There isn’t a clear new direction in the forex markets today. Euro remains firm against as supported by economic outlook, and improving political situation in Germany. But the common currency is out-performed by commodity currencies. On the other hand, Dollar’s recovery quickly lost momentum, with EUR/USD continuing to gyrate higher. The greenback is only performing slightly better than Swiss Franc, which trades as the weakest one so far. Overall, trading is rather quiet. Traders are holding their bets ahead of inflation data from US, Eurozone and Japan. Also, the development with US Senate tax bill and Germany coalition talks, as well as Brexit negotiations will also be the drivers later in the week.

Yen on the other hand, is out performing Europeans and Dollar.

Fed Governor Jerome Powell, President Donald Trump’s nomination for the next Fed chair, will appears before the Senate Banking Committee on Tuesday for confirmation hearing. Powell’s comments will be scrutinized for hints on how monetary policy direction would change in post-Yellen era. And more importantly, his view on inflation will catch most attentions. Meanwhile, current Fed chair Janet Yellen will also testify before Congress.

Tax plan to be floored in Senate

For now, the voting in Senate for the Republican’s tax bill this week is the first hurdle to overcome. With a slim 52 majority, Republicans can only afford to lose two votes. Ron Johnson is so far the only Republican that’s openly against the last version of the plan. In Johnson’s view, large corporations are the ones getting most benefits, leaving small businesses behind. Also, the tax plan is not without oppositions from other Senate Republicans. Bob Corker is very concerned with raising deficit in the long-run. Susan Collins is unhappy that repeal of Obamacare individual mandate is tied to the plan.

It’s reported that Senate Republicans are considering some last-minute changes to the tax bill to secure the votes before flooring this week. President Donald Trump hinted changes as he tweeted "the Tax Cut Bill is getting better and better". Generally, it’s seen that this week is "make or break" for the tax plan.

Merkel will try to bring SPD back to grand coalition

A breakthrough in German politics was seen as SPD has agreed to discuss with CDU/CSU over the possibility of forming a government. While both a repeat of the grand coalition or a support of a CDU/CSU minority government are possible, it is believe that the former is more likely. On CDU/CSU side, Chancellor Angela Merkel got support from her allies for the grand coalition. Daniel Günther, A CDU member and Minister President of Schleswig-Holstein said that effectiveness won’t come from a minority government but "instead an alliance with a parliamentary majority. That is a grand coalition." Leader of the Christian Social Union Horst Lorenz Seehofer also said that "an alliance of the conservatives and the SPD is the best option for Germany – better anyway than a coalition with the Free Democrats and the Greens, new elections or a minority government."

However, negotiations for rebirth of grand coalition is not necessarily easier than the Jamaican one, with migration and refugees issues also key points of contentions. According to Ralf Stegner, the SPD’s deputy, his party objects that the upper limit policy on refugee arrivals", noting this "goes against the constitution and the Geneva Refugee Convention". Stegner added that the SPD "won’t agree to an additional limit on the right to family reunification". Meanwhile, Alexander Schweitzer, SPD’s leader in Rhineland Pfalz, requests more investment in education, housing and broadband, and relief to indebted communities. He warned that a new grand coalition remains "out of reach", unless CDU/CSU changes agrees to concede in the above important issues. Foreign Minister Sigmar Gabriel, the former leader of the SPD, sounded non committal as he said that no one should take the grand coalition for granted. But he added that Germany needs "a sufficiently courageous, majority-equipped government that is capable of action" as the leader in EU.

Merkel will meet with SPD leader Martin Schulz, CSU leader Seehofer and President Frank-Walter Steinmeier on Thursday.

UK PM May has one more week to improve Brexit offers

As requested by European Council President Donald Tusk, UK Prime Minister Theresa now has only a week left to come up with a improved offer for Brexit negotiation. EU officials will check the progress to see if sufficient progress was made to move on to trade talk during the December 14/15 summit. UK is starting to soften its stance on the divorce bill and it’s reported that May is ready to double the amount offered. But the topic of Irish border has come to spotlight during the weekend.

