Sterling and Dollar remain the two strongest currencies for the week. The greenback was supported by better than expected GDP data overnight, as well as Fed Chair Janet Yellen’s upbeat comments. Positive sentiments in the US also sent DOW to record high at 23940.68, up 103.97 pts or 0.44%. NASDAQ, though, dropped -1.27% as investors dumped tech for bank stocks. That was in response to Fed Chair nominee Jerome Powell’s hints on easing regulations. An important development to note is the rebound in treasury yields. 10 year yield closed up 0.038 at 2.376, keeping the near term bullish trend. The focus will now turn to Senate tax plan vote and PCE inflation data from US today.

Senate to open debate on Republican tax plan

Senate voted to open the debate on Republican tax plan yesterday, moving another step to a final vote possibly today or tomorrow. President Donald Trump said in his usual tone said in a rally in Missouri that it’s a "once in a liftetime opportunity" and urged the Congress to deliver. And he added that "this week’s vote can be the beginning of the next great chapter for the American worker." It’s widely know that the Republicans got slim 52 majority in the Senate. All 48 Democrats and independents are expected to vote no. So, Republicans could only afford to lose two if they want to pass the bill this week. Then, they can move on to the next stage of reconciling the House and Senate versions.

Fed Yellen: Economic expansion is increasingly broad based

Outgoing Fed Chair Janet Yellen sounded upbeat in her last Congressional testimony overnight. She told the Joint Economic Committee that "the economic expansion is increasingly broad based across sectors as well as across much of the global economy." She acknowledged that "we are not seeing undue inflationary pressure in the labor market, so our policy remains accommodative." However, she also emphasized that " it’s important to gradually move our policy rate toward what I’ll call a neutral level, which would be consistent with sustainably strong labor market conditions." She maintained that Fed would want to remove stimulus "gradually" to avoid "overheating" and cause a "boom-bust" condition.

Fed Williams: Inflation will pickup in 2018

San Francisco Fed President John Williams also said "as long as the data continue to show steady growth and we see the uptick in inflation that we’re expecting, my own view is that we should continue to raise interest rates slowly over the coming year." He also sounded unconcerned with the low inflation. He noted that inflation would usually take around 12 months to pick up after growth accelerates. He added that "the next time you see a headline about stubbornly low inflation, you can smile to yourself, knowing that the mystery isn’t all that mysterious after all." And, "with the economy doing so well this year and based on the historical pattern, I expect to see a rise in inflation in 2018."

Fed’s Beige Book economic report noted that "price pressures have strengthened since the last report." Labor market also tightened as "most districts reported employers were having difficulties finding qualified workers across skill levels." Nonetheless, "wage growth was modest or moderate in most districts."

ECB Knot urged full phase out of QE from September onwards

ECB Governing Council member Klaas Knot said that "with deflation risk clearly off the radar, the main rationale for employing the APP (asset purchase program) has therefore ceased to exist." He added that "fear of relapse owing to an allegedly premature discontinuation of net purchases seems rather overdone." Hence, he urged a "full phasing" out of the program "from September onwards". Back in October, ECB extended the asset purchase program to September next year, but halved the purchase size to EUR 30b a month starting January.

SPD Schulz want bold vision in coalition talk with Merkel

German Chancellor Angela Merkel will meet with Social Democratic Party head Martin Schulz and President Frank-Walter Steinmeier today on talk of reforming the grand coalition. Ahead of the meeting, Schulz said that "I can’t tell you what the outcome of the talks will be, but I can assure you of one thing: that I will argue in favor of the best solutions for our country and that my party is aware of its political responsibility." And, he emphasized that "you can’t just wing it. You need a bold vision". Schulz also called fro a euro-area budget, a Eurozone finance minister and a "European framework for minimum wages".

On the data front

Japan industrial production rose 0.5% mom in October versus expectation of 1.8% mom. Australia private capital expenditure rose 1.0% in Q3, meeting consensus. Australia building approvals rose 0.9% mom in October, above expectation of -1.0% mom. New Zealand building permits dropped -9.6% mom in October. ANZ business confidence dropped sharply to -39.3 in November. China manufacturing PMI rose 0.2 pt to 5.18 in November, non-manufacturing PMI rose 0.5 to 54.8. UK Gfk consumer confidence dropped to -12 in November.

Looking ahead, the calendar is very busy today. Swiss GDP, KOF and retail sales will be featured in European session. Germany will release unemployment. Eurozone will release CPI and unemployment rate. Later in the day, US PCE is the main focus while jobless claims and Chicago PMI will be featured.

USD/CAD Daily Outlook

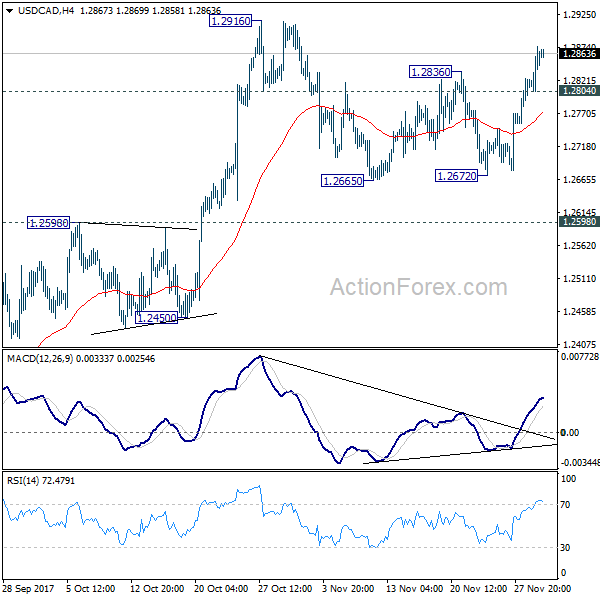

Daily Pivots: (S1) 1.2822; (P) 1.2847; (R1) 1.2890; More….

