US equities surged yesterday on Santa rally, yet DJIA failed to take out 20k handle and closed at 19974.62, up 91.56 pts, or 0.46%. It was, nonetheless, a record high. Meanwhile, S&P 500 also gained 8.23pts, or 0.36%, to close at 2270.76. Treasury yields also closed higher with 10 year yield gained 0.026 to 2.568 but stayed in recently established range. Dollar stays firm and is trading higher against most major currencies for the week, except versus Yen as USD/JPY is stuck in consolidation. In other markets, Gold trading sin tight range between 1125/1145 as sideway consolidation extends. WTI crude oil is trading higher at 53.6 but is held below recent resistance at 54.51.

US president-elect Donald Trump announced on Tuesday the plan to create an infrastructure "task force" for implementing a top level spending program. Meanwhile, the proposed "border adjustment tax" is expected to boost inflation. A key concern is, however, that the loose fiscal policy would likely result in higher budget deficit. US equities are staying in near term bullish trend and will pay close attention on the more details of Trump’s plan to be unveiled in January. For moment, DJIA is on course for 61.8% projection of 10404.49 to 18351.36 from 15450.56 at 20361.72.

On the data front, Japan all industry index rose 0.2% mom in October. Australia Westpac leading index rose 0.0% mom in November. New Zealand trade deficit narrowed to NZD -705m in November. UK will release public sector net borrowing in European session. Eurozone will release consumer confidence while US will release existing home sales later in the day.

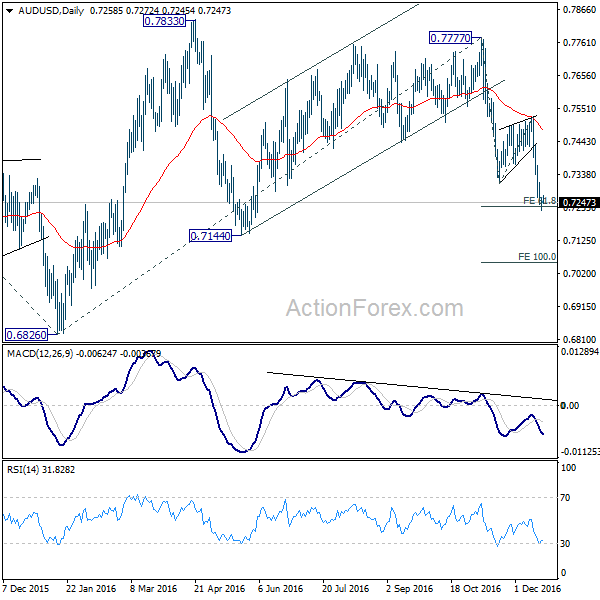

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7233; (P) 0.7247; (R1) 0.7273; More…

AUD/USD formed a temporary low at 0.7221 after breaching 61.8% projection of 0.7777 to 0.7310 from 0.7523 at 0.7234. Intraday bias is turned neutral for consolidations. Recovery should be limited by 4 hours 55 EMA (now at 0.7356) and bring fall resumption. Break of 0.7221 will target key near term support at 0.7144. As noted before, the whole corrective pattern from 0.6826 bottom should have finished. Break of 0.7144 support will likely extend the larger down trend through 0.6826.

In the bigger picture, AUD/USD is staying inside long term falling channel and it’s likely that the down trend from 1.1079 is still in progress. Break of 0.6826 low will confirm this bearish case and target 61.8% projection of 0.9504 to 0.6826 from 0.7777 at 0.6122 next. We’ll be looking for bottoming sign again as it approaches 0.6008 key support level. Meanwhile, sustained break of 0.7833 resistance will be a strong sign of medium term reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Nov | -705M | -500M | -846M | -815M |

| 23:30 | AUD | Westpac Leading Index M/M Nov | 0.00% | 0.06% | ||

| 4:30 | JPY | All Industry Activity Index M/M Oct | 0.20% | 0.10% | 0.20% | 0.00% |

| 9:30 | GBP | Public Sector Net Borrowing (GBP) Nov | 11.5B | 4.3B | ||

| 15:00 | EUR | Eurozone Consumer Confidence Dec A | -6 | -6.1 | ||

| 15:00 | USD | Existing Home Sales Nov | 5.52M | 5.60M | ||

| 15:30 | USD | Crude Oil Inventories | -2.6M |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box