Fed’s hawkish rate cut overnight sparked an outsized market reaction, with DOW plunging over -1100 points and NASDAQ losing -3.5%. Fed’s messages didn’t deviate from expectations leading to the meeting, indicating a slower easing path in 2025 with likely just two more rate cuts and a terminal rate near or above 3.0%. But markets responded as though these signals were underappreciated. The repricing of expectations pushed Fed fund futures to reflect a 90% chance of a January pause, up from 80% just a week earlier.

Dollar surged as the strongest performer in the currency markets, benefiting from risk aversion, Fed expectations, and a climb in 10-year Treasury yields, which are now approaching the 4.5% mark.

On the other hand, commodity currencies came under intense pressure. New Zealand Dollar was the weakest, hit hard by bleak GDP data showing a -1.0% contraction in Q3 and a sharp downward revision for Q2. Australian Dollar followed, weighed down by broader risk-off sentiment.

Yen also struggled after BoJ held rates steady, and dropped no hint on the timing of the next rate hike. BoJ Governor Kazuo Ueda maintained a cautious tone, citing uncertainties tied to domestic wage growth and the impact of trade policies from the incoming US administration.

British Pound, while sharply lower against the dollar, has shown relative resilience, ranking second strongest for the week. With BoE rate decision approaching, markets are watching for any changes in MPC voting. While a hold is widely expected, focus lies on whether another member might join Swati Dhingra in voting for a cut.

Swiss Franc is third-best for the week, while Euro and Canadian Dollar sit in the middle of the pack, although none appear strong compared to the greenback.

Technically, an immediate focus is now on whether US 10-year yield could power through 4.505 resistance to resume the rally from 3.603. That would set up further rise to 61.8% projection of 3.603 to 4.505 from 4.126 at 4.683 in the near term, and probably revisiting 4.997 high in the early part of next year. If realized, that would give extra boost to Dollar, in particular in USD/JPY.

German Gfk consumer sentiment improves slightly but remains fragile

Germany’s GfK Consumer Sentiment Index for January rose to -21.3, improving from December’s -23.1.

December’s subindices reflected mixed dynamics: economic expectations moved into positive territory at 0.3, up from -3.6, and income expectations increased to 1.4 from -3.5. Willingness to buy also ticked higher to -5.4 from -6.0, while willingness to save fell sharply to 5.9 from 11.9.

According to Rolf Bürkl, consumer expert at NIM, the improvement comes after a steep decline the prior month, partially reversing earlier losses. However, Bürkl noted that at -21.3 points, consumer sentiment remains at a very low level, highlighting a trend of “stagnation since mid-2024.”

He warned that a sustained recovery is “not yet in sight” due to persistent challenges. High food and energy prices, alongside growing concerns about job security in key sectors, continue to weigh heavily on sentiment.

BoJ stand pat, highlights wage and global risks

BoJ kept its uncollateralized overnight call rate unchanged at 0.25%, as widely anticipated, with an 8-1 vote in favor. Naoki Tamura dissented, advocating for a rate increase to 0.50%.

Governor Kazuo Ueda, speaking at the post-meeting press conference, reiterated that rate hikes would proceed cautiously. He noted, “If the economy and prices move in line with our forecast, we will continue to raise our policy rate,” but emphasized the need to carefully assess data before adjusting the level of monetary support.

The gradual pace of tightening, he explained, is due to the “moderate” rise in underlying inflation, which lacks the strength to warrant aggressive moves.

Ueda highlighted the importance of monitoring wage dynamics, particularly in the context of next year’s wage negotiations, to gauge the strength of Japan’s wage-inflation cycle.

He also pointed to uncertainties in the global economic outlook and the impacts of policy decisions under the incoming U.S. administration, despite the overall resilience of the US economy.

New Zealand’s GDP contracts -1% qoq in Q3, broad economic weakness

New Zealand’s economy contracted by -1.0% qoq in Q3, significantly worse than market expectations of -0.2%. The previous quarter’s GDP figure was also revised down sharply, from -0.2% to -1.1%, painting a grimmer picture of the country’s economic performance.

The decline was broad-based, with activity falling in 11 out of 16 industries, including significant contractions in manufacturing, business services, and construction. While primary industries posted gains, both goods-producing and service industries experienced declines.

