Dollar’s recovery once again loses momentum today. Overall the markets are staying in consolidative mode. Eurozone GDP came in meeting expectations but provides little boost to Euro. It’s seems that solid growth data from the region is becoming a norm. Meanwhile, Sterling also rebounds notably today even though political and Brexit news continue. For the moment, the markets are likely holding their breaths, waiting for US President Donald Trump’s State of Union address in the upcoming Asian session, as well as tomorrow’s FOMC announcement.

Sterling firms up with rate hike bets

Despite this week’s retreat, Sterling remains firmly in up trend against Dollar. Money markets are pricing in around 50% chance of a rate hike by BoE in May. The chance for a hike by August has even rose to 80%. A major focus today is BoE Governor Mark Carney’s speech in the Parliament. For now, political news might trigger some jitters in Sterling, its strong will likely continue. The key event will be the BoE quarterly inflation report on February 8, i.e. next Thursday. Released from UK, mortgage approvals dropped to 61k in December. M4 dropped -0.6% mom.

Eurozone GDP grew 0.6 qoq in Q4

Eurozone GDP grew 0.6% qoq in Q4, same as Q4 and met expectations. That’s also the 19th straight quarter of expansion. The solid Q4 also put annual growth in Eurozone to 2.5%, fastest since the financial crisis back in 2008. France GDP also grew 0.6% qoq in Q4. Also from Eurozone, business climate dropped to 1.54 in January. Economic confidence dropped to 114.7. Industrial confidence dropped to 8.8. Services confidence dropped to 16.7. Consumer confidence was finalized at 1.3. German CPI slowed to 1.6% yoy in January, below expectation of 1.7% yoy.

Swiss KOF retreated

Swiss KOF leading indicator dropped to 106.9 in January, down from 111.4 and missed expectation of 110.8. That ended a four month rising streak. The declines in the banking and manufacturing sector are the main factor sending the index lower. Nonetheless, KOF said the index remained well above its long-term average and "still indicates a more dynamic economic development than in mid-2017". Also from Swiss, trade surplus widened to CHF 2.63b in December, up from CHF 2.58b and beat expectation of CHF 2.54b.

Australia: Perplexing gap between business conditions and confidence narrowed

Australia NAB business conditions rose to 13 in December, up from 12 but missed expectation of 15. Nonetheless, that’ still way above long run average of 5. Business confidence rose to 11, up from 7 but also missed expectation of 12. That’s the highest reading since July. The strong bounce in confidence reading "helped to narrow the perplexing gap between business conditions and confidence evident over the past couple of years, and is an encouraging signal for investment," noted NAB group chief economist Alan Oster.

However, retail remained pressured at negative conditions at -2. Oster noted that "final retail prices also weakened sharply in December into negative territory, and are running at a slower rate than labour costs and purchases costs, pointing to margin compression." And the fall in prices is seen as a downside risk to Q4 CPI report due tomorrow.

New Zealand imports and exports hit records in 2017

New Zealand trade balance came in at strong surplus at NZD 640m in December, versus expectation of NZD -125m deficit. Exports surged 26% yoy to NZD 5.55b in the month while imports rose 11% to NZD 4.91b. Over the year, total exports hit NZD 53.7b in 2017, up 11% on 2016 and hit a new record. Imports also rose to NZD 56.5b, up 9.4% on 2016, and hit a record too. Exports to China jumped a strong 27% in 2017, hitting close to NZD 12b. Exports to Australia, however, grew a mere 6.5% to NZD 8.8b.

Abe’s advisor Hamada: BoJ Governor should follow Abenomics

In Japan, an economic adviser to Prime Minister Shinzo Abe said the BoJ should stick with so called "Abenomics" no matter who the next Governor is. Koichi Hamada, an emeritus professor of economics at Yale University said that the next BoJ Governor should have "boldness and experience". He emphasized that "Abenomics is managed excellently by the BOJ policy. If you are winning in a sport, you don’t change the strategy." For the moment, there is no decision on whether Haruhiko Kuroda would be given another term. Hamada commented that "there are many excellent people working at the BOJ and their morale will be reduced if someone outside of the central bank becomes governor so often, though I don’t know if a BOJ official will become next governor this time."

Released from Japan, retails ales rose 3.6% yoy in December, household spending dropped -0.1% yoy. Unemployment rate rose to 2.8%.

