Dollar’s selloff accelerates overnight on sharp selloff in treasury yields and stays weak in Asian session. 10 year yield lost -0.053 to close at 2.414, well below last week’s high at 2.499. Worse than expected consumer confidence reading was seen as a factor. Conference board consumer confidence dropped to 122.1 in December versus consensus of 128.2. Year end reposition was seen as another factor in the movements in bonds. But probably, the continuous flattening of yield curve is worsening before year end as markets are not to optimistic with the Republican’s tax plan.

For the momentum, near term outlook in 10 year yield is still bullish with 2.314 support intact. And rise from 2.034 is still in mild favor to extend to 2.621 resistance. But upside momentum has been clearly weak. And break of 2.314 will extend the corrective pattern from 2.621 with another decline, possibly a test on 2.034, before completion.

Summary of opinions of December BoJ meetings showed that due to improving economic outlook, there were calls for discussions on raising interest rate or cutting ETF purchases. One member noted urged the central bank to consider whether "adjustments in the level of interest rates will be necessary" if inflation and economic outlook improves further. Another board member warned of side effects of ETF purchases.

Released from Japan today, retail sales rose 2.2% yoy in November, above expectation of 1.0% yoy. Industrial production rose 0.6% mom in November, above expectation of 0.5% mom.

Looking ahead, the economic calendar is relatively light again today. ECB monthly bulletin will be a focus in European session. From US, jobless claims, trade balance, wholesale inventories and Chicago PMI will be released.

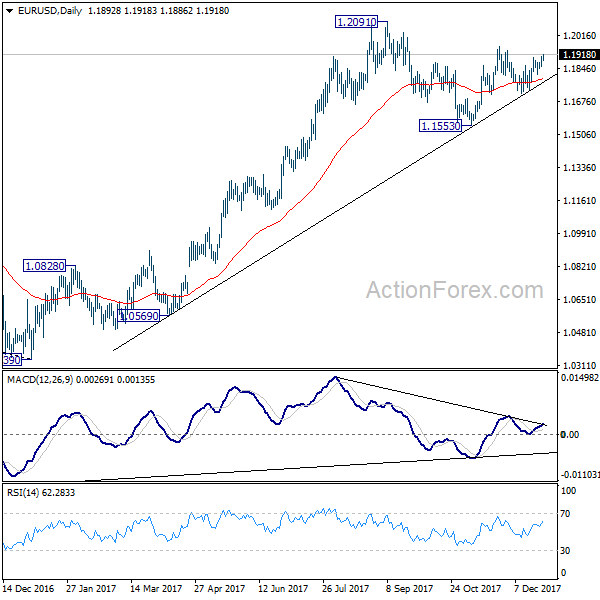

EUR/USD Daily Outlook

EUR/USD’s rise continues today and reaches as high as 1.1916 so far. Intraday bias remains on the upside for 1.1960 resistance next. Break will resume whole rally from 1.1553 and target 1.2091 high. On the downside, break of 1.1816 minor support is needed to indicate completion of the rebound form 1.1717. Otherwise, near term outlook will stay cautiously bullish in case of retreat.

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA (now at 1.1435) will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.