Dollar is mildly higher in Asian session, as it turns into consolidation after recent steep selloff. Among the mostly traded currencies, Australian Dollar is trading as the strongest one. That’s partly supported by strength in China as the Shanghai SSE composite index, trading at 3420, is close to 2017 high at 3450. And break there will push the index into highest level since 2015. Meanwhile, Hong Kong HSI, as a proxy to China, is also close to the record high at 31958 made 10 years ago. Euro is trading as the second strongest as supported by hawkish comments from ECB officials. It seems now, after last week’s December meeting minutes, ECB policymakers are starting to sing a chorus of ending asset purchases after September. As for today, UK inflation data will be a key event to watch.

ECB Hansson: Appropriate to end the purchases after September

ECB Governing Council Member Ardo Hansson said in an interview that there was "need for action in our communication." This echoed the views noted in December ECB minutes released last week. Hansson said that "there are certainly good reasons to reduce the importance of the net purchases in our communication soon — also with a view to a potential end to these purchases." And should incoming data show that the economy evolve in line with ECB’s own projections, it would "certainly be conceivable and also appropriate to end the purchases after September." Also, he said that the "last step to zero" asset purchase is "not a big deal anymore". And "we can go to zero in one step without any problems". He also talked down Euro’s rising exchange rate and said it’s "not a threat to the inflation outlook" and one "shouldn’t overdramatize" it.

BoE Tenreyro: Productivity growth could beat forecasts

BoE MPC member Silvana Tenreyro said in speech yesterday that she "concurred" with the central bank’s projections in the November inflation report. However, "in the medium-term, the risks to productivity may be skewed to the upside." She pointed to the drags on productivity from deleveraging in the financial sector and slowdown in manufacturing. However, the former is a process that would soon end. Meanwhile, global growth would help boost demand and manufactured goods from the UK. And productivity growth could beat BoE’s forecasts once these two drags fade. She also noted that based on the November forecasts, BoE would need two more rate hikes over the next three years. But a better development in the economy could also change the rate outlook.

On the data front

Japan domestic CGPI rose 3.1% yoy in December versus expectation of 3.2% yoy. German CPI final will be released in European session. But main focus will be UK inflation data, including CPI, RPI and PPI. US will release Empire State manufacturing index later in the day.

AUD/USD Daily Outlook

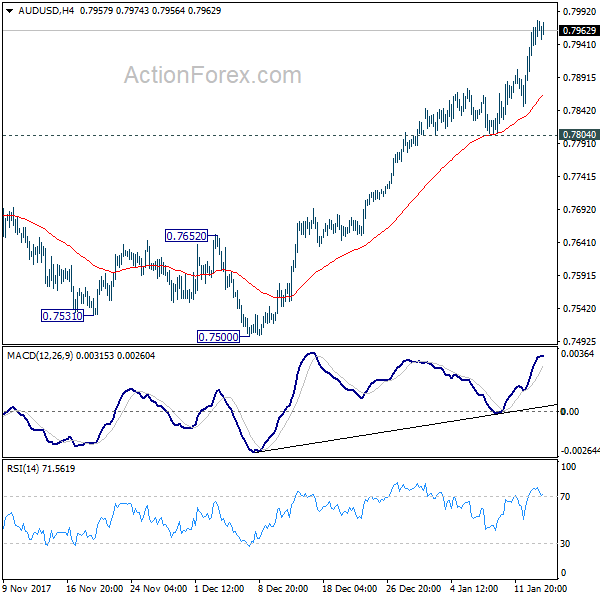

Daily Pivots: (S1) 0.7915; (P) 0.7947; (R1) 0.7994; More…

Intraday bias in AUD/USD remains on the upside as rise from 0.7500 is in progress for 0.8124 high. Break there will resume whole medium term rebound from 0.6826 and target key fibonacci level at 0.8451. On the downside, break of 0.7804 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, current development suggests that medium term rebound from 0.6826 is still in progress and could be resuming. Such rise could target 38.2% retracement of 1.1079 (2011 high) to 0.6826 (2016 low) at 0.8451. As such rise is seen as a corrective move, we’d expect strong resistance from 0.8451 to limit upside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Domestic CGPI Y/Y Dec | 3.10% | 3.20% | 3.50% | 3.60% |

| 4:30 | JPY | Tertiary Industry Index M/M Nov | 0.30% | 0.30% | ||

| 7:00 | EUR | German WPI M/M Dec | 0.50% | |||

| 7:00 | EUR | German CPI M/M Dec F | 0.60% | 0.60% | ||

| 7:00 | EUR | German CPI Y/Y Dec F | 1.70% | 1.70% | ||

| 9:30 | GBP | CPI M/M Dec | 0.40% | 0.30% | ||

| 9:30 | GBP | CPI Y/Y Dec | 3.00% | 3.10% | ||

| 9:30 | GBP | Core CPI Y/Y Dec | 2.60% | 2.70% | ||

| 9:30 | GBP | RPI M/M Dec | 0.60% | 0.20% | ||

| 9:30 | GBP | RPI Y/Y Dec | 3.90% | 3.90% | ||

| 9:30 | GBP | PPI Input M/M Dec | 0.40% | 1.80% | ||

| 9:30 | GBP | PPI Input Y/Y Dec | 5.30% | 7.30% | ||

| 9:30 | GBP | PPI Output M/M Dec | 0.20% | 0.30% | ||

| 9:30 | GBP | PPI Output Y/Y Dec | 2.90% | 3.00% | ||

| 9:30 | GBP | PPI Output Core M/M Dec | 0.20% | 0.20% | ||

| 9:30 | GBP | PPI Output Core Y/Y Dec | 2.30% | 2.20% | ||

| 9:30 | GBP | House Price Index Y/Y Nov | 4.20% | 4.50% | ||

| 13:30 | USD | Empire State Manufacturing Index Jan | 19 | 18 |