Euro continues to trade on the softer side in an otherwise directionless market. Yet it’s holding above its low against Dollar, lacking sufficient momentum for a decisive breakout. Market participants and ECB policymakers are grappling with critical questions regarding the pace at which interest rates should be reduced towards neutral, and whether the terminal rate in this easing cycle might dip below that neutral point. These deliberations are complicated by differing views within the ECB.

On one side, dovish members are voicing concerns about the risks of inflation undershooting, advocating for a more aggressive easing to prevent economic downturn. Conversely, hawkish policymakers are downplaying these risks, cautioning against premature easing that could reignite inflationary pressures.

Ultimately, barring any significant external shocks such as geopolitical escalations, the path of inflation will hinge on the duration and depth of the economic slowdown in the Eurozone. In this context, the upcoming release of the Eurozone PMI data tomorrow is highly anticipated, as it may provide clearer insights into economic activity, and could potentially catalyze more pronounced movements in Euro.

In the broader currency market, Japanese Yen is currently the weakest performer of the week. Dollar and Euro are also underperforming. In contrast, Canadian Dollar leads the major currencies, partly supported by stronger-than-expected CPI data released this week. Australian Dollar follows as the second-strongest currency, with Swiss Franc also showing resilience. New Zealand Dollar and British Pound are positioned in the middle of the performance spectrum.

Technically, Bitcoin’s up trend is picking up momentum ahead today, and breaks to new record high. For now, near term outlook will stay bullish as long as 88712 support holds. Next target is 100% projection of 24896 to 73812 from 52703 at 10619. Firm break there will pave the way to 138.2% projection at 12304 next.

In Asia, at the time of writing, Nikkei is down -0.86%. Hong Kong HSI is down -0.13%. China Shanghai SSE is down -0.10%. Singapore Strait Times is up 0.11%. Japan 10-year JGB yield is up 0.0136 at 1.083. Overnight, DOW rose 0.32%. S&P 500 rose 0.00%. NASDAQ fell -0.11%. 10-year yield rose 0.027 to 4.406.

Fed’s Bowman flags inflation risks as progress stalls amid tight labor market

Fed Governor Michelle Bowman expressed concerns over the recent slowdown in inflation reduction efforts, emphasizing that while there has been “considerable progress in lowering inflation since early 2023,” this progress “seems to have stalled in recent months.”

While acknowledging the complexity of monetary policy decisions, Bowman expressed particular concern about the price stability side of the Fed’s dual mandate, given that unemployment remains at historically low levels. “I see greater risks to the price stability side of our mandate, especially while the labor market remains near full employment,” she said in a speech.

Bowman is known for her hawkish stance on monetary policy. In September FOMC meeting, she dissented from the majority decision to cut rates by 50bps, advocating instead for a smaller 25bps reduction. Her comments reinforce her cautious approach toward easing monetary policy further, especially given the risks of persistent inflation in a strong labor market.

Fed’s Cook confident inflation moving toward target

Fed Governor Lisa Cook said in a speech that the US economy is in a “good position”. She remains “confident” that inflation is moving sustainably toward Fed’s 2% objective, while acknowledging that the path may be “occasionally bumpy.” Cook observed that employment risks are weighted to the downside but have “diminished somewhat” in recent months.

Cook reiterated that the direction for monetary policy remains “downward” but stressed that the “magnitude and timing of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Highlighting the need for flexibility, she emphasized that monetary policy is not on a “preset course” and that she is prepared to respond to changing conditions.

Fed’s Collins: Additional policy easing required, final destination still uncertain

Boston Fed President Susan Collins stated in a speech that “additional policy easing is needed” as monetary policy remains “at least somewhat restrictive.”

She acknowledged that the “final destination” of policy adjustments is “uncertain”, and emphasized the importance of a “careful and deliberate” approach. FOMC should take the time to “holistically assess” data and evaluate its implications for the economic outlook and balance of risks.

Collins described the economy as being in a “good place overall,” with inflation on track to return to Fed’s 2% target, albeit unevenly. She noted that while the labor market is healthy, job growth is becoming increasingly concentrated in fewer sectors. Collins warned that “any further slowing in hiring would be undesirable”.

