The forex markets are pretty steady in Asian session today as markets are preparing for an extremely busy week ahead. Dollar is trying to recovery. While the greenback is trading broadly higher, it’s kept in Friday’s range. There is no realistic sign of short term bottoming yet. There are countless important data to be released this week, including PCE, ISM and NFP from the US. FOMC is also expected to deliver a hawkish twist to prepare the markets for March hike. But US President Donald Trump’s tone regarding Dollar in the State of Union address could be the trend defining moment.

NAFTA negotiation to continue with an air of optimism

It’s reported that Trump will not announce withdrawal from the NAFTA during his State of Union address on Tuesday. Some US representatives expressed optimism on a deal during the weekend. Republican Dave Reichert said "there’s just an air of optimism". He pointed out that "they’re already talking about additional rounds, where not too long ago, we were wondering whether or not there would be continued negotiations." Meanwhile it’s reported that the NAFTA negotiation will extend deeper into 2018, probably beyond the presidential election in Mexico in July.

ECB Knot: There is no reason whatsoever to continue with QE after September

ECB Governing Council member Klass Knot delivered some hawkish comments over the weekend. He said "there is no reason whatsoever to continue" the EUR 30b a month asset purchase program after it ends in September. He added "we don’t have to communicate yet that it will be over after September, but I think that’s where we’re headed." Meanwhile, interest rates would stay low in the coming years. Knot noted that "Interest is mainly low because there are more people that want to save, than that want to invest. This will change as the economy grows, but that will take time."

EU to formally demand UK for unconditional legal compliance during transition

EU’s Brexit negotiator Michel Barnier might formally adopt the instructions today that UK must apply EU laws as if it were a member state during the transition period. And such compliance is expected to be unconditional. On the other hand, the UK is clearly uncomfortable with the demand. Brexit secretary David Davis hinted that he would demand the power to object. As Davis said, "means to remedy issues" are needed if laws were "deemed to run contrary to our interests". But some EU officials see the UK’s position on it being counter productive, in particular as Prime Minister Theresa May is targeting to complete a transition deal in March, as businesses requested.

FOMC to highlight an extremely busy week

Janet Yellen’s last FOMC meeting as Fed chair is the main highlight of an extremely busy week. Fed is widely expected to keep federal funds rates unchanged at 1.25-1.50%. But some economists are expecting a hawkish twist in the statement to pave the way for a March rate hike. Trump’s State of Union address on Tuesday will also be closely watched. In addition, there are countless important data to be featured. Here are some highlights for the week ahead:

- Monday: Germany import prices; US personal income and spending

- Tuesday: New Zealand trade balance; Australia NAB business confidence; Japan household spending, unemployment rate, retail sales; French GDP; German CPI; Eurozone GDP; Swiss trade balance, KOF; UK M4, mortgage approvals; US S&P Case-Shiller house price, consumer confidence

- Wednesday: BoJ summery of opinions, Japan industrial production; UK Gfk consumer confidence; Australia CPI; China PMIs; Japan consumer confidence, housing starts; Swiss UBS consumption indicator; German retail sales, unemployment; Eurozone CPI, unemployment rate; US ADP job, employment cost index, pending home sales, Chicago PMI, FOM rate decision; Canada GDP, RMPI and IPPI

- Thursday: Australia building approvals, import prices; China Caixin PMI manufacturing; Swiss SECO consumer climate, retail sales, PMI; Eurozone PMI manufacturing revision; UK PMI manufacturing; US Challenger job cuts, non-farm productivity, jobless claims; ISM manufacturing, construction spending

- Friday: New Zealand building approval; Japan monetary base; Australia PPI; UK construction PMI; Eurozone PPI; US non-farm payrolls, factory orders

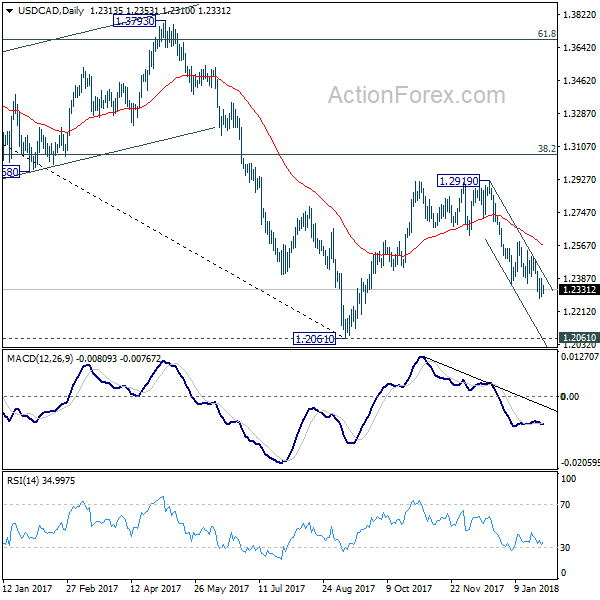

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2271; (P) 1.2331; (R1) 1.2371; More…

Intraday bias in USD/CAD remains neutral for consolidation above 1.2281 temporary low. Near term outlook will remain bearish as long as 1.2490 resistance holds. Below 1.2281 will extend the decline from 1.2919 and target a test on 1.2061 low. However, considering bullish convergence condition in 4 hour MACD, break of 1.2490 will indicate short term bottoming and bring stronger rebound.

In the bigger picture, rebound from 1.2061 is likely completed completed at 1.2919, rejected by 55 week EMA and kept below 38.2% retracement of 1.4689 to 1.2061 at 1.3065. The development also suggests that long term fall from 1.4689 is not completed yet. Decisive break of 1.2061 low will target 61.8% retracement of 0.9406 to 1.4689 at 1.1424. This will now be the favored case as long as 1.2919 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | EUR | German Import Price Index M/M Dec | 0.20% | 0.80% | ||

| 13:30 | USD | Personal Income Dec | 0.30% | 0.30% | ||

| 13:30 | USD | Personal Spending Dec | 0.40% | 0.60% | ||

| 13:30 | USD | PCE Deflator M/M Dec | 0.10% | 0.20% | ||

| 13:30 | USD | PCE Deflator Y/Y Dec | 1.70% | 1.80% | ||

| 13:30 | USD | PCE Core M/M Dec | 0.20% | 0.10% | ||

| 13:30 | USD | PCE Core Y/Y Dec | 1.50% | 1.50% |