Quick update: Canadian Dollar drops notably after BoC rate decision. Markets are viewing the 25bps rate hike as a dovish one. Firstly, BoC indicated that it will be "cautious in considering future policy adjustments". Secondly, it also pointed out that "uncertainty surrounding the future of the North American Free Trade Agreement (NAFTA) is clouding the economic outlook". USD/CAD would likely extend the consolidation from 1.2354 for a while.

Euro is trading generally lower today after some ECB officials expressed concerns over its recent appreciation against Dollar. The greenback is also trying to gain some footing as the steep broad based selloff is exhausted. But for the momentum, there is no confirmation of a turnaround in Dollar yet. At least, Dollar’s recovery today is overwhelmed by the strength in Aussie and Kiwi. Canadian Dollar, on the other hand, remains in tight range as traders await BoC rate decision cautiously.

After strings of strong economic data, BoC is generally expected to hike interest rate by 25bps to 1.25%. That will be the third hikes of the current tightening cycle. Some traders are cautious on the risk of a "hawkish hold" by BoC today. That is, while BoC also expects itself to raise interest rate in Q1, it could wait until March to do so. In that case, we’d probably see more range trading in USD/CAD above 1.2354. Nonetheless, we’re seeing a high chance of powering through 1.2354 support should BoC delivers the rate hike.

ECB officials concerned with Euro’s rise

ECB Vice President Vitor Constancio expressed concerns over Euro’s "sudden movements which don’t reflect changes in fundamentals. He pointed to inflation data while "declined slightly in December." He also talked down the expectation of a change in communications in the upcoming meeting on January 25, next week. Constancio said that "we see the need for a gradual adjustment of all the elements of our forward guidance if the economy continues to grow and inflation continues to move toward our goal." But, "this does not mean that changes will be immediate."Separately, Governing Council member Ewald Nowotny complained that Euro’s recent appreciation is "not helpful" to the Eurozone’s economy. While ECB has no exchange rate target, Nowotny said the central bank would monitor the developments.

Yesterday, Villeroy de Galhau, suggested by some as Mario Draghi’s successor, warned that the recent strength in the euro could dampen inflation. As he noted, "the only question is how long it (inflation) will take to meet our target. On this issue, the recent evolution of the exchange rate is a source of uncertainty which requires monitoring with regard to its possible downward effects on imported prices". Concerning the asset purchase program, Galhau indicated that the ECB is "not pre-committed in terms of precise timing [of exit]", noting that "we will make this contingent on the actual progress made in achieving our inflation objective".

BoE Saunders upbeat on employment market

BoE MPC member Michael Saunders, a know hawk, expressed his optimism on the employment market. He forecasts unemployment rate to fall further to 4% or even lower this year. That’s a better projection than BoE’s, which forecasts unemployment rate to be at 4.2% by the end of 2017. Also, Saunders expects wage growth to hit 3% or higher this year. And, if the economy develops as he expects, "I consider it likely that interest rates will need to rise further over time." But he also emphasized that the tightening would be limited and gradual". And, BoE "would be gradually lifting our foot off the accelerator, with no need to put the brakes on."

Dallas Fed Kaplan: Three rate hikes the base case

Dallas Fed President Robert Kaplan said in an interview that three rate hikes will be the base case for Fed this year. He expect the economy to be strong in 2018, with support from fiscal stimulus too. And risks, to him, are skewed to the upside. That is, if he’s wrong on the economy, it could heat up that makes it necessary for more than three rate hikes. Nonetheless, he still expressed some concerns on flattening and even inverted yield curve.

On the data front

Eurozone CPI was finalized at 1.4% yoy in December, core CPI at 0.9% yoy. Australia Westpac consumer confidence rose 1.8% in January, home loans rose 2.1% mom in November. Japan machine orders rose 5.7% mom in November.

EUR/USD Mid-Day Outlook

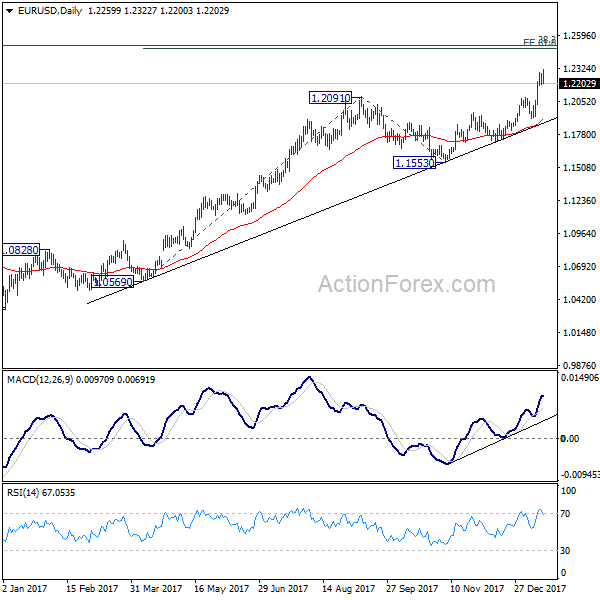

Daily Pivots: (S1) 1.2208; (P) 1.2246 (R1) 1.2297; More….

Intraday bias in EUR/USD remains neutral at this point and more consolidations could be seen. As long as 1.2088 resistance turned support stays intact, near term outlook remains bullish. Current medium term rally would target 1.2494/2516 key resistance zone next. At this point, we’d expect strong resistance from there to limit upside and bring reversal. On the downside, break of 1.2088 will argue that EUR/USD has topped earlier than expected. In that case, intraday bias will be turned to the downside for 1.1915 support first.

In the bigger picture, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. That is also close to 61.8% projection of 1.0569 to 1.2091 from 1.1553 at 1.2494. Break of 1.1553 support will confirm completion of the rise. However, sustained break of 1.2516 will carry larger bullish implication and target 38.2% retracement of 1.6039 to 1.0339 at 1.3862.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Jan | 1.80% | 3.60% | ||

| 23:50 | JPY | Machine Orders M/M Nov | 5.70% | -1.20% | 5.00% | |

| 0:30 | AUD | Home Loans M/M Nov | 2.10% | 0.00% | -0.60% | |

| 10:00 | EUR | Eurozone CPI Y/Y Dec F | 1.40% | 1.40% | 1.50% | |

| 10:00 | EUR | Eurozone CPI M/M Dec | 0.40% | 0.40% | 0.10% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Dec F | 0.90% | 0.90% | 0.90% | |

| 14:15 | USD | Industrial Production M/M Dec | 0.90% | 0.40% | 0.20% | -0.10% |

| 14:15 | USD | Capacity Utilization Dec | 77.90% | 77.30% | 77.10% | 77.20% |

| 15:00 | CAD | BoC Rate Decision | 1.25% | 1.25% | 1.00% | |

| 15:00 | USD | NAHB Housing Market Index Jan | 72 | 72 | 74 | |

| 19:00 | USD | Federal Reserve Beige Book | ||||

| 21:00 | USD | Net Long-term TIC Flows Nov | 23.2B |