Dollar recovers broadly today as it’s digesting recent losses. Also there is some support from OECD report that projects acceleration in US growth next year. Focus will turn to Fed chair nominee Jerome Powell’s confirmation hearing. But Powell is generally seen as a safe choice for the job and shouldn’t give us surprises. While the greenback recovers, momentum remains unconvincing as trader stays cautious ahead of Senate vote on tax bill later in the week. Elsewhere, Aussie and Kiwi are both trading as the strongest one today while Sterling is back under broad based pressure.

Powell expects interest rates to rise and balance sheet to shrink

Fed chair nominee Jerome Powell released a statement to the Senate Banking Committee before his confirmation hearing today. Powell said in the statement that Fed policy makers "expect interest rates to rise somewhat further and the size of our balance sheet to gradually shrink." Adding to that, he emphasized "while we endeavour to make the path of policy as predictable as possible, the future cannot be known with certainty." So far, Powell sounded like he would like maintain continuity from the Yellen era. But we may read deeper into his mind in the Q&A session today.

OECD projects Eurozone, Japan, UK, China growth to slow in 2018, US in 2019

The Organization for Economic Cooperation and Development published its semi-annual economic outlook report today. OECD projects further acceleration in global growth in 2018, but could slow in 2019. Global economy is forecast to grow 3.6% in 2017, accelerate to 3.7% in 2018, then slow to 3.6% in 2019. But it warned that "evidence continues to build that financial asset prices are inconsistent with expectations for future growth and the policy stance, exacerbating the risks of financial corrections and growth downdrafts." That suggests investors are being too optimistic.

US is projected to grow 2.2% in 2017, accelerates to 2.5% in 2018 and then slow sharply to 2.1% in 2019. Fiscal and business spending could boost wages and then prompt inflation and more Fed tightening. OECD noted that "risks to the outlook remain sizable". In particular "elevated leverage ratios in the corporate sector need careful monitoring and action to ensure that these risks are contained."

Eurozone growth is expected to peak at 2.4% in 2017, then slow to 2.1% in 2018 and 1.9% in 2019. OECD cautioned that ECB tightening too quickly could "weigh on the recovery in countries with high unemployment and large output gaps". Also, while OECD projected inflation to pick up to 1.7% by 2019, it would remain well below ECB’s target of at or slightly below 2%.

Japan growth is also projected to peak in 2017 at 1.5%, then slow to 1.2% in 2018 and then 1.0% in 2019. The organization urged that "a rethinking of the monetary policy strategy would, however, be needed if the inflation target is not met for a prolonged time." Also, it criticized that "the BOJ becomes an even more predominant holder and buyer of government bonds and financial intermediation and stability become compromised."

UK Growth is projected to slow to 1.5% in 2017 and continued the downward path, to 1.2% in 2018, then 1.1% in 2019. The growth slowdown would be due to "continuing uncertainty over the outcome of negotiations around the decision to leave the European Union and the impact of higher inflation on household purchasing power." Nonetheless, "the upward revision of 0.2 percentage points for 2018 in part reflects the slower pace of fiscal consolidation announced in the Budget, and also partly reflects our revised technical assumption on the exit from the EU."

While China remains one of the global economic driver, growth is also to peak in 2017 at 6.8%, then moderate to 6.6% in 2018 and then 6.4% in 2019. Instead, India might suffer a blip with grow to slowing to 6.7% in 2017. India growth is projected to pick up pace again to 7.0% in 2018 and 7.4% in 2019. Brazil is expected to come out of contraction and grow 0.7% in 2017, accelerate to 1.9% in 2018 and then 2.3% in 2019.

BoE: UK banks could manage disorderly Brexit

BoE’s latest stress test results show that "the U.K. banking system could continue to support the real economy through a disorderly Brexit." BoE Governor Mark Carney said in a press conference that "let’s be clear, this is a big call … Because we will be here in March 2019 in the unlikely event that we end up in a situation without a transition deal or without an agreement. So we are putting our money where our mouth is." Meanwhile, five of the seven biggest banks tested passed the healthcheck Barclays Pls and Royal Bank of Scotland group fell below their systemic reference point. But actions were taken by both since 2016 year end and no further action is needed.

A Spanish candidate could fill ECB Vice next year

ECB Vice President Vitor Constancio will step down next year. It’s reported that the position would probably go to a Spanish candidate. After Jose Manuel Gonzalez Paramo, Spain has not had an ECB Executive Board member since 2012. Spanish Economy Minister Luis de Guindos told newspaper El Economista that "I’m convinced that the position will go to Spain." Meanwhile, de Guindos rubbished the rumor that he will replace Jeroen Dijsselbloem as Eurogroup head.

BoJ Katakoa pushes for additional easing again

BoJ board member Goushi Katakoa was a new comer to the board, and the sole dissenter to last months’ decision to stand pat. He called for more easing as "our near-term challenge is to think about how we can achieve our 2 percent inflation target, and whether current steps are enough." He added that "if the global economy is hit by a big shock, there’s a risk things won’t proceed as projected. Before that happens, we need to ensure we return to a position where have room to take policy action when needed." Also, "we need to avoid a situation where we’re forced to continue current monetary policy as inflation fails to reach 2 percent, and gradually hurt Japan’s financial system,"

Separately, BoJ Governor Haruhiko Kuroda said that a "reversal rate", the level where central bank rate cuts could hurt the economy, could help BoJ understand the appropriate yield curve shape. This comes in a time where policy makers are considering reform of monetary policies.

