Quick update: Dollar recovers further after ISM manufacturing beat expectation. Price paid component also surged.

The forex markets are trading rather mixed ahead of FOMC minutes. Commodity currencies overtake Europeans as the main driver today, with Aussie and Loonie trading generally higher. Sterling dips on weaker than expected data but remains the second strongest for the week. Dollar is also trying to stage a rebound but stays in red for the week, except versus Swiss Franc. Strength in Dollar’s rebound is rather unconvincing. Traders are relatively more active back from holiday. But would likely need more inspirations from today’s ISM and Friday’s NFP.

FOMC minutes for December meeting will be a major focus of the day. Fed raised interest rate by the third time last year in December. The biggest difference that time was that Chicago Fed President Charles Evans joined Minneapolis Fed President Neel Kashkari in dissenting. What both have said during the meeting could be something of interest. Other than that, the minutes shouldn’t reveal anything new given that there was a press conference, with new projections released after the meeting.

North Korea ignored Trump and called South

Geopolitics are largely ignored by the markets. US President Donald Trump responded to North Korea, tweeting that "I too have a Nuclear Button, but it is a much bigger & more powerful one than his (Kim’s), and my Button works!" Such comments did nothing to deter the Koreas in rebuilding their dialogue. It’s reported that North Korea contacted South Korea authority over a special hotline for the first time in two years. According to Lee Yeon-du, a South Korea’s Unification Ministry official, representatives from both countries talked several times today. There were some technical checks ahead of South Korean President Moon Jae-in’s proposed talks on January 9 at the border village of Panmujom. That came after Kim Jung-un expressed the openness to join Winter Olympics.

Talks of UK joining TPP heat up

The talks of UK seeking to join the Trans-Pacific Partnership triggered some noises today. International Trade Secretary Liam Fox tried to talk down the speculations as he said the reports were "rather overblown". He added that "it is not full negotiated yet so we will want to see what emerges." But he also emphasized that "we would be foolish to rule anything out. We know that Asia-Pacific will be a very important market and we know a lot of the global growth in the future will come from there."

Trade Minister Greg Hands said despite the geographical difference, "nothing is excluded in all of this," and "with these kind of plurilateral relationships, there doesn’t have to be any geographical restriction." The department of international trade also said that "it is early days, but as our trade policy minister has pointed out, we are not excluding future talks on plurilateral relationships."

The TPP is renamed as Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) after the US withdrew last year under the decision of President Donald Trump. There are eleven remaining members including Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam. A partial agreement was reached last November without US participation.

UK construction PMI missed on commercial projects

UK construction PMI dropped to 52.2 in December, down from 53.1 and missed expectation of 53.1. That’s also the second disappointing PMI data released this week. Markit maintained that "house building remained a key engine of growth, with residential work expanding for the sixteenth consecutive month in December." However, "latest data indicated a moderate fall in commercial construction, thereby continuing the downward trend seen since July." On the other hand, "civil engineering work stabilized during the latest survey period, which ended a three-month period of decline.

Elsewhere, Swiss manufacturing PMI rose to 65.2 in December, up from 65.1 and beat expectation of 64.5. German unemployment dropped more than expected by -29k in December, unemployment rate was unchanged at 5.5%.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2010; (P) 1.2045 (R1) 1.2094; More….

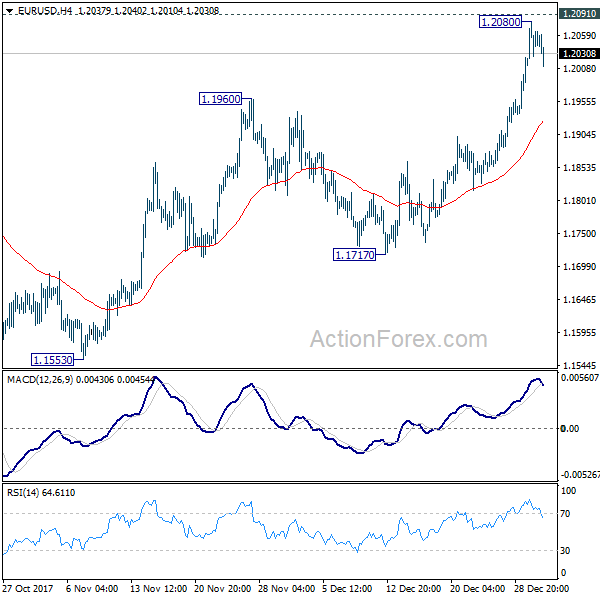

EUR/USD’s retreat, with 4 hour MACD crossed below signal line, suggests that a temporary top is formed at 1.2080, ahead of 1.2091 key resistance. Intraday bias is turned neutral first. Some consolidation could be seen but further rise is expected as long as 4 hour 55 EMA (now at 1.1922) holds. Firm break of 1.2091 will confirm medium term rally resumption and target next key fibonacci level at 1.2494/2516. However, sustained break of 4 hour 55 EMA will extend the consolidation pattern from 1.2091 with with another decline through 1.1717 support.

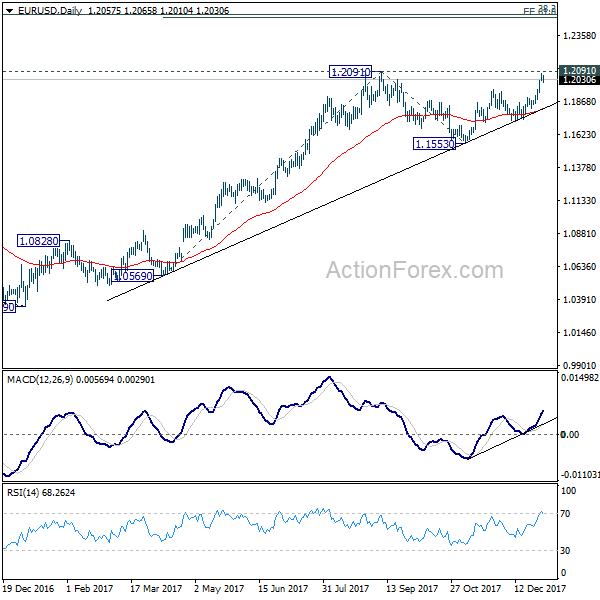

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. That is also close to 61.8% projection of 1.0569 to 1.2091 from 1.1553 at 1.2494.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 8:30 | CHF | PMI Manufacturing Dec | 65.2 | 64.5 | 65.1 | |

| 8:55 | EUR | German Unemployment Change Dec | -29k | -13k | -18k | |

| 8:55 | EUR | German Unemployment RateDec | 5.50% | 5.50% | 5.60% | 5.50% |

| 9:30 | GBP | Construction PMI Dec | 52.2 | 53.1 | 53.1 | |

| 15:00 | USD | Construction Spending M/M Nov | 0.80% | 0.50% | 1.40% | 0.90% |

| 15:00 | USD | ISM Manufacturing Dec | 59.7 | 58.2 | 58.2 | |

| 15:00 | USD | ISM Prices Paid Dec | 69 | 64.5 | 65.5 | |

| 19:00 | USD | FOMC Meeting Minutes Dec |