Yen continues today trade as the strongest major currency today as supported by relatively more upbeat BoJ. Dollar is also trying to rebound, in particular against Aussie but is outshone by both Yen and Swiss Franc. Confidence data from Germany is very upbeat but provides little support to Euro. Traders are getting a bit more cautious ahead of ECB rate decision and press conference on Thursday. Meanwhile, Aussie is trading as the weakest one on concern of more weakest in iron ore prices ahead.

German ZEW reviews optimistic outlook for H1 2018

German ZEW economic sentiment rose to 20.4 in January, up from 17.4 and above expectation of 17.9. Current situation gauge rose to 95.2, up from 89.3 and above expectation of 89.5, and hit record high. Eurozone ZEW economic sentiment rose to 31.8, up from 29.0, beat expectation of 29.7. ZEW President Achim Wambach noted in the release that "the latest survey results reveal an optimistic outlook for the German economy in the first six months of 2018. With 95.2 out of 100 points, this is the most positive assessment of the current economic situation since the introduction of the survey in December 1991. Private consumption, which was the most important driver of economic growth in 2017, is likely to continue to stimulate growth in the coming six months according to the survey participants. The assessment of the global economic environment in Europe and the USA is also much more favorable than it was at the end of 2017".

BoJ offered slightly more upbeat view

BOJ again voted 8-1 to leave the monetary policies unchanged today. The targets for short- and long-term interest rates stay at -0.1% and around 0%, respectively while the guideline for JGB purchases remains at an annual pace of about 80 trillion yen. As a ritual since he has joined the Board in September 2017, Goushi Kataoka has dissented again. The central bank has turned more upbeat on the inflation outlook although the members left the GDP growth and inflation forecasts unchanged for fiscal years from 2017 to 2019. At this meeting, the members also voted unanimously to extend for one year new the applications for the fund provisioning measure to achieve certain the goals such as stimulating bank lending and supporting economic growth. More in BOJ Left Policy Rates, QE, And Yield Curve Control Measures Unchanged

CPTPP to be signed in March

The 11 members of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), formerly Transpacific Partnership (TPP), reached a deal after two days of negotiations in Tokyo. The outstanding issues were finally resolved and legal verification of the agreement was also completed. Singaporean Trade Minister Lim Hng Kiang hailed that "the CPTPP will enhance trade among countries in the Asia-Pacific, resulting in more seamless flows of goods, services, and investment regionally." Japan Economy Minister Toshimitsu Motegi said the agreement will be signed on March 8 and Canada will follow through on that too. The participating countries include Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam. The US pulled out last year under the Presidency of Donald Trump.

NAFTA re-negotiations underway

The sixth round of the North American Free Trade Agreement (NAFTA) re-negotiation is underway in Montreal, Canada. Canadian Finance Minister Bill Moreau said that "our goal is to make real progress. We’ve got some constructive ideas. And we’re really focused on how we can improve NAFTA." He added that "NAFTA has been enormously positive for all three countries that have been party to the deal". And, "Canada-U.S. trade has grown hugely over the time of NAFTA. Now it’s almost $2 billion every single day, so we have a very strong trading relationship – 9 million U.S. jobs rely on trade with Canada, so we see it as something to be improved upon, and that’s why we’re working constructively towards that end."

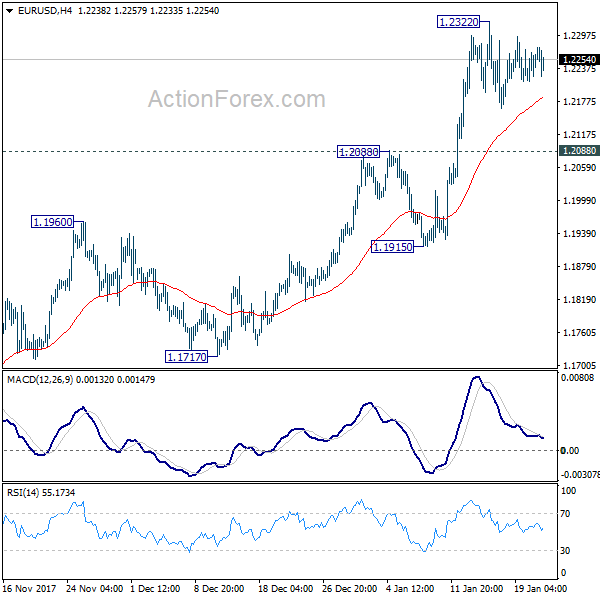

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2226; (P) 1.2248 (R1) 1.2284; More….

EUR/USD is still staying in consolidation below 1.2322 and intraday bias remains neutral. With 1.2088 support intact, near term outlook remains bullish and another rise is expected. Above 1.2322 will extend the medium term rise to next key fibonacci level at 1.2494/2516. We’d expect strong resistance from there to bring reversal. Meanwhile, break of 1.2088 will argue that EUR/USD has topped earlier than expected. In that case, intraday bias will be turned to the downside for 1.1915 support first.

In the bigger picture, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Therefore, in case of further rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. That is also close to 61.8% projection of 1.0569 to 1.2091 from 1.1553 at 1.2494. Break of 1.1553 support will confirm completion of the rise. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 3:15 | JPY | BoJ Rate Decision | -0.10% | -0.10% | -0.10% | |

| 4:30 | JPY | All Industry Activity Index M/M Nov | 1.00% | 0.90% | 0.30% | |

| 9:30 | GBP | Public Sector Net Borrowing Dec | 1.0B | 4.2B | 8.1B | 6.6B |

| 10:00 | EUR | German ZEW (Economic Sentiment) Jan | 20.4 | 17.9 | 17.4 | |

| 10:00 | EUR | German ZEW (Current Situation) Jan | 95.2 | 89.5 | 89.3 | |

| 10:00 | EUR | Eurozone ZEW (Economic Sentiment) Jan | 31.8 | 29.7 | 29 | |

| 11:00 | GBP | CBI Trends Total Orders Jan | 14 | 12 | 17 | |

| 15:00 | EUR | Eurozone Consumer Confidence Jan A | 1 | 1 |