US equities staged a strong rally overnight. Investors were happy that another step was taken with the Republican’s tax plan. Senate version was approved by the Budget Committee, paving the way for a floor vote on Thursday. Also, Fed chair nominee Jerome Powell commented that current banking regulations are "tough enough". And there could even be some easing also lifted sentiments. DOW closed up 255.93 pts or 1.09% at 23826.71. S&P 500 gained 25.62 pts or 0.98% at 2627.04. NASDAQ also rose 33.84 pts or 0.49% to 6912.36. All three indices closed at record highs. Dollar rebounded broadly but was overwhelmed by Sterling. The Pound was given a strong boost on reports that UK and EU have agreed on the divorce bill.

Fed Powell: Banking regulations tough enough already

Fed Chair nominee Jerome Powell’s confirmation hearing brought little new to the markets. Basically, Powell indicated that "the case for raising interest rates at our next meeting is coming together." He didn’t sound too concerned with slow inflation in the US and expected inflation to rise as the economy nears full employment. Regarding banking regulations, Powell indicated they are "tough enough" for now. And he expressed the intention to "consider appropriate ways to ease regulatory burdens while preserving core reforms".

Minneapolis Fed President Neel Kashkari sounded cautious again in his speech yesterday. He said that "because inflation is low, I am seeing no reason to tap the brakes on the economy." He added that "my perspective is, let’s allow the job market to continue to strengthen, allow more Americans to go back to work, allow wages to strengthen, and then, if we start to see inflation creep back up to our 2-percent target, we can tap the brakes then." Kashkari dissented both of Fed’s hikes this year. His comments suggested that he’s going to dissent again in December.

Sterling jumped as UK and EU agreed on divorce bill

Sterling rebounds broadly and stays firm on multiple reports that an agreement was reached between UK and EU on the divorce bill, clearing an important hurdle to move on to trade talks. The Daily Telegraph reported that EU’s request for EUR 60b was agreed in principle. There would be further detailed interpretations and the final amount could range between EUR 45b and EUR 55b. The Financial Times reported that EU liabilities could sum up to EUR 100b but net payments over the decades could add up to half the amount. UK’s Brexit Ministry just said that there were "intensive talks" and both sides were finding ways to "build on recent momentum". European Commission declined to comment. But the news raised hope that there would finally be "sufficient progress" made before EU summit on December 14/15 to move on to trade negotiations.

BoC Poloz named housing as big risks

Bank of Canada Governor Stephen Poloz said that "our financial system continues to be resilient, and is being bolstered by stronger growth and job creation". But he also emphasized the need to "continue to watch financial vulnerabilities closely." The central bank pointed out, in the latest financial system review, risks of historic levels of household debts. And, more than 80% of the debts is on mortgages and home equities credit lines. Poloz warned that "these vulnerabilities continue to be elevated and it will take a long time for them to return to more sustainable levels."

RBNZ to unwind home loan restrictions

RBNZ indicates today that it would to unwind some restrictions on home loans. The loan-to-value ratio restrictions could be modestly eased starting January 1 next year. Governor Grant Spencer said that "over the past six months, pressures in the housing market have continued to moderate due to the tightening of LVR restrictions in October 2016." And, "the market has been coming off really since mid-last year and so we have been considering it particularly as Auckland was flattening out and indeed going negative." Also, "housing market policies announced by the government are also expected to have a dampening effect on the housing market."

North Korea close to striking anywhere in US mainland

North Korea launched an intercontinental ballistic missile which flew for 53 minutes over 960km and reached an altitude of more than 4000km. US Secretary of Defense James Mattis said that it’s the highest reaching missile ever. And it’s believed that North Korea is now close to being able to strike anywhere in the mainland US. South Korea President Moon Jae-in called for dialogue and urged to "prevent a situation where North Korea threatens us with its nuclear arsenal based on misjudgment or the US. considers a preemptive strike." The news was shrugged off by the markets though.

