Markets are generally back in risk seeking mode. Major US indices ended in record highs as DOW gained 0.69% to 23590.83, S&P 500 up 0.65% to 2599.03 and NASDAQ rose 1.06% to 6862.48. Asian markets follow with Nikkei gaining 200 pts in initial trading. Trading in currency markets is relatively subdued in Asian session. For the week, Sterling remains the strongest one follow by commodity currencies. Euro remains the weakest one on political uncertainties in Germany, but loss is, again, limited. Dollar is trading mixed as markets await FOMC minutes. Expectation on the minutes is rather low as they shouldn’t reveal anything that alter the chance of a December Fed hike.

Fed Yellen: New normal is really different

Fed Chair Janet Yellen said that inflation staying below the 2% is one of the "biggest challenge". She added that "the issue facing monetary policy at the moment is how to craft a monetary policy that maintains a strong labor market, but also moves inflation back up to our 2% objective." And the so called "new normal" was "really different". Yellen noted that "we have been revising down our estimates [of the neutral rate], and market participants have been doing the same." However, under the new norm, Fed would have left with few tools to respond to another crisis and that is "very dangerous state of affairs."

NAFTA talks ended in frustrations

US Trade Representative Robert Lighthizer expressed his frustration after the fifth round of North American Free Trade Agreement (NAFTA) renegotiation talk with Canada and Mexico. Lighthizer said that he "remain concerned about the lack of headway", and "we have seen no evidence that Canada or Mexico are willing to seriously engage on provisions that will lead to a rebalanced agreement." He warned that "absent rebalancing, we will not reach a satisfactory result." On the other hand, Canadian Foreign Minister Chrystia Freeland said the U.S. put forward "extreme proposals" that "we simply cannot agree to." Freeland warned that "some of the proposals that we have heard would not only be harmful for Canada but would be harmful for the U.S. as well." Mexican Economy Minister Ildefonso Guajardo said "we’re prepared to work towards that (rebalancing) goal, provided it doesn’t limit Mexico’s ability to produce and export."

Near 50% German prefers new election

In Germany, a new poll by INSA for Bild daily showed that 49.9% of German preferred new election, after coalition talks between Chancellor Angela Merkel’s CDU/CSU, FDP and Greens collapsed earlier this week. 28% blamed FDP for the failure of talks, but that was closely followed by 27% who blamed Merkel. And, only four out of 10 said Merkel should run again as chancellor in new election. 24% prefer another someone else from CDU. A big question is on whether a new election could change the current deadlock. The poll showed that support of CDU at 30%, SPD at 21%, GDP on 10% and Greens on 11%. That is, the deadlock would remain a deadlock unless the parties adjust their stances.

ECB Coeure: Link between asset purchase and inflation would change

ECB Executive Board member Benoit Coeure said in an interview that "European recovery is the strongest for the last decade, and the broadest for the last two decades." But inflation "remains weak" even through there are "some signs" of picking up. And even in in Germany, "inflationary pressures are surprisingly subdued". And therefore monetary policy needs to "remain accommodative". The end data of the asset purchase program in September 2018 "is still far away" according to Coeure. But the link between asset purchases and inflation would change "at some point between now and September 2018".

On the data front

Australia Westpac leading index rose 0.1% mom in October, construction work done rose 15.7% in Q3. Economic calendar is busy in the US today, with jobless claims, durable goods, and FOMC minutes featured.

AUD/USD Daily Outlook

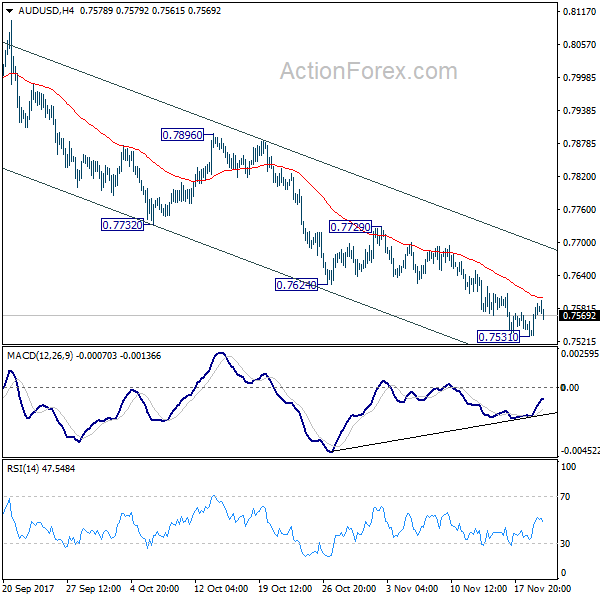

Daily Pivots: (S1) 0.7543; (P) 0.7566; (R1) 0.7601; More…

A temporary low is in place at 0.7531 in AUD/USD and intraday bias is turned neutral for consolidation. Upside of recovery should be limited below 0.7729 resistance and bring another decline. Break of 0.7531 will resume the whole fall from 0.8124 and turn bias to the downside for next key cluster level at 0.7322/8. However, considering bullish divergence condition in 4 hour MACD, break of 0.7729 will indicate near term reversal and bring stronger rebound back to 0.7896 resistance and above.

In the bigger picture, corrective rise from 0.6826 medium term bottom is likely completed at 0.8124, after hitting 55 month EMA (now at 0.8049). Decisive break of 0.7328 key cluster support (61.8% retracement 0.6826 to 0.8124 at 0.7322) will confirm. And in that case, long term down trend from 1.1079 (2011 high) will likely be resuming. Break of 0.6826 will target 61.8% projection of 1.1079 to 0.6826 from 0.8124 at 0.5496. This will now be the favored case as long as 0.7729 near term resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Oct | 0.10% | 0.10% | ||

| 0:30 | AUD | Construction Work Done Q3 | 15.70% | -2.30% | 9.30% | 9.80% |

| 12:30 | GBP | U.K. Chancellor Presents Budget to Parliament | ||||

| 13:30 | USD | Initial Jobless Claims (NOV 18) | 241K | 249K | ||

| 13:30 | USD | Durable Goods Orders Oct P | 0.30% | 2.00% | ||

| 13:30 | USD | Durables Ex Transportation Oct P | 0.40% | 0.70% | ||

| 15:00 | EUR | Eurozone Consumer Confidence Nov A | -0.9 | -1 | ||

| 15:00 | USD | U. of Mich. Sentiment Nov F | 98 | 97.8 | ||

| 15:30 | USD | Crude Oil Inventories | 1.9M | |||

| 17:00 | USD | Natural Gas Storage | -18B | |||

| 19:00 | USD | FOMC Meeting Minutes Nov |