GBP/USD Mid-Day Outlook

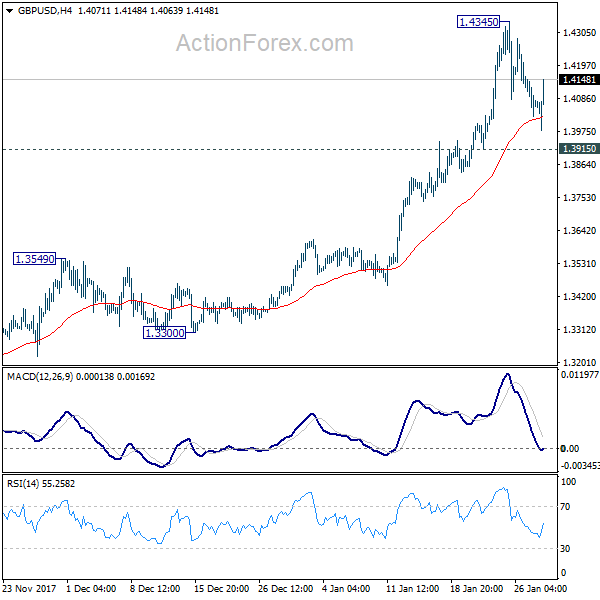

Daily Pivots: (S1) 1.4015; (P) 1.4086; (R1) 1.4148; More…..

GBP/USD recovers after drawing support from 4 hour 55 EMA. But it’s limited below 1.4345 and intraday bias neutral. More corrective trading could be seen. But downside should be contained by 1.3915 support to bring rally resumption. On the upside, break of 1.4345 will resume medium term up trend to 100% projection of 1.2108 to 1.3651 from 1.3038 at 1.4581 next. However, break of 1.3915 will argue that, at least, deeper pull back in underway to 1.3651 resistance turned support.

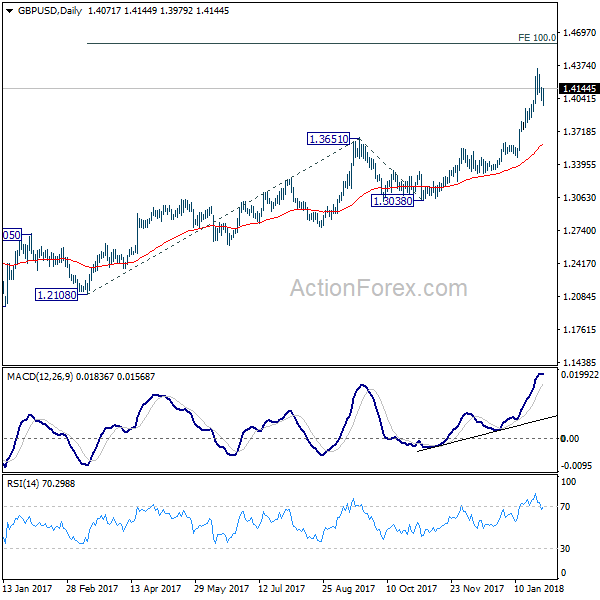

In the bigger picture, sustained break of 1.3835 key resistance level indicates that rebound from 1.1946 is at least correcting the long term down from from 2007 high at 2.1161. Further rise should now be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. Medium term outlook will stay bullish as long as 1.3038 support holds, in case of pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance Dec | 640M | -125M | -1193M | -1233M |

| 23:30 | JPY | Jobless Rate Dec | 2.80% | 2.70% | 2.70% | |

| 23:30 | JPY | Household Spending Y/Y Dec | -0.10% | 1.50% | 1.70% | |

| 23:50 | JPY | Retail Trade Y/Y Dec | 3.60% | 2.10% | 2.20% | 2.10% |

| 00:30 | AUD | NAB Business Conditions Dec | 13 | 15 | 12 | |

| 00:30 | AUD | NAB Business Confidence Dec | 11 | 12 | 6 | 7 |

| 06:30 | EUR | French GDP Q/Q Q4 A | 0.60% | 0.60% | 0.60% | 0.60% |

| 07:00 | CHF | Trade Balance (CHF) Dec | 2.63B | 2.54B | 2.63B | 2.58B |

| 08:00 | CHF | KOF Leading Indicator Jan | 106.9 | 110.8 | 111.3 | 111.4 |

| 09:30 | GBP | Mortgage Approvals Dec | 61.0k | 63.5k | 65.1k | 64.7k |

| 09:30 | GBP | Money Supply M4 M/M Dec | -0.6 | 0.20% | 0.10% | |

| 10:00 | EUR | Eurozone Business Climate Indicator Jan | 1.54 | 1.68 | 1.66 | |

| 10:00 | EUR | Eurozone Economic Confidence Jan | 114.7 | 116.2 | 116 | |

| 10:00 | EUR | Eurozone Industrial Confidence Jan | 8.8 | 8.9 | 9.1 | |

| 10:00 | EUR | Eurozone Services Confidence Jan | 16.7 | 18.5 | 18.4 | |

| 10:00 | EUR | Eurozone Consumer Confidence Jan F | 1.3 | 1.3 | 1.3 | |

| 10:00 | EUR | Eurozone GDP Q/Q Q4 A | 0.60% | 0.60% | 0.60% | |

| 13:00 | EUR | German CPI M/M Jan P | -0.70% | -0.60% | 0.60% | |

| 13:00 | EUR | German CPI Y/Y Jan P | 1.60% | 1.70% | 1.70% | |

| 14:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Nov | 6.30% | 6.40% | ||

| 15:00 | USD | Consumer Confidence Jan | 123 | 122.1 |