Dollar remains the strongest currency in early US session as supported by positive job data. Initial jobless claims dropped 2k to 236k in the week ended December 2, below expectation of 241k. That’s also the lowest level in five weeks. Four week moving average dropped from 242.25k to 241.50k. Continuing claims dropped -52k to 1.91m in the week ended November 25. Challenger report, though, showed 30.1% yoy rise in planned layoff in November. Overall, recent job released data point to solid non-farm payroll report to be released tomorrow. And expectation of 200k job growth could easily be matched. But again, the tricky point will remain to be wage growth.

Released elsewhere, Canada building permits rose 3.5% mom in October versus expectation of 1.70%. Eurozone GDP was finalized at 0.6% qoq in Q3, unrevised. German industrial production dropped -1.4% mom in October. Swiss unemployment rate was unchanged at 3.0% in November while foreign currency reserves dropped to CHF 735b. Japan leading indicator dropped 0.3 to 106.1 in October. Australia trade surplus narrowed to AUD 0.11b in October.

In the currency markets, Euro follow dollar as the second strongest one today. Sterling is trading as the third strongest even though there is apparently no breakthrough in Brexit negotiations Commodity currencies are trading generally as the weakest ones.

German Merkel making no progress in grand coalition talks yet

So far, there is no conclusion in the coalition talk between German Chancellor Angela Merkel’s CDU/CSU and the SPD. SPD leader Martin Schulz sounded non-committal regarding the idea of grand coalition and said "we don’t want to govern at any price, … but we also shouldn’t refuse to govern at any price." According to the latest Spiegel poll, only 27.9% of SPD supporters preferred a grand coalition. 56.5% preferred a minority government while 13% preferred new election. On the other hand, 61.6% of CDU/CSU supports preferred a grand coalition, 25.7% preferred a minority government and 9.7% preferred a new election.

Merkel has been clear that she even preferred a new election than a minority government. But German deputy Finance Minister Jens Spahn said in a CNBC interview that Merkel could still lead a minority government if the negotiation talk with SPD fails. He noted that "if the Social Democrats aren’t willing to actually compromise with us on the necessary issues like the question of how we remain a strong economic power … Then there can’t be a grand coalition." And still, "we, as Christian Democrats, want to govern even in a minority government, that will be new for Germany, but it’s time for new things anyway." Spahn was also sure that "Angela Merkel will lead the next government, no matter if it’s a grand coalition again or perhaps a minority government."

UK PM May to announce new Irish board proposal

In UK, under-pressure Prime Minister Theresa May is set to announce a new proposal on the Irish border issue. That’s an effort to please pro-Brexit Northern Ireland DUP while May is rushing to complete the three tasks of divorce bill, Irish border and citizens right. Time is getting tight to make sufficient progress before December 14/15 EU summit, to move on to trade talks. But even if the Irish border and divorce bill issues are solved, EU citizens rights in UK will remain a sticky point. It’s reported that EU is insisting that UK must stay within European Court of Human Rights, so that EU citizens in UK are protected, or, there will be no talk on trade deal.

BoJ Kuroda hails YCC as sustainable framework

BoJ Governor Haruhiko Kuroda hailed that the central bank’s yield curve control is a "sustainable" framework, effective in pushing down long term interest rates. He pointed out that the program has ended deflation in the country and boosted the economy. Also, he noted that "BOJ’s bond buying has been conducted in a smooth manner so far. The risk of us facing problems in terms of buying bonds will be small for the time being." Though, he added that "in accordance with changes in the economy, prices and financial conditions, we will consider where our short- and long-term rate targets should be to create an appropriate shape of the yield curve." Kuroda also reiterated that BoJ will continue to "persistently pursue powerful monetary easing".

AUD staying weak as trade surplus shrank

Aussie follow closely as the third weakest for the week. Yesterday’s GDP data miss showed weak household consumption and wage growth. Today’s trade balance data is not giving any support neither. Trade surplus narrowed sharply to AUD 0.11b in October, missing expectation of AUD 1.41b. The result was driven by a steep -3% slide in exports and 2% jump in imports. Slump in iron ore sales, which tumbled -10% to AUD 7b contributed a large part to the contraction in exports. Coal exports also dropped -3% mom to AUD 4.3b.

China foreign exchange reserves rose for 10 straight month

China’s foreign exchange reserves increased for the 10th month in a row to USD 3.1193T at the end of November. That represents an increase of USD 10b from a month early. The State Administration of Foreign Exchange (SAFE) noted that cross-border capital flows were kept stable thanks the strength of the economy and structural adjustments. And in turn, the steady international balance of payments supported gradual rebound in reserves. Meanwhile, there has been concern of capital out flow last year which resulted in China’s forex reserves dipping below USD 3T briefly back in January. But a bottomed was formed there as economic outlook improved.

