Dollar is trying to regain some ground in early US session after ultra-low jobless claims and strong retail sales. Indeed, at the time of writing, the greenback is trading up against all but Aussie for today. Nonetheless, after yesterday’s post CPI and FOMC selloff, Dollar has to do more to convince the markets of its momentum. Meanwhile, Euro is actually trading as the strongest one today, trailing Dollar closely. The common currency is lifted by strong Eurozone PMIs. ECB also raised growth and 2019 inflation forecasts in the latest projections. Elsewhere, BoE and SNB stand pat as widely expected.

US jobless claims at 225k ultralow

US initial jobless claims dropped -11k to 225k in the week ended December 9, well below expectation of 239k. Four week moving average dropped 6.75k to to 234.75k. Continuing claims dropped to 1.89m in the week ended December 1. Headline retail sales rose 0.8% mom in November, well above expectation of 0.3% mom. Ex-auto sales grew 1.0% mom, also beat expectation of 0.7% mom. Import price index rose 0.7% mom in November. Also released in US session, Canada new housing price index rose 0.1% mom in October.

We’d maintain that yesterday’s FOMC announcement was not dovish at all. Growth forecasts were revised higher, unemployment forecasts revised lower. Inflation forecasts and fed funds rate projections were unchanged. The only dovish part of the voting with Chicago Fed Evans joining Minneapolis Kashkari in dissenting. That’s it. Dollar’s selloff was largely due to a combination of factors. That includes Republican’s defeat in deep red state of Alabama Senate Election, possibly dissatisfaction on the final corporate tax rate at 21%. But more importantly, the core CPI miss. More in FOMC Hikes Rate For Third Time, With Two Dissents

ECB stands pat, raised 2018 inflation forecast

ECB left the main refinancing rate unchanged at 0% as widely expected. The central bank also maintained the pledge to keep rates low for an extend period and be open to add stimulus if needed. ECB President Mario Draghi emphasized in the press conference that very favorable financial conditions are still needed in Eurozone. Also price pressure remained low and there was no sign of a pick up yet. Nonetheless, strong Eurozone growth momentum and improved growth outlook gave ECB confidence that inflation will climb back to 2% target.

In the updated economic forecasts, ECB project 2017 growth to be at 2.4%, revised up from 2.2%. For 2019, growth is seen at 1.9%, revised from from 1.7%. 2020 growth forecast was left unchanged at 1.7%. Inflation is projected to be at 1.5% in 2017, unchanged. 2018 inflation is estimated to be at 1.4%, notably revised up from 1.2%. 2019 inflation is projected to be at 1.5%, unchanged. 2020 inflation is projected to be at 1.7%. That is, within the projection horizon, ECB is still short of its 2% inflation target.

Solid Eurozone PMIs suggests strong Q4, and firm Q1.

PMIs from Eurozone generally strengthened in December, painting a brighter outlook for early next 2018. Eurozone PMI manufacturing rose to 60.6 in December, up from 60.1 and beat expectation of 59.7. That’s also the highest level on record. Eurozone PMI services rose to 56.5, up from 56.2 and beat expectation of 56.0. Germany PMI manufacturing rose to 63.3, up from 62.5, above expectation of 62.0. Germany PMI services rose to 55.8, up from 54.3, above expectation of 54.6. France PMI manufacturing rose to 59.3, up from 57.7, above expectation of 57.2. France PMI services, however, dropped to 59.4, down from 60.4, missing expectation of 59.4.

Markit chief business economist Chris Williamson noted that "the eurozone economy is picking up further momentum as the year comes to a close, ending its best quarter since the start of 2011. The PMI is signalling an impressive 0.8% GDP increase in the fourth quarter, with accelerating growth seen in both Germany and France, where fourth quarter growth rates of 1.0% and 0.7-0.8% are indicated respectively."

Also, he added that "The eurozone upturn is being led by a booming manufacturing sector, with a record PMI seen in December, but stronger domestic demand is also helping drive faster service sector growth. Demand in the region’s home markets is being buoyed by the improved labour market, with new jobs being created at a pace not seen for 17 years over the past two months."

BoE blames inflation overshoot on exchange rate

The BOE voted unanimously to leave the Bank rate unchanged at 0.5% today, following a historic rate hike in the prior month. Policymakers also decided to leave the asset purchase program unchanged at 435B pound. Overshooting of inflation remains a key concern with the central bank putting its blame on British pound’s weakness. Policymakers noted that recent macroeconomic data have been "mixed" and raised the concern that GDP growth might slow in 4Q17. The central bank also acknowledged the progress of Brexit negotiations, suggesting that it has helped support the pound. We expect the BOE would keep its powder dry at least for the first half of next year, unless abrupt changes in the growth and inflation developments. More in BOE Stands on Sideline after November Hike, Attributing Inflation Overshoot to Weak Currency

SNB turned upbeat after standing pat

While leaving the policy rates unchanged for another month and pledged to continue FX market intervention when needed, the SNB has turned less dovish in today’s announcement. It has turned more upbeat over the economic recovery outlook and acknowledged the depreciation of Swiss franc and the euro and US dollar. the central bank revised modestly higher the inflation forecasts for this year and 2018, while leaving that for 2019 unchanged. More in SNB Raised CPI Forecasts, Acknowledged Franc’s Weakness But Pledged To Stay Cautious

Also from Swiss, PPI rose 0.6% mom, 1.8% yoy in November.

Aussie surges on stunning job data

Australian Dollar remains the strongest one for today as supported by strong job data. The employment market grew 61.6k in November, more than triple of expectation of 19.2k. Full time jobs grew 41.9k while part time jobs grew 19.7k. Unemployment rate was unchanged at 5.4% as participation rate jumped from 65.2% to 65.5%. Nonetheless, there is no change in the general view that RBA will stand pat throughout 2018, unless there is a pickup in wage growth. Also from Australia consumer inflation expectation rose 3.7% in December.