On the data front

US trade deficit widened to USD -68.3b in October. Wholesale inventories dropped -0.4% mom in October. Canada RMPI rose 3.8% mom in October while IPPI rose 1.0% mom. German Gfk consumer sentiment was unchanged at 10.7. Import price rose 0.6% mom in October. Eurozone M3 rose 5.0% yoy in October.

USD/CHF Mid-Day Outlook

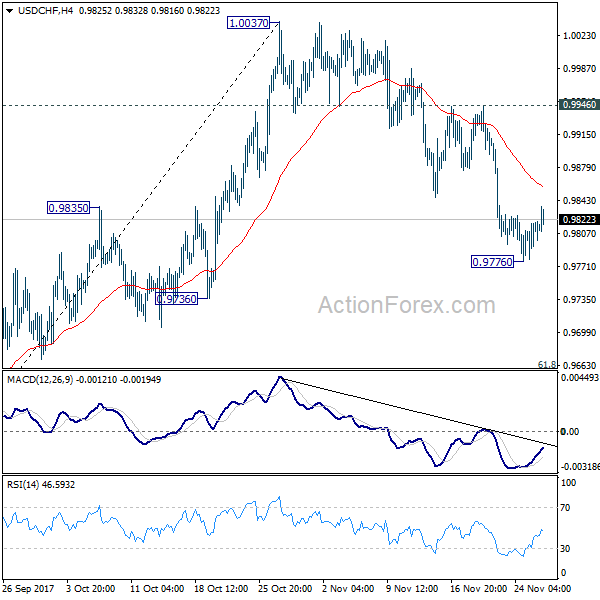

Daily Pivots: (S1) 0.9788; (P) 0.9804; (R1) 0.9832; More….

Intraday bias in USD/CHF remains neutral as recovery from 0.9776 temporary low continues. As long as 0.9946 resistance holds, another fall is still expected. Below 0.9776 will extend the decline from 1.0037 to 61.8% retracement of 0.9420 to 1.0037 at 0.9656. We’ll look for bottoming again below 0.9656 and above 0.9420. On the upside, break of 0.9946 resistance will indicate that the decline from 1.0037 has completed and bring retest of this resistance.

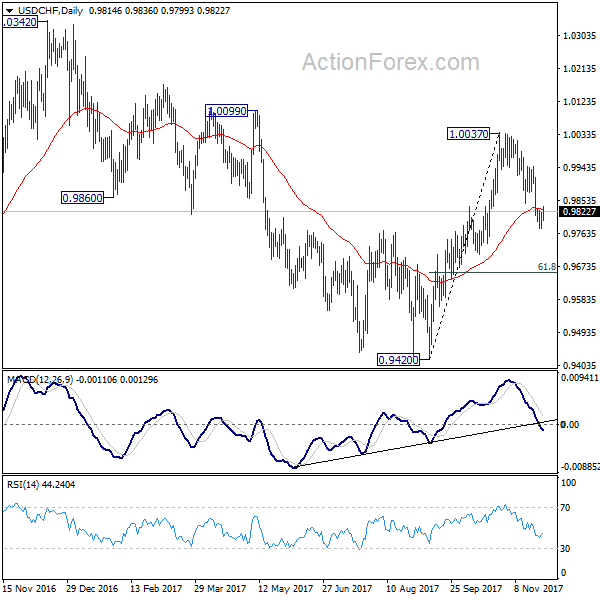

In the bigger picture, range trading continues between 0.9420/1.0342. At this point, 0.9420 appears to be a strong support level. Therefore, in case of decline attempt, we don’t expect a firm break of this level. Nonetheless, strong break of 1.0342 is also needed to confirm upside momentum. Otherwise, medium term outlook will stay neutral.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | EUR | German Import Price Index M/M Oct | 0.60% | 0.40% | 0.90% | |

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Oct | 5.00% | 5.10% | 5.10% | 5.20% |

| 12:00 | EUR | German GfK Consumer Confidence Dec | 10.7 | 10.7 | 10.7 | |

| 13:30 | USD | Advance Goods Trade Balance Oct | -68.3B | -65.0B | -64.1B | |

| 13:30 | USD | Wholesale Inventories M/M Oct P | -0.40% | 0.40% | 0.30% | 0.10% |

| 13:30 | CAD | Industrial Product Price M/M Oct | 1.00% | 0.50% | -0.30% | |

| 13:30 | CAD | Raw Materials Price Index M/M Oct | 3.80% | 2.00% | -0.10% | -0.20% |

| 14:00 | USD | House Price Index M/M Sep | 0.50% | 0.70% | ||

| 14:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Sep | 6.00% | 5.92% | ||

| 15:00 | USD | Consumer Confidence Index Nov | 124 | 125.9 |