Euro dives broadly after Germany Chancellor Angel Merkel declared failure in forming a coalition government. After over time exploratory talks, Merkel’s Christian Democratic-led bloc couldn’t reach an agreement with pro-business Free Democratic Party and center-left Greens. Merkel will now meet with President Frank-Walter Steinmeier next. The meeting with Steinmeier suggests that Merkel will not opt for forming a minority government with the Greens. And the reincarnation of the grand coalition with SPD is unlikely too. Instead, Merkel may ask Steinmeier to order another election. In the meantime, she will stay as the "caretaker" chancellor. And for the time being, Germany will hold of any work with France on Euro reforms until the domestic political picture comes clear.

Chancellor Hammond: UK ready to offer Brexit bill before Dec summit

Chancellor of Exchequer Philip Hammond indicated that UK could be ready to break the negotiation "logjam" with EU and make a divorce bill offer before December summit. Hammond said on BBC that UK is "on the brink of making some serious movement forward". And, "we will make our proposals to the European Union in time for the council. I am sure about that." Meanwhile he also insisted that "It’s not about demands, it’s about what is properly due from the U.K. to the European Union under international law in accordance with European treaties." He added that "we’ve always been clear it won’t be easy to work out that number. But whatever is due, we will pay."

Goldman Sachs predicts four Fed hikes in 2018

It’s widely expected that Fed will raise interest rate in December by 25bps to 1.25-1.50%. And according to Fed’s own projections and comments from some hawks, Fed would hike three more times in 2018. But accord to a note by Goldman Sachs economist, Fed would indeed hike four times. The note said that "the US economy heads into 2018 with strong growth momentum and an unemployment rate already below levels that Fed officials view as sustainable.: And, "the strength is becoming ‘too much of a good thing’ and containing further overheating will become a more urgent priority in 2018 and beyond."

White House softens stance on Obamacare individual mandate repeal

It’s clear that with 52-58 advantages over the Democrats in Senate, the Republicans can only afford two "no" votes for the tax bill. Ron Johnson has already declared opposition last week. And Susan Collins is a great uncertainty as she said "I haven’t reached that conclusion yet" during the weekend. There are many areas that Collins, as a centrist, is not satisfied with the Senate Republican tax bill. But a key stick point is the inclusion of the provision to remove the individual mandate of the Obamacare. She criticized that "The fact is that if you do pull this piece of the Affordable Care Act out, for some middle-income families, the increased premium is going to cancel out the tax cut that they would get."

But the White House has also softened their stance on this issue. Office of Management and Budget Director Mick Mulvaney said that "If it becomes an impediment to getting the best tax bill we can, then we are okay with taking it out." And, it’s ultimately up to House and Senate Republicans to figure out what to do. The Senate will take their bill to floor after lawmakers return from Thanksgiving.

In the calendar

On the data front, Japan trade surplus widened to JPY 0.32T in October. German PPI and US leading indicator will be featured later in the day. Looking ahead, the calendar is relatively light with US on Thanksgiving holiday. FOMC minutes and ECB accounts will be the main feature. meanwhile, focuses will also be on Eurozone PMIs ad German Ifo. Here are some highlights for the week:

- Monday: Japan trade balance; German PPI; US leading indicator

- Tuesday: RBA minutes; Japan all industry index; Swiss trade balance; UK public sector net borrowing; Canada wholesale sales; US existing home sales

- Wednesday: US jobless claims, durable goods orders; FOMC minutes; Eurozone consumer confidence

- Thursday: New Zealand retail sales; German GDP final; Eurozone PMIs, ECB monetary policy accounts; UK GDP revision ; Canada retail sales

- Friday: Japan PMI manufacturing; German IFO; US PMIs

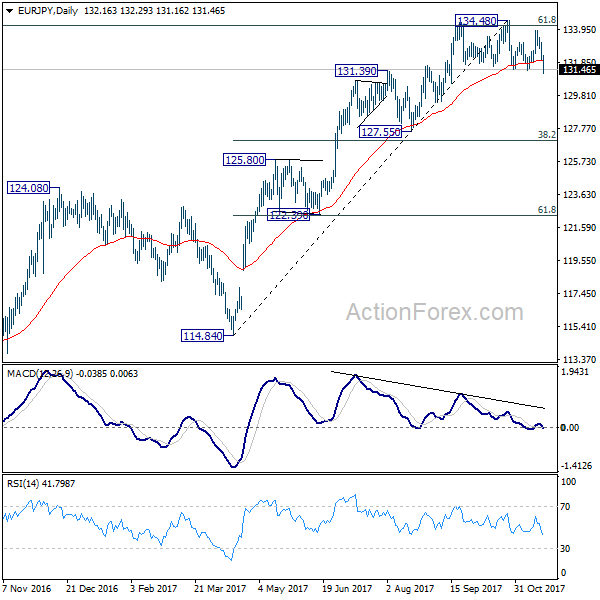

EUR/JPY Daily Outlook

Daily Pivots: (S1) 131.74; (P) 132.45; (R1) 132.85; More….

EUR/JPY fall’s sharply today and breaches 131.38 support. The development argues that a head and should top pattern is completed (ls: 134.39; h: 134.48; rs: 133.85). That indicates near term reversal after rejection from 134.20 long term fibonacci level. Intraday bias is now on the downside for 38.2% retracement of 114.84 to 134.48 at 126.97, which is close to 127.55 support. We’ll look for support from there to bring rebound on first attempt. On the upside, above 132.30 will dampen this bearish case and turn bias back to the upside for 133.85 instead.

In the bigger picture, medium term rise from 109.03 (2016 low) is seen as at the same degree as the down trend from 149.76 (2014 high) to 109.03 (2016 low). 61.8% retracement of 149.76 to 109.03 at 134.20 is already met. Sustained break there will pave the way to key long term resistance zone at 141.04/149.76. However, break of 127.55 support will argue that the medium term trend has reversed and will turn outlook bearish for deeper fall back to 114.84/124.08 support zone at least.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Oct | 0.32T | 0.21T | 0.24T | 0.27T |

| 7:00 | EUR | German PPI M/M Oct | 0.30% | 0.30% | ||

| 7:00 | EUR | German PPI Y/Y Oct | 2.70% | 3.10% | ||

| 15:00 | USD | Leading Index Oct | 0.60% | -0.20% |