Sterling remains resilient, as supported by UK employment data indicating that wages remain robust. This development aligns with improved conditions in the UK’s services sector, as seen in yesterday’s PMI release, and suggests that underlying price pressures have not diminished despite growing pessimism tied to the Autumn Budget’s uncertainty. Markets maintain near-zero expectations for a BoE rate cut at this week’s meeting, keeping the outlook for monetary easing firmly anchored in the future. Current pricing indicates around a 75% probability of a rate reduction by February, followed by a base case of four 25bps cuts in 2025. The latest figures do not alter these expectations, leaving Sterling well-supported for now.

Elsewhere in currency markets, the Swiss franc is the weakest performer so far this week, extending its decline after last week’s surprise 50bps rate cut by SNB. With persistent deflationary pressures, SNB is likely to maintain its loosening bias into next year, with zero rates now a plausible scenario as the easing cycle progresses. The Franc’s weakness is accompanied by Yen, which remains under pressure from rising US and European benchmark yields, while Canadian Dollar trails as the third worst performer.

Meanwhile, New Zealand dollar emerges as the second strongest currency, following the Pound. Dollar takes third place, awaiting the upcoming FOMC decision, where a “hawkish cut” is anticipated. Such a move would imply a pause at the next Fed meeting and a more measured pace of easing through the coming year. Euro and Australian Dollar occupy the middle ground. Notably, Aussie shows little response to reports of China targeting around 5% economic growth next year, indicating market fatigue with repeated “verbal” commitments from Beijing.

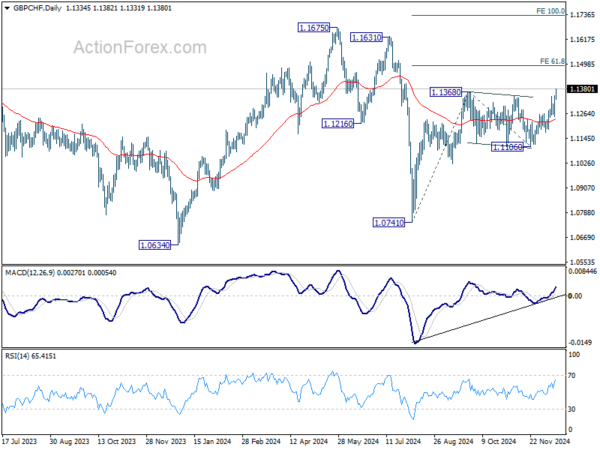

Technically, GBP/CHF finally breaks through 1.1368 resistance to resume the rally from 1.0741 (August low). Near term outlook will now stay bullish as long as 55 D EMA (now at 1.1233) holds. Next target is 61.8% projection of 1.0741 to 1.1368 from 1.1106 at 1.1493. Decisive break there could prompt upside acceleration through 1.1675 (2024 high) to 100% projection at 1.1733 in the medium term.

Looking ahead, the European session will feature the release of Germany’s Ifo Business Climate and ZEW Economic Sentiment data, as well as the Eurozone trade balance. Later in the North American session, attention will shift to Canada’s CPI data and US retail sales.

UK job numbers decline, but wage growth remains elevated

UK labor market showed signs of softening in November, with payrolled employment falling by -35k or -0.1% mom to 30.4m. Meanwhile, median monthly pay growth slowed to 6.3% yoy, down sharply from 7.9% yoy in the prior month.

In the three months to October, employment rate edged up by 0.1% to 74.9%, while the unemployment rate also increased slightly to 4.3%, up by 0.1%. Economic inactivity rate fell by -0.2% to 21.7%, suggesting some progress in bringing inactive workers back into the labor force.

Wage growth remained robust overall, with average earnings excluding bonuses rising 5.2% yoy in the three months to October, up from 4.9% yoy in the previous month. Including bonuses, average earnings also grew by 5.2% yoy, accelerating from 4.4% yoy. This uptick in earnings may keep pressure on BoE, as policymakers balance moderating inflation with still-elevated wage growth.

Australia Westpac consumer sentiment falls as economic outlook worsens

Australian Westpac Consumer Sentiment Index declined -2.0% mom to 92.8 in December. The drop was driven by a sharp deterioration in economic expectations. The economic outlook, next 12 months sub-index fell -9.6% mom to 91.2, while the economic outlook, next 5 years dropped -7.9% to 95.9 mom, erasing nearly half of the gains from the past two months.

Westpac noted that while RBA has expressed growing confidence in inflation returning to its 2-3% target range, the latest sentiment data highlights lingering consumer uncertainty. Concerns about labor market slack and weak productivity growth continue to complicate the inflation outlook.

Looking ahead, RBA is expected to maintain its current policy stance at its February meeting, absent a significant downside surprise in inflation. Westpac anticipates the easing cycle will begin in May 2025, once clearer evidence of slowing inflation and stable labor conditions emerges.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.4217; (P) 1.4244; (R1) 1.4272; More…

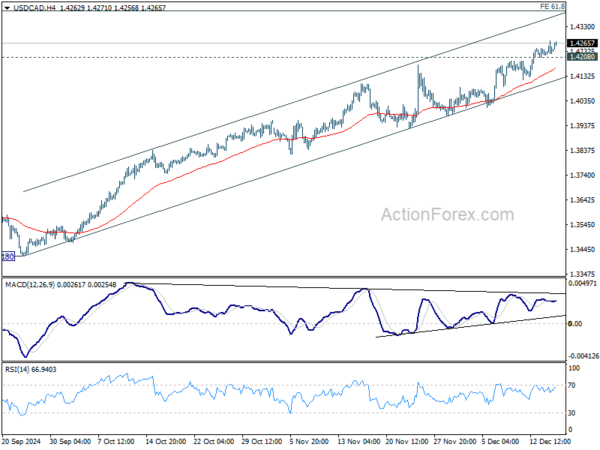

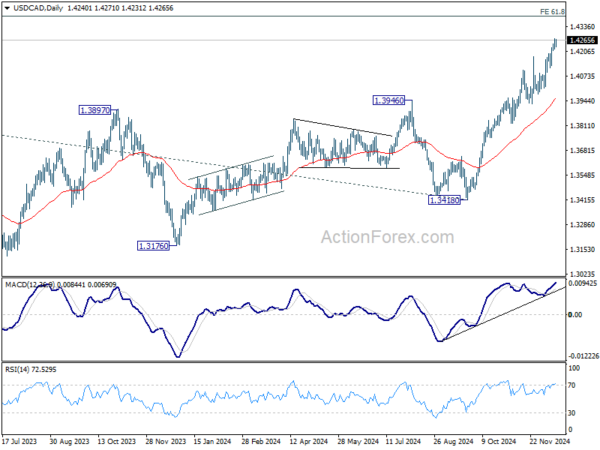

USD/CAD’s up trend continues today and intraday bias stays on the upside. Next target is 1.4391 projection level. On the downside, break of 1.4208 minor support will turn intraday bias neutral again first, and bring deeper pull back to channel support (now at 1.4114). Considering bearish divergence condition in 4H MACD, firm break of the channel support will indicate short term topping and bring deeper correction.

In the bigger picture, up trend from 1.2005 (2021) is in progress. Next target is 61.8% projection of 1.2401 to 1.3976 from 1.3418 at 1.4391. Medium term outlook will remain bullish as long as 55 W EMA (now at 1.3706) holds, even in case of deep pullback.