On the data front

Japan retail sales rose 0.8% yoy in October. UK BRC shop price dropped -0.1% yoy in November. Germany CPI will be the main feature in European session. Eurozone will release confidence indicators and French GDP. UK will release mortgage approvals and M4. Swiss will release UBS consumption indicators. Later in the day, US will release Q2 GDP revisions, pending home sales and Fed’s Beige Book. Fed Chair Janet Yellen will also have her last Congressional testimony.

GBP/JPY Daily Outlook

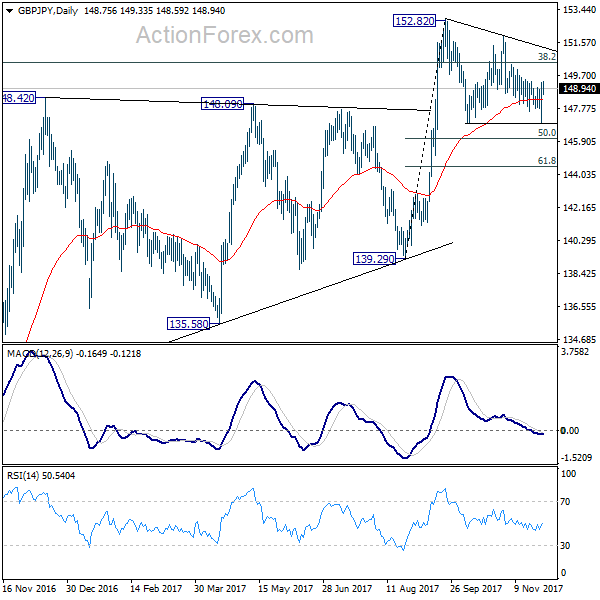

Daily Pivots: (S1) 147.35; (P) 148.31; (R1) 149.65; More…

Outlook in GBP/JPY is unchanged that price actions from 152.82 are forming a corrective pattern. On the upside, above 149.45 will turn bias to the upside for 151.92 resistance first. Break there will likely resume rise from 139.29 through 152.82 high. On the downside, below 146.96 will bring deeper fall. But now, we’d expect downside to be contained by 50% retracement of 139.29 to 152.82 at 146.05 to bring up trend resumption eventually.

In the bigger picture, medium term rebound from 122.36 is still expected to resume after corrective pull back from 152.82 completes. Firm break of 38.2% retracement of 196.85 to 122.36 at 150.43 will carry long term bullish implications. In that case, GBP/JPY could target 61.8% retracement at 167.78. However, break of 139.29 will indicate rejection from 150.43 key fibonacci level. And the three wave corrective structure of rebound from 122.36 will argue that larger down trend is resuming for a new low below 122.26.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y Oct | 0.80% | 0.00% | 2.20% | |

| 00:01 | GBP | BRC Shop Price Index Y/Y Nov | -0.10% | -0.10% | ||

| 07:00 | CHF | UBS Consumption Indicator Oct | 1.56 | |||

| 07:45 | EUR | French GDP Q/Q Q3 P | 0.50% | 0.50% | ||

| 09:30 | GBP | Mortgage Approvals Oct | 65K | 66K | ||

| 09:30 | GBP | M4 Money Supply M/M Oct | 0.30% | -0.20% | ||

| 10:00 | EUR | Eurozone Business Climate Indicator Nov | 1.51 | 1.44 | ||

| 10:00 | EUR | Eurozone Economic Confidence Nov | 114.6 | 114 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Nov | 8.6 | 7.9 | ||

| 10:00 | EUR | Eurozone Services Confidence Nov | 16.7 | 16.2 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Nov F | 0.1 | 0.1 | ||

| 13:00 | EUR | German CPI M/M Nov P | 0.30% | 0.00% | ||

| 13:00 | EUR | German CPI Y/Y Nov P | 1.70% | 1.60% | ||

| 13:30 | USD | GDP Annualized Q/Q Q3 S | 3.20% | 3.00% | ||

| 13:30 | USD | GDP Price Index Q3 S | 2.20% | 2.20% | ||

| 15:00 | USD | Pending Home Sales M/M Oct | 1.20% | 0.00% | ||

| 15:30 | USD | Crude Oil Inventories | -1.9M | |||

| 19:00 | USD | Federal Reserve Beige Book |