Euro remains pressured today and suffers some renewed selling. But overall sentiments in Eurozone are not too bad as German DAX rebounds today and is trading up 0.87% at the time of writing. CAC 40 is also trading up 0.69%. US futures also point to higher open. Political deadlock Germany will remain a focus but it will likely take some more time to resolve. Meanwhile, Dollar trading is subdued with Thanksgiving holiday this week and Senate could only vote on the tax plan next week. The greenback is trading as the second weakest one today, next to Euro. On the other hand, commodity currencies are trading broadly higher, paring recent losses.

Merkel prefers new election to minority government

German Chancellor Angela Merkel make her stance very clear regarding the political deadlock in an interview with ARD. Merkel said that "a minority government isn’t part of my plans." And, "I’m certain that new elections are the better way." That came after German President Frank-Walter Steinmeier, a member of SPD, urged the parties to "pause and reconsider their positions". Overall, there are four possibilities present in the aftermath of coalition talk collapse. 1 New election, 2. Grand coalition (a CDU/CSU+SPD Government), 3. Restart of the Jamaica talks (CDU/CSU + FDP+ Greens) or 4. Formation of a minority government by CDU/CSU with either the Greens or FDP. Assessing the likelihood of the scenarios at this stage appears premature as the developments remain fluid. But we’ve analyzed each of the four scenarios in German Political Stalemate: Four Options on Table, None An Easy Way.

BoE Saunders, Cunliffe, McCafferty and Vlieghe defend British way of guidance

BoE policymakers Michael Saunders, Jon Cunliffe, Ian McCafferty and Gertjan Vlieghe defend their communications in a parliamentary hearing today. Saunders noted that "it’s tempting to think the bank could promise where rates will be in future, but this would create more uncertainty." And Saunders emphasized that, "Monetary policy responds to what the economy does. It’s not possible to forecast the economy with perfect certainty."

McCafferty said Fed’s style forward guidance would be an "undesirable" one for BoE. And McCafferty argued "against the false precision that seeks to give you a path of interest rates that you know for certainty will be followed, as I don’t think that’s possible." He added that "it is useful for the bank to communicate widely to households and businesses a general sense that interest rates are likely to go up over the next two, three years if the economy evolves as we expect — and we can’t give you a precise path, but I think that general guidance is a very useful thing."

Cunliffe also criticized that forward guidances "gets misunderstood a bit" and he prefers the British way. Vlieghe said "we will support the economy to meet the inflation target," and "that’s all we can do."

BoE Ramsen had a "somewhat different" view to some other MPC members

BoE Deputy Governor Dave Ramsen, who voted against the rate hike this month, said yesterday that he had a "somewhat different" view of the economy to most of his colleagues. He noted that "I attach some weight to the idea that workers have responded to the changing outlook by showing greater flexibility in their wage demands." Then, "if true it would mean there is a little more room than headline measures of slack suggest for the economy to grow without generating above-target inflation in the medium term."

RBA Low: We’re patient and we’ll continue to be patient

RBA Governor Philip Lowe said today that the country is "not too far away from 2%" inflation and is "just not getting there as quickly as we would like to". He emphasized that "we’re prepared to be patient. We’re getting there, we’re making progress, we’re patient and we’ll continue to be patient." Also, regarding sluggish wage growth, as also noted the RBA minutes, Lowe said "I think eventually the forces of supply and demand will win out and wage growth will pick up, it’s just taking time.:" He added that "my sense is that wage growth has stabilized at a low level and it’s not going to fall further." Lowe’s comment is in line with the view that RBA would stand pat for longer.

The RBA minutes for the November minutes delivered a dovish tone as policymakers expressed concerns over the wage growth outlook. This is consistent with the central bank’s worry over household spending as indicated in the meeting statement (released earlier this month). We believe this has added further pressure to Aussie’s recent weakness, sending AUDUSD to the lowest level in 5 months. The central bank kept its powder, leaving the cash rate unchanged at 1.5%, in November. We expect the monetary policy would stay unchanged at least until 1H18 and could extend to 2H18. More in RBA Worried About Wage Growth Despite Strong Job Market.

