Dollar is trading broadly higher today as its shrugged off negative news. US President Donald Trump announced to recognize Jerusalem as Israel’s capital could unsettle the region and triggered a dip in USD/JPY. But the pair quickly recovered as the impact faded. Markets are also ignoring the risk of partial government shut down after money runs out on December 8 if no spending bill is agreed by the Congress. Also, news regarding special counsel Robert Mueller subpoena on Trump’s Deutsche Bank records was also disregarded by traders.

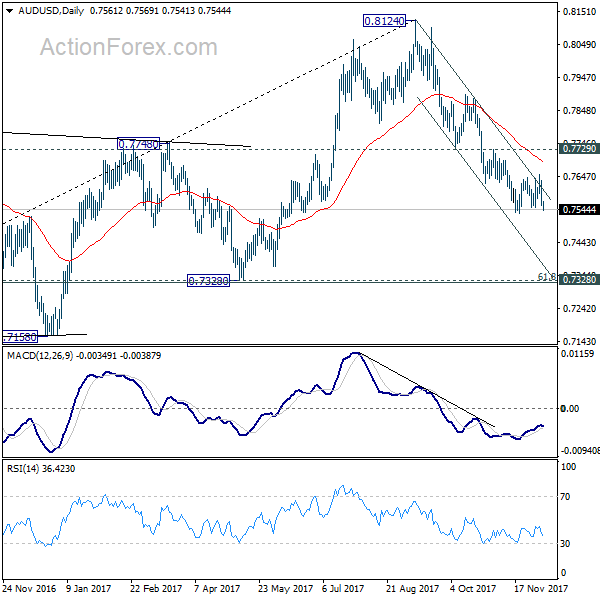

Nonetheless, it’s hard to tell whether Dollar’s rise this week is impulsive or corrective. AUD/USD’s break of 0.7550 support today clearly suggests resumption of the fall from 0.8124 that started back in September. USD/CAD also looks completed the consolidation from 1.2916 and is ready to resume rise from 1.2061, also the September low. But the pull-backs in EUR/USD and GBP/USD are so far corrective looking. And the direction is USD/JPY is rather unclear since it failed to take out 114.49 key resistance back in November. Dollar traders would probably need to wait for non-farm payroll report tomorrow before making up their minds.

UK PM May’s Brexit plan in chaos

In UK, Prime Minister Theresa May faced objections from Tory MPs on backing North Ireland DUP’s opposition to the Brexit proposal on Irish border. Nineteen of them urged May not to allow Eurosceptic to "impose their own conditions" and that is "highly irresponsible" for someone to dictate the terms that could ruin a deal. Many business leaders are also dissatisfied that the Brexit negotiation is turning into chaos with time ticking. A CBI survey showed that 10% of companies have already started planning or a "no-deal" scenario on Brexit, and that would jump to as much as 60% by March. European Commission President Jean-Claude Juncker also expressed his concern that the UK government would collapse if the Brexit talk fails. May would be going back to Brussels later this week to secure support from EU team for approval to move on to trade talk during next EU summit on December 14/15.

BoJ Kuroda hails YCC as sustainable framework

BoJ Governor Haruhiko Kuroda hailed that the central bank’s yield curve control is a "sustainable" framework, effective in pushing down long term interest rates. He pointed out that the program has ended deflation in the country and boosted the economy. Also, he noted that "BOJ’s bond buying has been conducted in a smooth manner so far. The risk of us facing problems in terms of buying bonds will be small for the time being." Though, he added that "in accordance with changes in the economy, prices and financial conditions, we will consider where our short- and long-term rate targets should be to create an appropriate shape of the yield curve." Kuroda also reiterated that BoJ will continue to "persistently pursue powerful monetary easing".

