Risk appetite remains strong in global financial markets. All three major US indices, DOW, S&P 500 and NASDAQ made record highs over night. Optimism carries on in Asian session. Even though Nikkei is trading a touch lower, stocks in China and Hong Kong are strong. The biggest surprise overnight was the surge in US treasury yields. 10 year yield close up 0.066 at 2.546. 2.621 key medium term resistance is now within reach. The development also helped lifting the dollar index back above 92.5. The greenback is probably finally preparing for a sustainable rebound.

10 year yield surged sharply to close at 2.546. The development continues to affirm the case that correction from 2.621 has completed at 2.034. Rise from there is in progress for retesting 2.621 resistance. Decisive break there will resume the up trend from 2016 low at 1.336. Such development should give a strong boost to Dollar. This will remain the favored case as long as 2.405 holds.

As we mentioned, before, Dollar index was close to 100% projection of 95.15 to 92.49 from 94.21 at 91.55. And it touched lower channel support already. If the fall from 95.15 is a correction, the index should be close to bottoming and reversal. Break of 55 day EMA (now at 93.21) would affirm this and turn focus to 94.21 resistance for confirmation. However, another decline through 91.55 will resume the larger down trend instead.

UK Ministers urged close cooperation between regulators after Brexit

In UK, Chancellor of Exchequer Philip Hammond and Brexit Secretary David Davis published a joint article for German newspaper Frankfurter Allgemeine Zeitung. They urged close cooperation between EU and UK finance regulators after Brexit. And with that, "such a catastrophe" like 2008 global financial crisis "doesn’t happen again". And they urged to "re-double our collective effort to ensure that we do not put that hard-earned financial stability at risk, by getting a deal that supports collaboration within the European banking sector, rather than forcing it to fragment."

Moody’s optimistic on APAC sovereign outlook and growth

Rating agency Moody’s said that APAC sovereign outlook for 2018 is stable. It noted that the region’s economic strength and high levels of trade openness well positions the nations to benefit from stronger global growth. APAC emerging markets are projected to grow by 6.5% in 2018. Frontier economies are projected to grow by 5.9% while advanced economies by 1.8%. India and China will remain the fastest growing countries in the region. While there would be gradual moderation in China and temporary slowdown in India, the impact will be offset by robust growth in other countries.

On the data front

China CPI quickened to 1.8% yoy in December but missed expectation of 1.9% yoy. PPI slowed to 4.9% yoy, above expectation of 4.8% yoy. UK productions and trade balance are the main feature in European session. Canada will release building permits, UK will release import prices later in the day.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1908; (P) 1.1942 (R1) 1.1968; More….

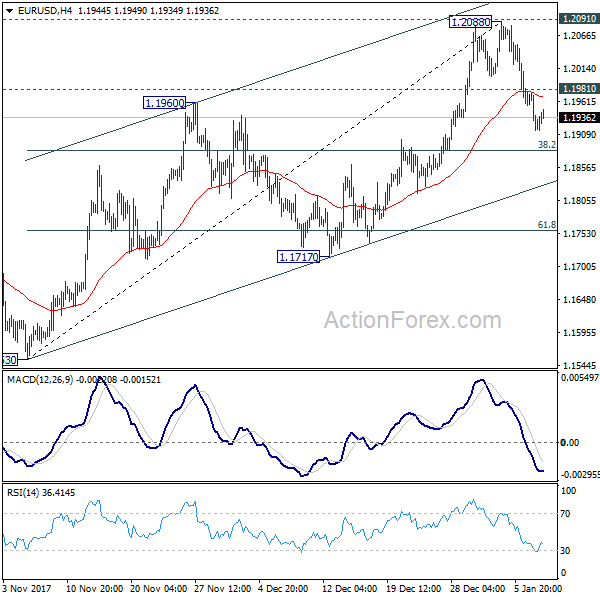

Intraday bias in EUR/USD remains on the downside as fall from 1.2088 is in progress. Such decline could be the the third leg of consolidation pattern from 1.2091. Break of 38.2% retracement of 1.1553 to 1.2088 at 1.1884 will target 61.8% retracement at 1.1757 and below. On the upside, above 1.1981 minor resistance will turn bias neutral first. But firm break of 1.2091 is needed to confirm up trend resumption. Otherwise, we’d expect more corrective trading in near term.

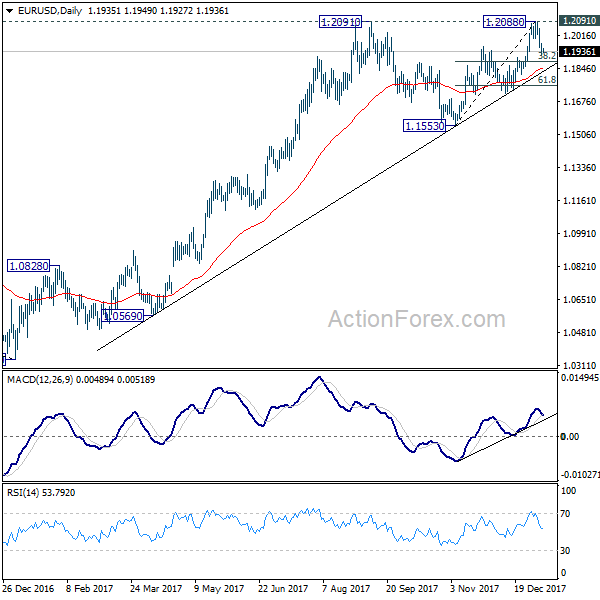

In the bigger picture, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. That is also close to 61.8% projection of 1.0569 to 1.2091 from 1.1553 at 1.2494.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:30 | CNY | PPI Y/Y Dec | 4.90% | 4.80% | 5.80% | |

| 1:30 | CNY | CPI Y/Y Dec | 1.80% | 1.90% | 1.70% | |

| 9:30 | GBP | Industrial Production M/M Nov | 0.40% | 0.00% | ||

| 9:30 | GBP | Industrial Production Y/Y Nov | 1.80% | 3.60% | ||

| 9:30 | GBP | Manufacturing Production M/M Nov | 0.30% | 0.10% | ||

| 9:30 | GBP | Manufacturing Production Y/Y Nov | 2.80% | 3.90% | ||

| 9:30 | GBP | Construction Output M/M Nov | 0.70% | -1.70% | ||

| 9:30 | GBP | Visible Trade Balance (GBP) Nov | -11.0B | -10.8B | ||

| 13:00 | GBP | NIESR GDP Estimate Dec | 0.50% | 0.50% | ||

| 13:30 | CAD | Building Permits M/M Nov | 3.50% | |||

| 13:30 | USD | Import Price Index M/M Dec | 0.40% | 0.70% | ||

| 15:00 | USD | Wholesale Inventories M/M Nov F | 0.70% | 0.70% | ||

| 15:30 | USD | Crude Oil Inventories | -7.4M |