Euro is facing immense selling pressure today as US session commences, driven by both external trade concerns and internal political challenges in Germany. The market is wary of escalation in trade tensions with the US following Donald Trump’s election victory, with reports suggesting that Robert Lighthizer—a trade hawk known for his aggressive stance—could make a return as the US Trade Representative. Such a move signals a push for increased tariffs, raising fears of a “second round” of the trade war, which could place substantial pressure on Europe’s already sluggish economy.

Compounding these external risks, Germany is facing its own internal political crisis. Chancellor Olaf Scholz has indicated willingness to move up national elections after the collapse of his ruling coalition last week. This came following his dismissal of former Finance Minister Christian Lindner, triggering turmoil within the government. The prospect of a snap election adds a layer of uncertainty for Euro, as markets turn anxious about Germany’s future fiscal direction, given its role as the economic engine of the Eurozone.

Despite the Euro’s struggles, Yen remains the weakest currency today. Prime Minister Shigeru Ishiba managed to retain his position in a parliamentary vote but received only 221 votes, well below the required majority in the 465-seat legislature. Ishiba’s position is now precarious, heading a minority government that faces escalating trade threats from the US, along with heightened geopolitical challenges involving China and North Korea. This political instability could hinder BoJ’s ability to execute its planned policy tightening as the central bank deals with heightened uncertainty both at home and abroad.

Meanwhile, Dollar is so far the day’s strongest performer, though it remains below last week’s peak against all major currencies except the Euro and Swiss Franc, indicating restrained momentum. Australian and New Zealand Dollars follow the greenback as next strongest. British Pound and Canadian Dollar sit in the middle of the pack.

Technically, EUR/GBP’s down trend also picks up momentum today. Further fall should be seen to 61.8% projection of 0.8624 to 0.8294 from 0.8446 at 0.8242 and possibly below. The question remains on whether 0.8201 key support (2023 low) is strong enough to contain downside.

In Europe, at the time of writing, FTSE is up 0.68%. DAX Is up 1.45%. CAC is up 1.31%. UK 10-year yield is up 0.033 at 4.478. Germany 10-year yield is down -0.007 at 2.364. Earlier in Asia, Nikkei rose 0.08%. Hong Kong HSI fell -1.45%. China Shanghai SSE rose 0.51%. Singapore Strait Times rose 0.41%. Japan 10-year JGB yield fell -0.0045 to 1.001.

SNB’s Martin: Swiss Franc appreciation expected due to inflation differentials

SNB Vice President Antoine Martin conveyed a cautious stance on future monetary policy in an interview with Le Temps.

While SNB indicated at its September meeting the readiness to cut interest rates further, Martin stressed that “it’s not useful for central banks to lock themselves into forward-looking communications.”

He highlighted that “between now and the next decision, there may be changes in conditions that render current communications invalid,” This approach means SNB has made “absolutely no commitment” to a specific policy path.

Addressing the performance of Swiss Franc, Martin noted that its development this year has been “neither particularly surprising nor exceptionally problematic.”

He explained that due to the inflation differential between Switzerland and other countries, SNB expects Swiss Franc to “appreciate structurally over time in nominal terms.”

However, he pointed out that “in real terms, excluding the inflation effect, the appreciation has been limited.”

BoJ affirms core stance: Rate hikes to proceed gradually if economic outlook holds

BoJ’s Summary of Opinions from its October 30-31 reiterated its “basic thinking” that it will adjust the degree of monetary accommodation if the outlook for economic activity and prices unfolds as expected. Emphasizing the importance of “communicating effectively” this core message, BoJ aims to manage market expectations carefully.

One member indicated that if economic conditions progress as anticipated, BoJ could “raise the policy interest rate gradually,” reaching 1.0% in the second half of fiscal 2025 at the earliest.

Conversely, another member expressed caution, noting the difficulty in confidently conveying a medium-term policy rate path due to “high uncertainties” surrounding the neutral interest rate and the transmission mechanism of monetary policy.

RBNZ 1-yr inflation expectation down, 2-yr’s up

RBNZ’s latest Survey reveals that expectations for one-year-ahead annual inflation dropped significantly by -35 basis points from 2.40% to 2.05%, extending a steady downward trend in inflation expectations since Q2 2023. On the other hand, two-year inflation expectations inched up to from 2.03% 2.12% .

For wage inflation, one-year-ahead expectations decreased modestly by -7 basis points to 2.81%, while two-year projections rose from 2.86% to 3.16%.

Growth expectations improved. The mean one-year-ahead GDP growth expectation jumped by 61 basis points to 1.60%, with a smaller increase of 7 basis points for two-year growth expectations to 2.17%.

On the interest rate front, the survey points to further monetary easing ahead. OCR is expected to be 4.20% by the end of Q4 2024, with a sharper decline to 3.33% anticipated by Q3 2025. OCR is currently at 4.75% following a recent 50bps cut in October.

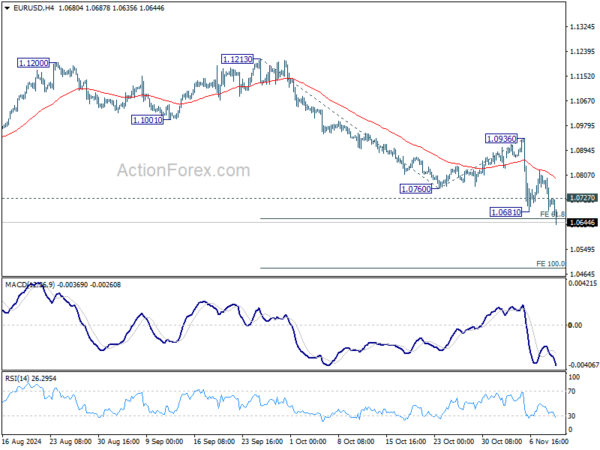

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0667; (P) 1.0738; (R1) 1.0788; More…

EUR/USD’s decline resumed by breaking through 1.0681 temporary low and intraday bias is back on the downside. Sustained trading below 61.8% projection of 1.1213 to 1.0760 from 1.0936 at 1.0656 will extend the fall from 1.1213 to 100% projection at 1.0483. On the upside, above 1.0727 minor resistance will turn intraday bias neutral first. But outlook will stay bearish as long as 1.0936 resistance holds.

In the bigger picture, price actions from 1.1274 (2023 high) are seen as a consolidation pattern to up trend from 0.9534 (2022 low), with fall from 1.1213 as the third leg. Downside should be contained by 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404, to bring up trend resumption at a later stage.