ECB’s Stournaras: Avoiding inflation undershoot becoming policy priority

Greek ECB Governing Council member Yannis Stournaras emphasized at an event overnight that inflation in Eurozone is now projected to reach the 2% target “sooner than earlier expectations,” likely by early 2025 rather than the fourth quarter as previously anticipated. This shift suggests the ECB’s policy focus may increasingly pivot to ensuring “we don’t undershoot our inflation objective”.

Stournaras highlighted markets are “extremely sensitive” to disappointing growth readings. He warned, “If negative surprises for growth come in and we fail to unwind our restrictive monetary-policy stance at the appropriate pace, unnecessary market turbulence could be induced.”

While he acknowledged that the September inflation reading of 1.7% marked a success in controlling price pressures, he cautioned it should also serve as a “wake-up call.” Prolonged monetary restrictions, he warned, could risk “undershooting of our inflation target over the medium term and impede growth”.

BoE’s Ramsden supports gradual rate cuts, but highlights inflation undershooting risks

BoE Deputy Governor Dave Ramsden expressed support for the MPC’s cautious approach to easing interest rates, citing economic uncertainties tied to recent fiscal measures and labor market data. Ramsden emphasized the need for a “watchful and responsive” strategy given lingering questions about the effects of higher employer taxes and potential misrepresentations in labor statistics.

However, Ramsden suggested he might endorse a faster pace of rate cuts if uncertainties ease and disinflationary pressures become more evident. He noted, “Were those uncertainties to diminish and the evidence to point more clearly to further disinflationary pressures… then I would consider a less gradual approach to reducing Bank Rate to be warranted.”

BoE has projected that inflation will remain above its 2% target until early 2027, driven in part by fiscal stimulus and higher minimum wages under the Labour government. Ramsden acknowledged this scenario as “plausible” but also placed significant weight on an alternative outlook where inflation declines more quickly. This could occur through “more symmetry in wages and price setting, with less domestic inflationary pressure.”

Looking ahead, Ramsden predicted that employers are likely to implement pay settlements at the lower end of the 2–4% range, which could lead to inflation staying closer to 2% in the early part of the forecast period. However, under this scenario, inflation could dip “more materially later on, lower than in the MPC’s published forecasts,” he added.

Looking ahead

UK will release publis sector net borrowing in European session. Later in the day, Canada will release IPPI and RMPI. US will release jobless claims, Philly Fed survey, and existing home sales.

EUR/CHF Daily Outlook

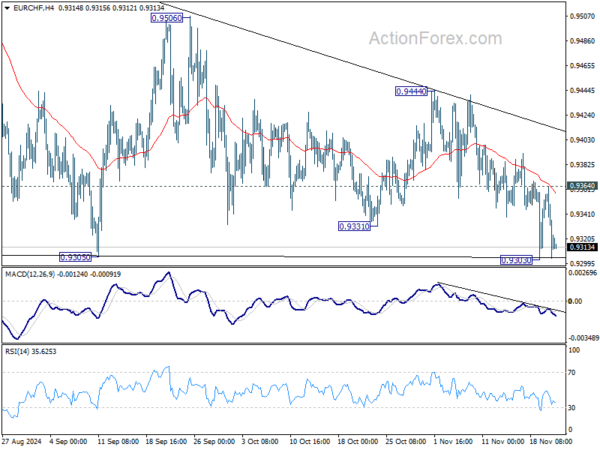

Daily Pivots: (S1) 0.9314; (P) 0.9341; (R1) 0.9376; More….

Intraday bias in EUR/CHF stays neutral first. On the downside, break of 0.9303 will revive the case that triangle consolidation pattern 0.9305 has already completed. Intraday bias will be back on the downside for retesting 0.9209 low next. For now, risk will stay on the downside as long as 0.9444 resistance holds, in case of another recovery.

In the bigger picture, fall from 0.9928 is seen as part of the long term down trend. Repeated rejection by 55 D EMA (now at 0.9408) keeps outlook bearish for breaking through 0.9209 low at a later stage. Nevertheless, sustained trading above 55 D EMA will confirm medium term bottoming at 0.9209 and bring stronger rebound back towards 0.9928 key resistance.