Global currency markets are treading water today, as all eyes turn to the US presidential election, where Kamala Harris and Donald Trump are in a dead heat. Adding to the suspense, the Congressional elections will determine the president’s ability to push policy forward effectively, making the stakes especially high. Given the close race and critical swing states, a definitive result on election night is unlikely, leaving markets in a state of “nervous calm” as they await clarity.

Australian and New Zealand Dollars stand out as the better performers today. Aussie, in particular, is supported by RBA’s steady stance with no dovish shift, as well as positive sentiment from an Asian stock market rebound. On the other hand, Dollar, Yen, and Canadian dollar lag behind. European majors are mixed while Sterling has a slight edge over Euro and Swiss Franc.

Looking ahead, New Zealand’s employment report in the upcoming Asian session could bring some volatility for Kiwi. The market expects a -0.5% contraction in Q3 employment and a rise in the unemployment rate from 4.6% to 5.0%. Earlier today, RBNZ flagged persistent downside risks for the economy in the Financial Stability Report. With a 50bps rate cut widely anticipated for the final meeting of the year on November 27, any downside surprise in employment data could raise the possibility of a more aggressive 75bps cut.

New Zealand employment data could be a mover for Kiwi in the upcoming Asian session. Employment is expected to contract -0.5% qoq in Q3 while unemployment rate jumped from 4.6% to 5.0%. RBNZ warned in today’s Financial Stability Report that households have reduced their discretionary spending and businesses have put investment plans on hold. While business confidence is recovering as inflation and interest rates fall, significant further weakening in the economy remains a risk. Markets are expecting another 50bps rate cut at the final rate decision of the year on Nov. 27. But any downside surprise tomorrow could prompt RBNZ to rethink whether to cut deeper by 75bps.

Technically, NZD/USD turned into consolidation after falling to 0.5939 last week. While further recovery cannot be ruled out, outlook will stay bearish as long as 55 D EMA (now at 0.6091) holds. Break of 0.5939 will resume the fall form 0.6378 to 0.5849 support, or even further to 0.5771 (2023 low).

In Europe, at the time of writing, FTSE is down -0.16%. DAX is up 0.21%. CAC is up 0.20%. UK 10-year yield is up 0.0467 at 4.504. Germany 10-year yield is up 0.031 at 2.424. Earlier in Asia, Nikkei rose 1.11%. Hong Kong HSI rose 2.14%. China Shanghai SSE rose 2.32%. Singapore Strait Times rose 0.27%. Japan 10-year JGB yield fell -0.0162 to 0.929.

UK PMI services finalized at 52.0, sector slows on policy uncertainty

UK PMI Services as finalized at 52.0, down from September’s 52.4 and marking the lowest level since November 2023. PMI Composite similarly slipped to 51.8, a decline from 52.6 the previous month, also the lowest since last November.

According to Tim Moore, Economics Director at S&P Global Market Intelligence, the delay in policy clarity ahead of the Autumn Budget created a “wait-and-see” atmosphere, dampening business confidence and spending. Added to this were broader geopolitical uncertainties and anticipation of the US election, both contributing to businesses holding back on investment decisions.

Higher wages contributed to another month of strong input cost inflation, which rose to a three-month high but remained lower than in early 2024. Nevertheless, Moore noted that output charge inflation stayed near the 43-month low observed in September, continuing the “longer-term trend of decelerating price pressures”.

RBA stands pat, still not ruling anything in or out

RBA maintained its cash rate at 4.35% today, as expected, while underscoring that inflation risks remain a concern. In its statement, RBA noted that although headline inflation has declined and is projected to stay lower in the short term, it considers underlying inflation as “more indicative” of inflation trends, and this measure remains “too high.”

In line with this cautious approach, the emphasized the need to remain “vigilant to upside risks to inflation,” signaling flexibility by reiterating that it is “not ruling anything in or out.” The ’s latest economic projections offer a more tempered outlook, with slight downward adjustments to growth and inflation forecasts, pointing to persistent caution amid moderated expectations.

