Speculation surrounding the incoming US administration’s tariff strategy continues to rattle global markets. Reports suggest that President-elect Donald Trump’s economic team is exploring a phased approach to tariffs, gradually increasing rates by 2% to 5% per month. This tactic, if adopted, would utilize executive powers under the International Emergency Economic Powers Act to maximize negotiation leverage while reducing immediate inflation risks. However, the proposal is still in its infancy and has not yet even reached Trump for approval, leaving markets to grapple with the uncertainty.

The potential for a measured tariff escalation has brought mixed reactions across asset classes. US equities displayed divergence overnight, with DOW rallying on diminished fears of abrupt trade disruptions. In contrast, NASDAQ underperformed, partly as investors rotated out of tech-heavy growth stocks. Meanwhile, Asian markets presented a fragmented picture—Hong Kong and China posted robust gains, buoyed by optimism surrounding trade resilience, while Japan’s Nikkei suffered steep losses.

In the currency markets, Dollar is taking a breather as it consolidates recent gains. The greenback has been the weakest performer of the week so far, as traders await critical US economic data, including today’s PPI and tomorrow’s CPI. Sterling remains under significant pressure, ranked as the second weakest currency, weighed down by ongoing fiscal concerns in the UK. The Swiss Franc is close behind as third worst.

Conversely, commodity-linked currencies are leading the charge. Kiwi is the top performer, benefiting from improved risk sentiment, followed by Aussie and Loonie. Yen and Euro are mixed in middle positions.

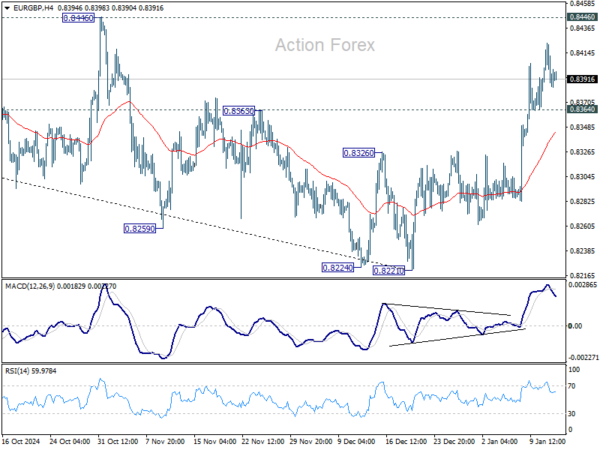

Technically, EUR/GBP is worth some attention in the coming days. Rebound from 0.8221 is starting to lose momentum ahead of 0.8446 near term resistance, as seen in 4H MACD. Break of 0.8364 minor support will indicate short term toping and bias deeper pull back. Such a development could hint at stabilization in sentiment following the recent fiscal “mini-crisis”. The relative medium term strength of Sterling against Euro would remain intact after near term jitters.

BoJ’s Himino signals rate hike possible in upcoming meeting

In remarks today, BoJ Deputy Governor Ryozo Himino signaled that a rate hike remains a tangible possibility at the upcoming policy meeting. He said the board “will discuss whether to raise interest rates next week, base its decision on thee projections detailed in the quarterly outlook report.

Himino stated, “When the appropriate timing comes, we must shift policy without delay, as the effect of monetary policy is said to show up with a lag of one to one-and-a-half years.”

The Deputy Governor clarified that BoJ does not rely on a predefined “checklist” for rate decisions. Instead, the board intends to thoroughly analyze the economic outlook and inflation expectations to determine the next steps.

Australian Westpac consumer sentiment dips again, RBA easing unlikely before May

Australia’s Westpac Consumer Sentiment fell -0.7% mom in January, settling at 92.1, reflecting a second consecutive decline. However, Westpac noted a divergence within the data: current conditions sub-indexes weakened, while forward-looking measures were flat or showed slight gains.

RBA faces a mixed picture as it prepares for its next policy meeting on February 17–18. While the central bank appears increasingly confident about bringing inflation back within its 2–3% target range, labor market “stopped easing” in the latter half of 2024 and subdued consumer surveys highlighted “mixed signals”.

According to Westpac, RBA is likely to keep interest rates unchanged in February, with an easing cycle more probable to commence in May.

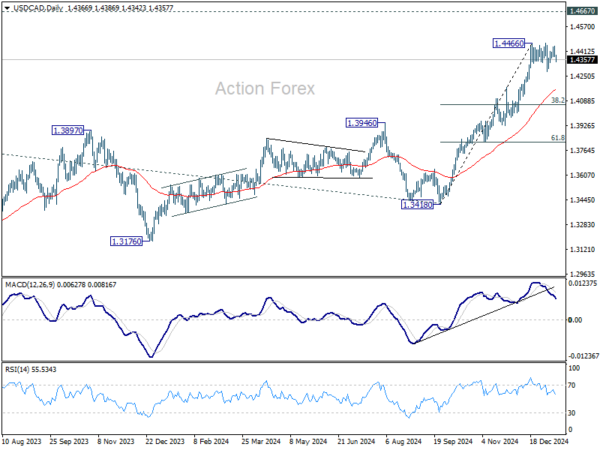

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.4354; (P) 1.4401; (R1) 1.4425; More…

USD/CAD dips ahead of 1.4466 resistance as consolidations pattern from there extends. Intraday bias remains neutral first. Break of 1.4279 support will bring further correction. But downside should be contained by 55 D EMA (now at 1.4166) to bring rebound. On the upside, break of 1.4466 will resume larger up trend to 1.4667/89 long term resistance zone.

In the bigger picture, up trend from 1.2005 (2021) is in progress for retesting 1.4667/89 key resistance zone (2020/2015 highs). Medium term outlook will remain bullish as long as 1.3976 resistance turned holds (2022 high), even in case of deep pullback.