On the data front

Canada wholesale sales dropped -1.2% mom in September. UK CBI trends trade total orders rose to 17 in November. Public sector net borrowing rose to GBP 7.5b in October. Swiss trade surplus widened to CHF 2.33b in October. Japan all industry index dropped -0.5% mom in September.

EUR/USD Mid-Day Outlook

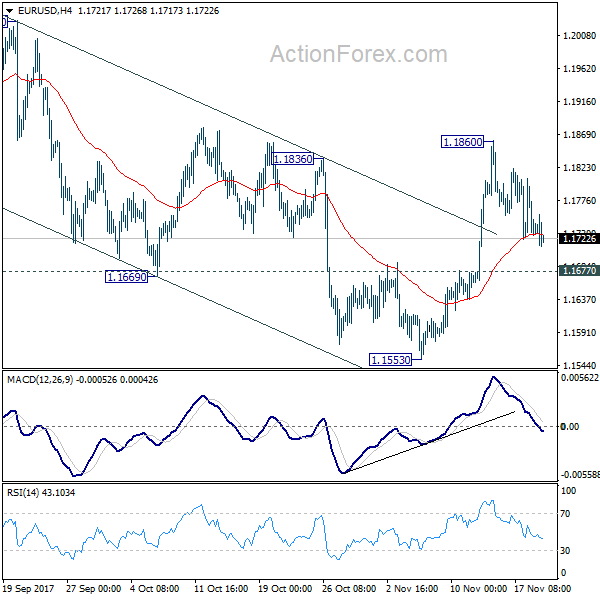

Daily Pivots: (S1) 1.1699; (P) 1.1753 (R1) 1.1786; More….

EUR/USD’s choppy decline from 1.1860 extends lower today. But it’s staying well above 1.1677 minor support. Intraday bias remains neutral and another rally is still in favor. As noted before, corrective fall from 1.2091 has completed at 1.1553 already, ahead of 38.2% retracement of 1.0569 to 1.2091 at 1.1510. Above 1.1860 will turn bias to the upside for retesting 1.2091 high. However, break of 1.1677 will dampen this bullish view and turn focus back to 1.1553 low instead.

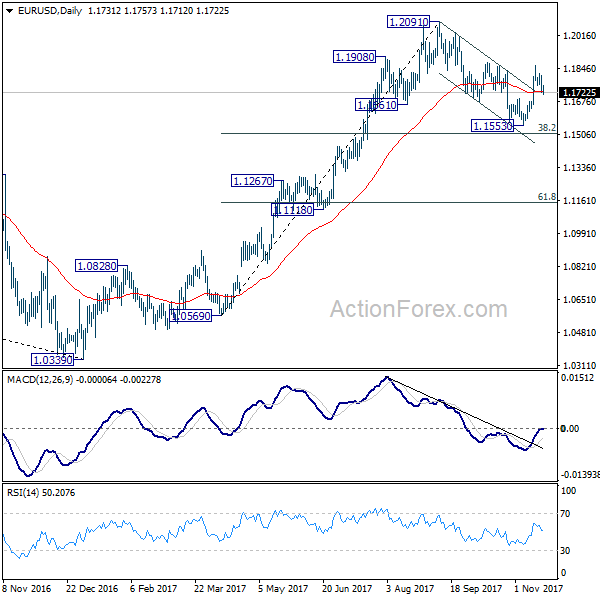

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be cautious on 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA (now at 1.1373) will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | RBA Minutes Nov | ||||

| 04:30 | JPY | All Industry Activity Index M/M Sep | -0.50% | -0.40% | 0.10% | 0.20% |

| 07:00 | CHF | Trade Balance Oct | 2.33B | 3.21B | 2.92B | |

| 09:30 | GBP | Public Sector Net Borrowing Oct | 7.5B | 6.6B | 5.3B | 4.4B |

| 11:00 | GBP | CBI Trends Total Orders Nov | 17 | 3 | -2 | |

| 13:30 | CAD | Wholesale Trade Sales M/M Sep | -1.20% | 0.40% | 0.50% | 0.40% |

| 15:00 | USD | Existing Home Sales Oct | 5.42M | 5.39M |