Key revisions in the RBA’s projections include:

- Year-average GDP growth: 2024 unchanged at 1.2%, but lowered for 2025 from 2.5% to 2.2% and for 2026 from 2.4% to 2.3%.

- Year-ended CPI: Forecast for December 2024 is revised down from 3.0% to 2.6%, with December 2025 held steady at 3.7%, and December 2026 slightly reduced from 2.6% to 2.5%.

- Trimmed mean inflation: Forecast for December 2024 lowered from 3.5% to 3.4%, with additional downgrade for December 2025 from 2.9% to 2.8%, and December 2026 from 2.6% to 2.5%.

These adjustments reflect an outlook of moderated economic growth and slightly eased inflation pressures. However, RBA’s flexible stance indicates it is prepared to act if inflation risks become more pronounced, balancing economic stability with its inflation objectives.

China’s Caixin PMI composite rises to 51.9, policy impact begins to show

China’s Caixin Services PMI rose to 52.0 in October, surpassing expectations of 50.5 and marking the highest rate of growth in three months. The services sector continues its expansionary streak that began in January 2023. PMI Composite also increased from 50.3 to 51.9, its highest level in four months, maintaining expansion for the 12th consecutive month, driven largely by service-sector resilience.

Wang Zhe, Senior Economist at Caixin Insight Group noted that challenges noted that a range of supportive policies has since been introduced by the Politburo since September. The recent Caixin PMI readings for both manufacturing and services suggest that “market demand stabilized and optimism improved,” signaling early effects of the new policies.

USD/JPY Mid-Day Outlook

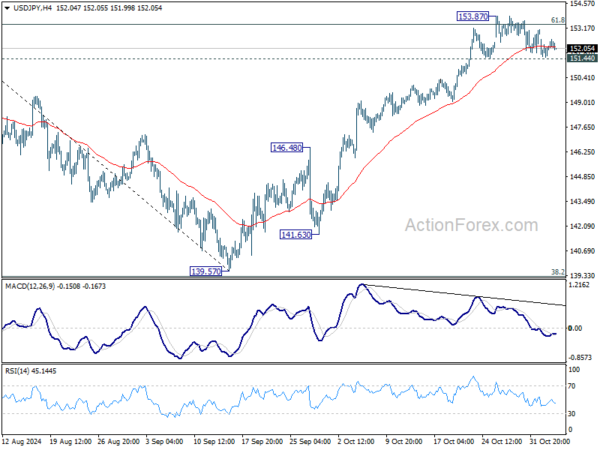

Daily Pivots: (S1) 151.59; (P) 152.08; (R1) 152.62; More…

USD/JPY is still bounded in consolidation below 153.87 and intraday bias stays neutral. Further rally is in favor with 151.44 support intact. Sustained trading above of 61.8% retracement of 161.94 to 139.57 at 153.39 will pave the way to retest 161.94 high. However, considering bearish divergence condition in 4H MACD, firm break of 151.44 will indicate short term topping, and turn bias back to the downside for 55 D EMA (now at 149.08).

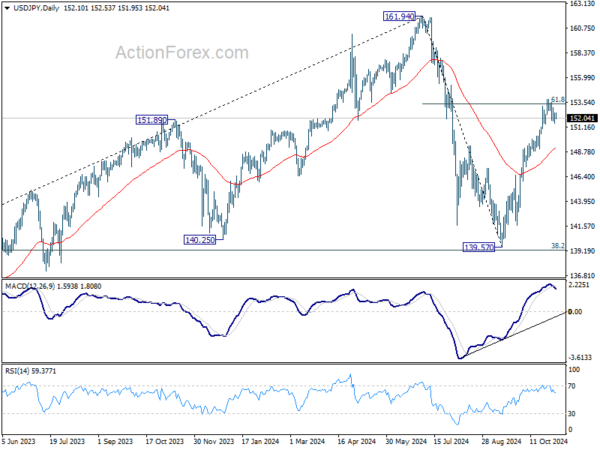

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low). The range of medium term consolidation should be set between 38.2% retracement of 102.58 to 161.94 at 139.26 and 161.94. Nevertheless, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.