UK’s international trade secretary Liam Fox warned that "we can’t come to a final answer to the Irish question until we get an idea of the end state." That is, according to Fox, the decision on Irish border won’t be made before reaching a trade agreement with EU. And Fox blamed that "the quicker we can do that the better, and we are still in a position where the EU doesn’t want to do that."

EUR/USD Mid-Day Outlook

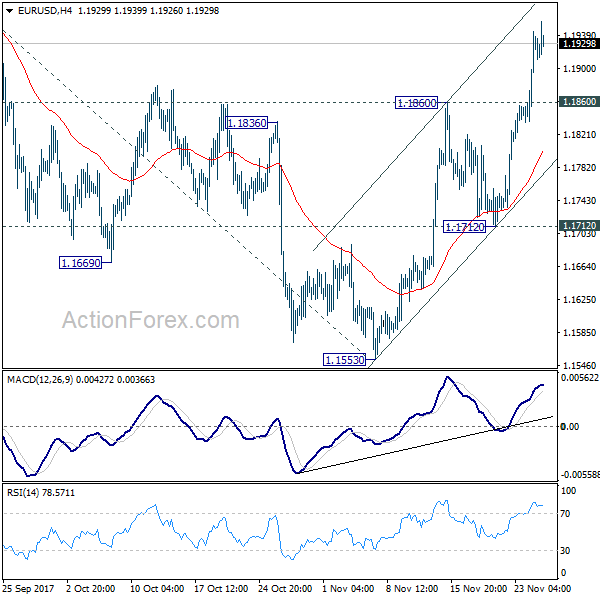

Daily Pivots: (S1) 1.1859; (P) 1.1901 (R1) 1.1967; More….

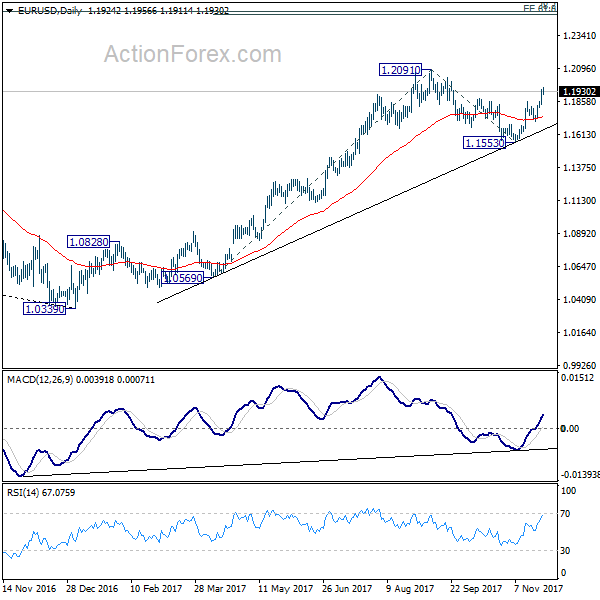

EUR/USD’s rally continues today and edges higher to 1.1956 so far. Intraday bias remains on the upside and rise from 1.1553 should target a test on 1.2091 high. Break there will resume medium term up trend from 1.0339 and target 61.8% projection of 1.0569 to 1.2091 from 1.1553 at 1.2494, which is close to 1.2516 long term fibonacci level. We’d expect strong resistance from there to bring reversal. On the downside, touching 1.1860 support will turn intraday bias neutral first. But break of 1.1712 support is needed to indicate completion of rise from 1.1553. Otherwise, outlook will remain cautiously bullish in case of retreat.

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA (now at 1.1393) will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Y/Y Oct | 0.80% | 0.90% | 0.90% | |

| 15:00 | USD | New Home Sales Oct | 627K | 667K |