Intraday bias in USD/CAD remains on the upside for 1.2916 resistance. As noted before, corrective pattern from 1.2916 could have completed at 1.2672 already. Break of 1.2916 will resume whole rise from 1.2061 and target 1.3065 medium term fibonacci level. On the downside, below 1.2804 minor support will delay the bullish case and extend the correction from 1.2916 with another fall. But still, we’d expect downside to be contained by 1.2598 resistance turned support and bring rebound.

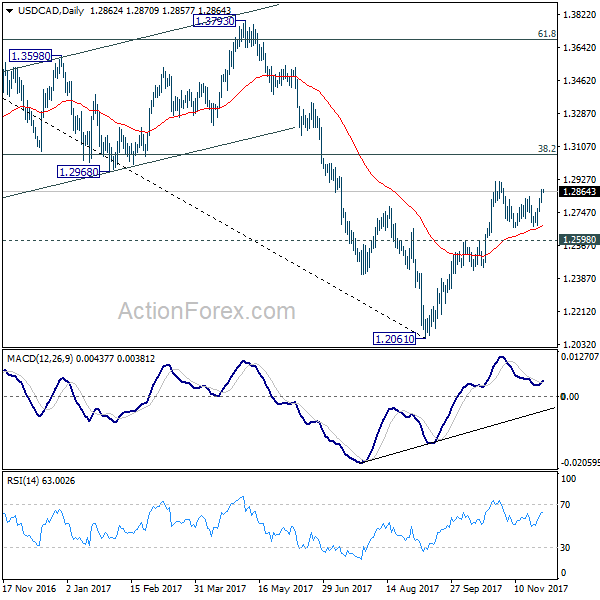

In the bigger picture, USD/CAD should have defended 50% retracement of 0.9406 (2011 low) to 1.4689 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. Rise from 1.2061 medium term bottom should now target 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Firm break there will target 1.3793 key resistance next (61.8% retracement at 1.3685). We’ll now hold on to this bullish view as long as 1.2450 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Oct | -9.60% | -2.30% | -2.50% | |

| 23:50 | JPY | Industrial Production M/M Oct P | 0.50% | 1.80% | -1.00% | -1.00% |

| 00:00 | NZD | ANZ Business Confidence Nov | -39.3 | -10.1 | ||

| 00:01 | GBP | GfK Consumer Confidence Nov | -12 | -11 | -10 | |

| 00:30 | AUD | Private Capital Expenditure Q3 | 1.00% | 1.00% | 0.80% | 1.10% |

| 00:30 | AUD | Building Approvals M/M Oct | 0.90% | -1.00% | 1.50% | 0.60% |

| 01:00 | CNY | Manufacturing PMI Nov | 51.8 | 51.5 | 51.6 | |

| 01:00 | CNY | Non-manufacturing PMI Nov | 54.8 | 54.3 | ||

| 05:00 | JPY | Housing Starts Y/Y Oct | -2.80% | -2.90% | ||

| 06:45 | CHF | GDP Q/Q Q3 | 0.60% | 0.30% | ||

| 08:00 | CHF | KOF Leading Indicator Nov | 109.5 | 109.1 | ||

| 08:15 | CHF | Retail Sales Real Y/Y Oct | 0.30% | -0.40% | ||

| 08:55 | EUR | German Unemployment Change Nov | -10K | -11K | ||

| 08:55 | EUR | German Unemployment Claims Rate Nov | 5.60% | 5.60% | ||

| 10:00 | EUR | Eurozone Unemployment Rate Oct | 8.90% | 8.90% | ||

| 10:00 | EUR | Eurozone CPI Estimate Y/Y Nov | 1.60% | 1.40% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Nov A | 1.00% | 0.90% | ||

| 13:30 | CAD | Current Account Balance (CAD) Q3 | -20.3B | -16.3B | ||

| 13:30 | USD | Initial Jobless Claims (NOV 25) | 241K | 239K | ||

| 13:30 | USD | Personal Income Oct | 0.30% | 0.40% | ||

| 13:30 | USD | Personal Spending Oct | 0.30% | 1.00% | ||

| 13:30 | USD | PCE Deflator M/M Oct | 0.10% | 0.40% | ||

| 13:30 | USD | PCE Deflator Y/Y Oct | 1.50% | 1.60% | ||

| 13:30 | USD | PCE Core M/M Oct | 0.20% | 0.10% | ||

| 13:30 | USD | PCE Core Y/Y Oct | 1.40% | 1.30% | ||

| 14:45 | USD | Chicago PMI Nov | 62.3 | 66.2 | ||

| 15:30 | USD | Natural Gas Storage | -46B |