Release from China, retail sales rose 10.2% yoy in November, below expectation of 10.3% yoy. Fixed assets investments rose 7.2% yoy, in line with consensus, industrial production rose 6.1% yoy, below expectation of 6.2% yoy. From Japan, industrial production was finalized at 0.50% mom in October.

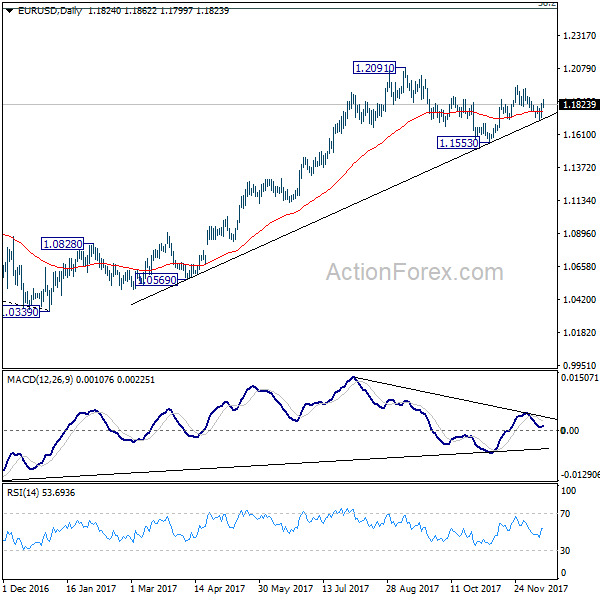

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1759; (P) 1.1795 (R1) 1.1861; More….

Intraday bias in EUR/USD remains on the upside for the moment. Corrective pull back from 1.1960 has completed at 1.1717 already. Also, as the pair defended 1.1712 cluster support (61.8% retracement of 1.1553 to 1.1960 at 1.1708), near term bullish outlook is retained. Further rise should be seen to 1.1960 first. Break will target 1.2029 high next. And even in case of retreat, outlook will remain bullish as long as 1.1708/12 cluster support holds.

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA (now at 1.1423) will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | AUD | Consumer Inflation Expectation Dec | 3.70% | 3.70% | ||

| 00:01 | GBP | RICS House Price Balance Nov | 0% | 0% | 1% | |

| 00:30 | AUD | Employment Change Nov | 61.6K | 19.2K | 3.7K | 7.8K |

| 00:30 | AUD | Unemployment Rate Nov | 5.40% | 5.40% | 5.40% | |

| 02:00 | CNY | Retail Sales Y/Y Nov | 10.20% | 10.30% | 10.00% | |

| 02:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Nov | 7.20% | 7.20% | 7.30% | |

| 02:00 | CNY | Industrial Production Y/Y Nov | 6.10% | 6.20% | 6.20% | |

| 04:30 | JPY | Industrial Production M/M Oct F | 0.50% | 0.50% | 0.50% | |

| 08:00 | EUR | France Manufacturing PMI Dec P | 59.3 | 57.2 | 57.7 | |

| 08:00 | EUR | France Services PMI Dec P | 59.4 | 59.9 | 60.4 | |

| 08:15 | CHF | Producer & Import Prices M/M Nov | 0.60% | 0.30% | 0.50% | |

| 08:15 | CHF | Producer & Import Prices Y/Y Nov | 1.80% | 1.20% | ||

| 08:30 | CHF | SNB Sight Deposit Interest Rate | -0.75% | -0.75% | -0.75% | |

| 08:30 | CHF | SNB 3-Month Libor Upper Target Range | -0.25% | -0.25% | -0.25% | |

| 08:30 | CHF | SNB 3-Month Libor Lower Target Range | -1.25% | -1.25% | -1.25% | |

| 08:30 | EUR | Germany Manufacturing PMI Dec P | 63.3 | 62 | 62.5 | |

| 08:30 | EUR | Germany Services PMI Dec P | 55.8 | 54.6 | 54.3 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Dec P | 60.6 | 59.7 | 60.1 | |

| 09:00 | EUR | Eurozone Services PMI Dec P | 56.5 | 56 | 56.2 | |

| 09:30 | GBP | Retail Sales M/M Nov | 1.10% | 0.40% | 0.30% | |

| 12:00 | GBP | BoE Bank Rate | 0.50% | 0.50% | 0.50% | |

| 12:00 | GBP | BOE Asset Purchase Target Dec | 435B | 435B | 435B | |

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | 7–0–2 | |

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 12:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | 0.00% | |

| 13:30 | EUR | ECB Press Conference | ||||

| 13:30 | CAD | New Housing Price Index M/M Oct | 0.10% | 0.20% | 0.20% | |

| 13:30 | USD | Initial Jobless Claims (DEC 09) | 225K | 239K | 236K | |

| 13:30 | USD | Retail Sales Advance M/M Nov | 0.80% | 0.30% | 0.20% | 0.50% |

| 13:30 | USD | Retail Sales Ex Auto M/M Nov | 1.00% | 0.70% | 0.10% | 0.40% |

| 13:30 | USD | Import Price Index M/M Nov | 0.70% | 0.80% | 0.20% | |

| 14:45 | USD | US Manufacturing PMI Dec P | 54.2 | 53.9 | ||

| 14:45 | USD | US Services PMI Dec P | 54.6 | 54.5 | ||

| 15:00 | USD | Business Inventories Oct | -0.10% | 0.00% | ||

| 15:30 | USD | Natural Gas Storage | 2B |