Euro strengthens again today as boost by strong confidence data. German Ifo business climate hit a record high. Additionally, there is positive political news out of Germany as the Social Democrats announced to enter into talk with Chancellor Angela Merkel. Dollar pared back some losses against all but Euro and Sterling. But the greenback will still likely end the week as the weakest one. Meanwhile, Japanese Yen lost much ground as risk appetites returned to global markets. Yen and Canadian Dollar could end as the weakest ones together with Dollar.

German Ifo hit record high, economy on track for a boom

German Ifo business climate jumped to 117.5 in November up from 116.8 and beat expectation of 116.5. More importantly, that’s the highest reading on record. Expectation gauge rose to 111.0, up from 109.2, beat expectation of 108.8. Current assessment gauge, however, dropped to 124.4, down from 124.8 and missed expectation of 125.0. Ifo head Clemens Fuest said that "sentiment among German businesses is very strong." And, "this was due to far more optimistic business expectations. The German economy is on track for a boom." However, it remains to be seen if the upbeat sentiments could continue as the country is facing some political risks after the collapse of coalition talk.

Social Democrats: Talks have to take place

Euro is also supported by news that Germany’s Social Democrats are ready to talk with Chancellor Angela Merkel and her CDU/CSU bloc. SPD announced, after an eight-hour marathon meeting between its leaders, that "the SPD is firmly convinced that talks have to take place. The SPD is not closed to talks." Nonetheless, deputy party leader, Manuela Schwesig emphasized that "just because we say we are open to talks doesn’t mean that these are automatically talks about a grand coalition, and it is certainly not a vote in favour of a grand coalition." It’s reported that SPD are considering two options. One option is to back Merkel’s minority government for certain key votes, like budget and EU poly. Another option is reformation of the grand coalition.

UK May in Brussels to meet EC Tusk

UK Prime Minister arrived in Brussels for a meeting with European Council Donald Tusk. She told reporters after the meeting that "these negotiations are continuing but what I am clear about is that we must step forward together. This is for both the UK and the European Union to move on to the next stage." It’s believed that May is willing raise the divorce bill offer but only if EU agrees to start talks on trade agreement and transition period. However, EU leaders could be bounded to consult their national parliaments before making such a guarantee. And most likely, the member states won’t be willing to "rubber-stamp" an offer".

UK consumer confidence hit post Brexit referendum low

Staying in UK, a consumer index by YouGov and the Centre for Economics and Business Research sank sharply from 109.3 to 106.6 in November, hitting the lowest level since the Brexit referendum. CEBR economist Christian Jaccarini linked the deterioration to factors like BoE hike and a slowdown in housing. He said that "the first interest-rate hike in over a decade triggered fears that higher borrowing costs will compound the inflation-induced squeeze on household incomes." And. "with these economic headwinds set to persist, and the OBR forecasting weaker growth, households are understandably worried."

Japan PMI manufacturing posted strongest improvement since 2014

Japan PMI manufacturing rose to 53.8 in November, up from 52.8 and beat expectation of 52.6. That’s the strongest improvements for 44 months since March 2014. Markit economists Joe Hayes noted that "new orders increased strongly, underpinned by business from abroad amid recent yen weakness. New export orders expanded at the fastest pace in almost four years." However, he also warned that " cheaper yen and higher material prices have intensified cost pressures, as input price inflation increased to a 35-month high in November."

New Zealand trade deficit narrowed despite record imports

New Zealand trade deficit narrowed to NZD -871m in October, larger than expectation of NZD -750m. Imports surged to a record high at USD 5.4b, but that was offset by rise in exports to NZD 4.56b. Jump in imports include intermediate goods, used as ingredients or inputs into the production of other goods and services. Meanwhile dairy and lamb shipments were the key drivers of export growth.

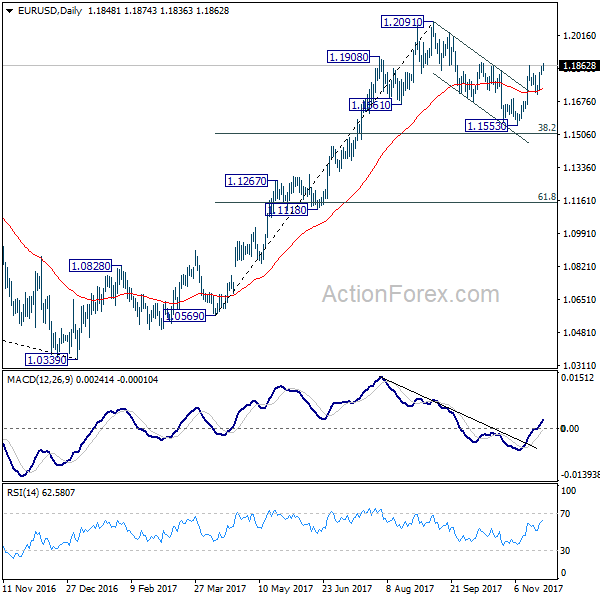

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1822; (P) 1.1839 (R1) 1.1865; More….

Break of 1.1860 resistance indicates that EUR/USD’s rally from 1.1553 has completed. Intraday is back on the upside for retesting 1.2091 high. Decisive break there will resume medium term rally from 1.0339. On the downside, break of 1.1712 support is needed to indicate completion of the rebound. Otherwise, outlook will stay bullish in case of retreat.

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be cautious on 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA (now at 1.1373) will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance Oct | -871M | -750M | -1143M | -1156M |

| 0:30 | JPY | PMI Manufacturing Nov P | 53.8 | 52.6 | 52.8 | |

| 9:00 | EUR | German IFO Business Climate Nov | 117.5 | 116.5 | 116.7 | 116.8 |

| 9:00 | EUR | German IFO Expectations Nov | 111 | 108.8 | 109.1 | 109.2 |

| 9:00 | EUR | German IFO Current Assessment Nov | 124.4 | 125 | 124.8 | |

| 14:45 | USD | Manufacturing PMI Nov P | 55 | 54.6 | ||

| 14:45 | USD | Services PMI Nov P | 55.4 | 55.3 |