On a per capita basis, GDP dropped -1.2% qoq, marking the eighth consecutive quarterly decline. The expenditure measure of GDP also contracted by -0.8% qoq. Notably, household consumption expenditure decreased by -0.3% qoq, with reductions in spending on essentials such as grocery food and electricity, highlighting the strain on consumer budgets.

NZ ANZ business confidence falls to 62.3, demand recovery offers glimmers of hope

New Zealand’s ANZ Business Confidence Index fell to 62.3 in December, down from 64.9. However, some subindices showed encouraging signs of recovery. The own activity outlook improved to 50.3 from 48.0, while profit expectations rose significantly to 31.1 from 26.5. Investment intentions also jumped to 21.5 from 18.0, signaling increased business willingness to allocate resources despite a challenging environment.

However, labor market metrics were mixed, with employment intentions slipping slightly from 14.7 to 14.3. At the same time, cost pressures intensified sharply, as cost expectations surged to 70.1 from 62.9, and wage expectations jumped from 75.5 to 79.2. Price intentions remained steady at 42.7, slightly up from 42.2, while inflation expectations ticked higher to 2.63%, up from 2.53%, reflecting ongoing pricing pressures.

ANZ noted that while the survey results indicate signs of recovering demand, they come against the backdrop of this morning’s weak Q3 GDP figures, which showed a sharp contraction. The low bar set by the GDP downturn provides room for optimism if demand continues to improve. However, rising cost and wage pressures could complicate the outlook, especially for inflation management.

AUD/USD Daily Report

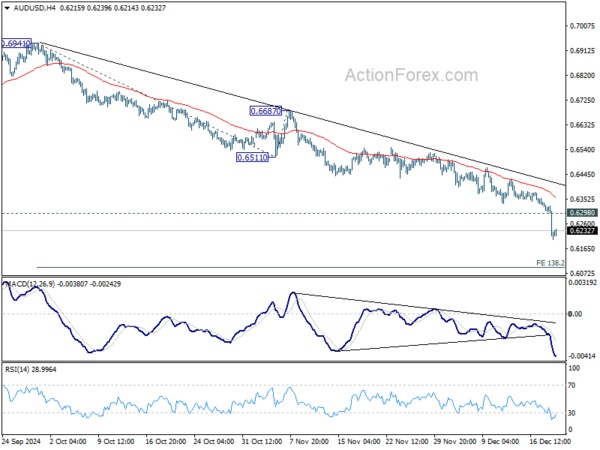

Daily Pivots: (S1) 0.6174; (P) 0.6258; (R1) 0.6302; More...

AUD/USD’s decline accelerates lower and intraday bias says on the downside for 0.6169 key support. Decisive break there will confirm larger down trend resumption. Next near term target is 138.2% projection of 0.6941 to 0.6511 from 0.6687 at 0.6074. On the upside, above 0.6298 minor resistance will turn intraday bias neutral first.

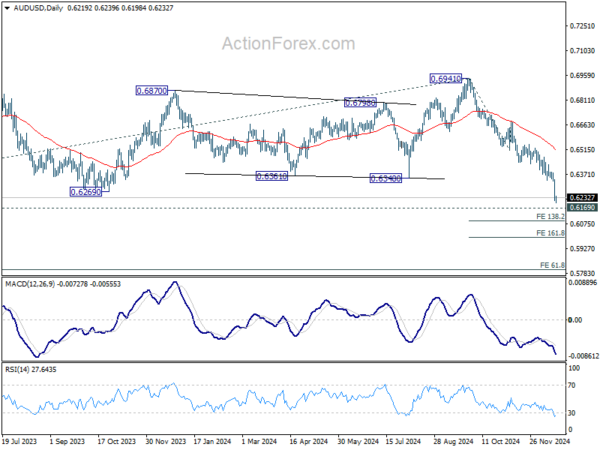

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term consolidation to the down trend from 0.8006. More sideway trading could be seen above 0.6169, but overall outlook will stay bearish as long as 0.6941 resistance holds. Firm break of 0.6169 will resume the down trend to 61.8% projection of 0.8006 to 0.6169 from 0.6941 at 0.5806 next.