | 1.90% | 1.80% | |

| 00:30 | AUD | CPI RBA Weighted Median Q/Q Q4 | 0.40% | 0.50% | 0.30% | |

| 00:30 | AUD | CPI RBA Weighted Median Y/Y Q4 | 2.00% | 1.90% | 1.90% | |

| 01:00 | CNY | Manufacturing PMI Jan | 51.3 | 51.5 | 51.6 | |

| 01:00 | CNY | Non-manufacturing PMI Jan | 55.3 | 55 | 55 | |

| 05:00 | JPY | Consumer Confidence Jan | 44.7 | 44.9 | 44.7 | |

| 05:00 | JPY | Housing Starts Y/Y Dec | -2.10% | 1.10% | -0.40% | |

| 07:00 | EUR | German Retail Sales M/M Dec | -1.90% | -0.40% | 2.30% | |

| 07:00 | CHF | UBS Consumption Indicator Dec | 1.69 | 1.67 | 1.73 | |

| 08:55 | EUR | German Unemployment Change Jan | -25K | -20K | -29K | |

| 08:55 | EUR | German Unemployment Claims Rate Jan | 5.40% | 5.40% | 5.50% | |

| 10:00 | EUR | Eurozone Unemployment Rate Dec | 8.70% | 8.70% | 8.70% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Jan A | 1.00% | 1.00% | 0.90% | |

| 10:00 | EUR | Eurozone CPI Estimate Y/Y Jan | 1.30% | 1.30% | 1.40% | |

| 13:15 | USD | ADP Employment Change Jan | 234K | 183K | 250K | 242K |

| 13:30 | USD | Employment Cost Index Q4 | 0.60% | 0.60% | 0.70% | |

| 13:30 | CAD | GDP M/M Nov | 0.40% | 0.40% | 0.00% | |

| 13:30 | CAD | Industrial Product Price M/M Dec | -0.10% | 0.00% | 1.40% | |

| 13:30 | CAD | Raw Materials Price Index M/M Dec | -0.90% | -2.50% | 5.50% | |

| 14:45 | USD | Chicago PMI Jan | 64 | 67.6 | ||

| 15:00 | USD | Pending Home Sales M/M Dec | 0.50% | 0.20% | ||

| 15:30 | USD | Crude Oil Inventories | 0.1M | -1.1M | ||

| 19:00 | USD | FOMC Rate Decision | 1.50% | 1.50% |