Dollar tumbles overnight as November FOMC minutes should some members are concerned with weaker inflation. December hike is still the base case but there might be growing doubts on whether there will be three more hikes next year. Euro closely follow Dollar as the second weakest on political uncertainties in Germany. Meanwhile, commodity currencies are supported by this week’s rebound in commodity prices. ECB monetary policy accounts, Eurozone PMIs are the main focus in European session today. Canada will release retail sales while US will be on holiday.

FOMC Minutes Revealed Bigger Concerns Over Soft Inflation

The greenback slumped as the FOMC minutes for the November meeting revealed that ‘several’ members were concerned that weak inflation would be persistent, rather than temporary. They highlighted the worries about a ‘a diminished responsiveness of inflation to resource utilization’. Another important message suggested in the minutes is that a December rate hike is almost a done deal with ‘many’ members judging that it is ‘warranted in the near term’ if the macroeconomic data remain steady. Such opinion has outweighed the thought of ‘a few ‘members’ that a rate hike should be delayed.

We view the USD selloff might have been over-reacted. Note that the (core) PCE, the Fed’s preferred inflation barometer, has improved, while the October CPI, released after the November meeting, also picked up. We believe the majority of the FOMC still retain the view that weak inflation is transitory. More in FOMC Minutes Revealed Bigger Concerns Over Soft Inflation, Affirmed December Rate Hike.

Dollar index heading back to 91

Dollar index’s break of 93.47 support now argues that rebound from 91.01 has completed at 95.15 already. And, deeper fall is in favor in near term back to retest this low. Nonetheless, we maintain that 91.91/3 represents a key long term support zone. That is 2016 low at 91.91 and 38.2% retracement of 72.69 to 103.82 at 91.93. Hence, we’d look for bottoming signal again as the index approaches 91.01.

ECB said to review asset purchase program

Meeting accounts of ECB November meeting will be a key focus of the day. It’s reported that ECB would start reviewing the asset purchase plan once it moves to the next stage. That is, ECB is going to half the monthly size to EUR 30b, running from January to September. The central bank would evaluate the effectiveness of the EUR 126b spent and the impact of credit supply to the region. Also, assessment would done of whether the program benefits larger corporations more. But overall, ECB said before in its monthly bulletin that "favorable bond-market conditions have resulted in positive spillover effects which have supported bank lending." And, "when large corporations increasingly finance themselves through bond issuances, rather than bank loans, this releases capacity in the balance sheets of banks for potential lending to SMEs."

On the data front

New Zealand retail sales rose 0.2% qoq in Q3, core retail sales rose 0.5% qoq, both below expectation. Eurozone PMI will be a main feature in European session. Germany will also release Q3 GDP final. UK will release Q3 GDP revision. Later in the day, Canada will release retail sales.

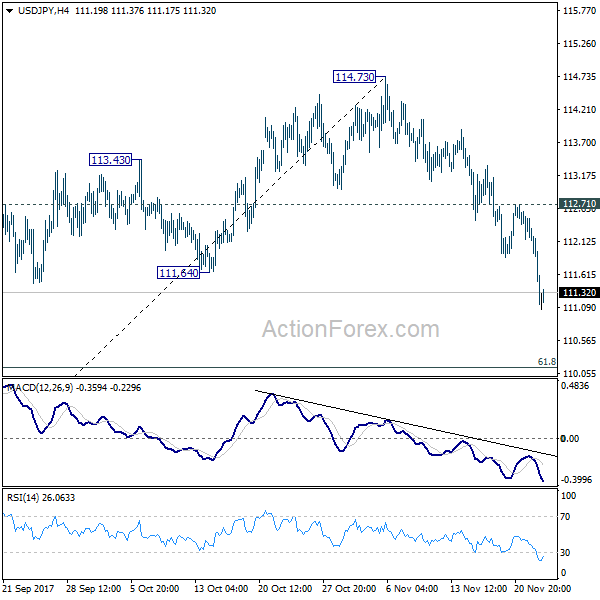

USD/JPY Daily Outlook

Daily Pivots: (S1) 110.74; (P) 111.62; (R1) 112.09; More…

USD/JPY’s fall from 114.73 extends to as low as 111.06 so far today. The strong break of 111.64 support should confirm that whole rebound from 107.32 has completed at 114.73. Intraday bias remains on the downside for 61.8% retracement of 107.31 to 114.73 at 101.14. For the moment, we’re still favoring the case medium term corrective pattern from 118.65 has completed at 107.31 already. Hence, we’ll looking for bottoming below 101.14 to bring another rise. On the upside, break of 112.71 resistance will indicate that the fall from 114.73 is completed and turn bias back to the upside.

In the bigger picture, medium term rise from 98.97 (2016 low) is not completed yet. It should resume after corrective fall from 118.65 completes. Break of 114.49 resistance will likely resume the rise to 61.8% projection of 98.97 to 118.65 from 107.31 at 119.47 first. Firm break there will pave the way to 100% projection at 126.99. This will be the key level to decide whether long term up trend is resuming. However, firm break of 111.64 support will dampen this view and turn focus back to 107.31 instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Retail Sales Q/Q Q3 | 0.20% | 0.40% | 2.00% | 1.80% |

| 21:45 | NZD | Retail Sales Core Q/Q Q3 | 0.50% | 0.90% | 2.10% | 1.90% |

| 7:00 | EUR | German GDP Q/Q Q3 F | 0.80% | 0.80% | ||

| 8:00 | EUR | France Manufacturing PMI Nov P | 55.9 | 56.1 | ||

| 8:00 | EUR | France Services PMI Nov P | 57 | 57.3 | ||

| 8:30 | EUR | Germany Manufacturing PMI Nov P | 60.3 | 60.6 | ||

| 8:30 | EUR | Germany Services PMI Nov P | 55 | 54.7 | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Nov P | 58.2 | 58.5 | ||

| 9:00 | EUR | Eurozone Services PMI Nov P | 55.2 | 55 | ||

| 9:30 | GBP | GDP Q/Q Q3 P | 0.40% | 0.40% | ||

| 9:30 | GBP | Total Business Investment Q/Q Q3 P | 0.30% | 0.50% | ||

| 9:30 | GBP | Index of Services 3M/3M Sep | 0.40% | 0.40% | ||

| 11:00 | GBP | CBI Reported Sales Nov | 3 | -36 | ||

| 12:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 13:30 | CAD | Retail Sales M/M Sep | 1.00% | -0.30% | ||

| 13:30 | CAD | Retail Sales Ex Auto M/M Sep | 1.10% | -0.70% |