IMF warns of China financial system risks

The International Monetary Fund published as assessment on financial system stability of China today. In the report, IMF warned that "the system’s increasing complexity has sown financial stability risks." And it urged that "holding more capital would strengthen the banking system and bolster financial stability." Three tensions in the system are identified. The first one being surge in risk credits as debt-to-GDP ratio jumped from 180% in 2011 to 255.9% by Q2 of 2017. Second tension is that lending has shifted away from traditional banks to the shadow banking sector, the less-regulated part of the system. That makes supervision increasingly difficult. Moral hazard and excessive risk-taking is seen as the third with the expectation that the government with bail out state-owned enterprises and financial institutions in case of troubles. The People’s Bank of China responded by disagreeing some points even though the recommendations are "highly relevant in the context of deepening financial reforms" in China.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9844; (P) 0.9865; (R1) 0.9894; More….

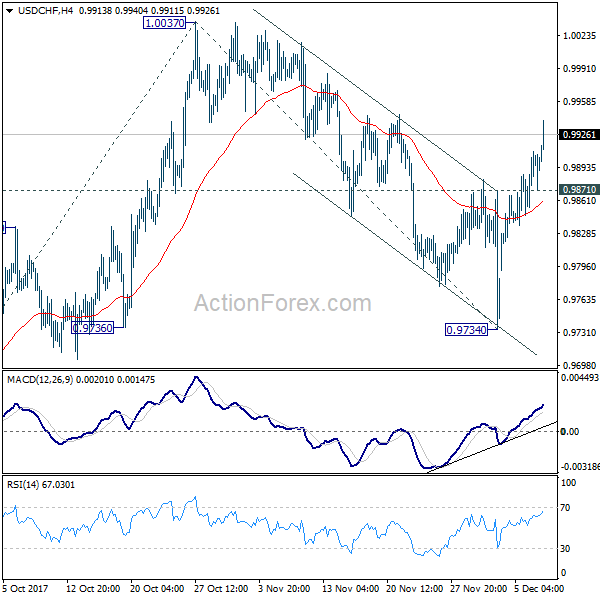

USD/CHF’s rally from accelerates to as high as 0.9940 so far and intraday bias remains on the upside for 1.0037 resistance. Firm break there will confirm resumption of whole rise from 0.9420 and target 61.8% projection of 0.9420 to 0.9734 from 1.0047 at 1.0115 next. On the downside, below 0.9871 minor support will dampen the immediate bullish case and turn intraday bias neutral first.

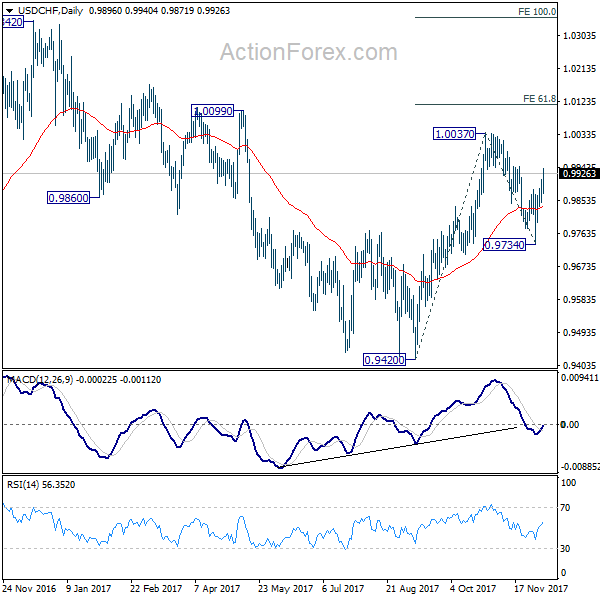

In the bigger picture, range trading continues between 0.9420/1.0342. At this point, 0.9420 appears to be a strong support level. Therefore, in case of decline attempt, we don’t expect a firm break of this level. Nonetheless, strong break of 1.0342 is also needed to confirm upside momentum. Otherwise, medium term outlook will stay neutral.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Trade Balance Oct | 0.11B | 1.41B | 1.75B | 1.60B |

| 05:00 | JPY | Leading Index CI Oct P | 106.1 | 106.1 | 106.4 | |

| 06:45 | CHF | Unemployment Rate Nov | 3.00% | 3.10% | 3.00% | |

| 07:00 | EUR | German Industrial Production M/M Oct | -1.40% | 1.00% | -1.60% | |

| 08:00 | CHF | Foreign Currency Reserves (CHF) Nov | 735B | 745B | 742B | |

| 10:00 | EUR | Eurozone GDP Q/Q Q3 F | 0.60% | 0.60% | 0.60% | |

| 12:30 | USD | Challenger Job Cuts Y/Y Nov | 30.10% | -3.00% | ||

| 13:30 | CAD | Building Permits M/M Oct | 3.50% | 1.70% | 3.80% | 4.90% |

| 13:30 | USD | Initial Jobless Claims (DEC 02) | 236K | 241K | 238K | |

| 15:00 | CAD | Ivey PMI Nov | 63.8 | |||

| 15:30 | USD | Natural Gas Storage | -33B |