CAD trading as second weakest on cautious BoC

Canadian Dollar is trading as the second weakest one for the week. The Loonie was sold off after BoC left interest rate unchanged at 1.00% and issued a "cautious statement". While acknowledging the strength in the employment situation, it warned of the slack in the labor market. While upgrading GDP growth forecast, it noted that it does not necessarily imply a narrower output gap. While admitting the policy rate would have to increase over time, it reiterated caution over any monetary decision. All in all, the central bank attempted to deliver a neutral to dovish message, so as not to cripple the recovery path – a lesson learnt after two consecutive rate hikes in July and September. More in BOC Kept Powder Dry, Warned of Slack Capacity Despite Falling Jobless Rate.

AUD staying weak as trade surplus shrank

Aussie follow closely as the third weakest for the week. Yesterday’s GDP data miss showed weak household consumption and wage growth. Today’s trade balance data is not giving any support neither. Trade surplus narrowed sharply to AUD 0.11b in October, missing expectation of AUD 1.41b. The result was driven by a steep -3% slide in exports and 2% jump in imports. Slump in iron ore sales, which tumbled -10% to AUD 7b contributed a large part to the contraction in exports. Coal exports also dropped -3% mom to AUD 4.3b.

IMF warns of China financial system risks

The International Monetary Fund published as assessment on financial system stability of China today. In the report, IMF warned that "the system’s increasing complexity has sown financial stability risks." And it urged that "holding more capital would strengthen the banking system and bolster financial stability." Three tensions in the system are identified. The first one being surge in risk credits as debt-to-GDP ratio jumped from 180% in 2011 to 255.9% by Q2 of 2017. Second tension is that lending has shifted away from traditional banks to the shadow banking sector, the less-regulated part of the system. That makes supervision increasingly difficult. Moral hazard and excessive risk-taking is seen as the third with the expectation that the government with bail out state-owned enterprises and financial institutions in case of troubles. The People’s Bank of China responded by disagreeing some points even though the recommendations are "highly relevant in the context of deepening financial reforms" in China.

Looking ahead

Swiss will release unemployment rate and foreign currency reserves in European session. Eurozone will release Q3 GDP final and German industrial production. Canada will release building permits and Ivey PMI. US will release jobless claims on a Thursday as usual.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7537; (P) 0.7584; (R1) 0.7609; More…

AUD/USD’s break of 0.7550 minor support argues that consolidation from 0.7531 has completed with three waves up to 0.7653 already. Intraday bias is back on the downside. Break of 0.7531 low will resume whole fall from 0.8124 and target next key cluster level at 0.7322/8. In any case, outlook will remain bearish as long as 0.7729 resistance holds and further fall is expected.

In the bigger picture, corrective rise from 0.6826 medium term bottom is likely completed at 0.8124, after hitting 55 month EMA (now at 0.8033). Decisive break of 0.7328 key cluster support (61.8% retracement 0.6826 to 0.8124 at 0.7322) will confirm. And in that case, long term down trend from 1.1079 (2011 high) will likely be resuming. Break of 0.6826 will target 61.8% projection of 1.1079 to 0.6826 from 0.8124 at 0.5496. This will now be the favored case as long as 0.7729 near term resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | Trade Balance Oct | 0.11B | 1.41B | 1.75B | 1.60B |

| 5:00 | JPY | Leading Index CI Oct P | 106.1 | 106.1 | 106.4 | |

| 6:45 | CHF | Unemployment Rate Nov | 3.10% | 3.00% | ||

| 7:00 | EUR | German Industrial Production M/M Oct | 1.00% | -1.60% | ||

| 8:00 | CHF | Foreign Currency Reserves (CHF) Nov | 745B | 742B | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q3 F | 0.60% | 0.60% | ||

| 12:30 | USD | Challenger Job Cuts Y/Y Nov | -3.00% | |||

| 13:30 | CAD | Building Permits M/M Oct | 3.80% | |||

| 13:30 | USD | Initial Jobless Claims (DEC 02) | 241K | 238K | ||

| 15:00 | CAD | Ivey PMI Nov | 63.8 | |||

| 15:30 | USD | Natural Gas Storage | -33B |