Dollar remains the weakest currency in the lead-up to the US presidential election, though its downside appears contained as early selling momentum in Asia has not extended into European session. Safe-haven currencies, led by the Swiss Franc and Yen, are gaining as US and European Treasury yields retreat. Among other currencies, Sterling and Loonie are also lagging behind, although overall market indecisiveness keeps most major pairs within Friday’s trading range.

While the US election remains the primary focus, attention is also turning to RBA’s rate decision in the upcoming Asian session. The central bank is widely expected to hold rates at 4.35%, with virtually no expectation for any surprises. Market participants will be watching closely for any changes in RBA’s language that might hint at future policy easing, particularly any shift from the “not ruling anything in or out ” stance, which could set a clearer tone for policy easing in 2025. The release of new economic projections will also be key in gauging RBA’s outlook.

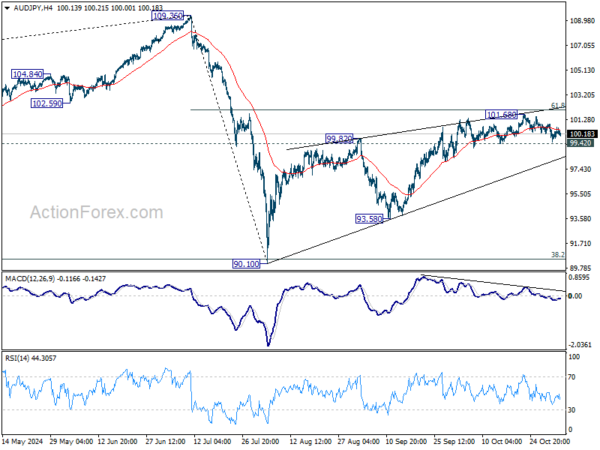

Technically, a short term top was in place at 101.68 in AUD/JPY, on bearish divergence condition in 4H MACD, ahead of 61.8% retracement of 109.36 to 90.10 at 102.02. Firm break of 99.42 support will argue that corrective rise from 90.10 has completed with three-waves up to 101.68. The third leg of the pattern from 109.36 might have then commenced. Next target will be 90.10/93.58 support zone in the near term.

In Europe, at the time of writing, FTSE is up 0.62%. DAX is down -0.06%. CAC Is up 0.12%. UK 10-year yield is down -0.018 at 4.442. Germany 10-year yield is down -0.006 at 2.404. Earlier in Asia, Japan was on holiday. Hong Kong HSI rose 0.30%. China Shanghai SSE rose 1.17%. Singapore Strait Times rose 0.47%.

Eurozone Sentix investor confidence rises slightly to -12.8, inflation fears resurface

Eurozone Sentix Investor Confidence index showed modest improvement, rising from -13.8 to -12.8 in November, though it fell just short of the anticipated -12.7. Current Situation index also moved up slightly from -23.3 to -21.5, while the Expectations index held steady at -3.8.

Sentix noted that Germany continues to be the “problem child” of the Eurozone, with ongoing economic struggles that have drawn widespread media attention. However, investors remain largely unfazed by these issues, showing limited reaction to the concerns surrounding Germany’s economic policy.

Meanwhile, inflationary concerns have re-emerged, with Sentix highlighting a significant drop in its “Inflation” theme barometer from +11 to -12.25—the lowest reading since July 2023.

This slump underscores a difficult situation for ECB. A struggling economy would typically benefit from more accommodative monetary policy, but inflationary pressures could restrict the ECB’s ability to cut rates further.

Eurozone PMI manufacturing finalized at 46 in Oct, intense competition pressures margins

Eurozone manufacturing showed mild signs of stabilization in October, with PMI Manufacturing index finalizing at 46.0, up from September’s 45.0. This marks a slight improvement, but activity remains firmly in contraction.

By country, Spain led the group with a PMI Manufacturing of 54.5, a 32-month high, followed by Ireland at 51.5 and Greece at 51.2. In contrast, the Netherlands and Austria reported significant declines, with PMIs at 47.0 and 42.0 respectively. Germany saw a modest rise to 43.0, marking a three-month high but still in contraction territory, while France’s index held steady at 44.5, a two-month low.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, commented that while the manufacturing recession “did not deepen further” in October, challenges persist. Production and new orders both declined at a slower rate, leading to a Q4 GDP Nowcast indicating a -0.1% contraction in industrial output.

The environment remains “deflationary,” benefiting purchasing departments with lower input costs but intensifying competitive pressures, particularly with firms passing on price reductions to customers. De la Rubia noted that this “fierce competition,” likely amplified by competition from China, is squeezing profit margins across the sector.

RBNZ flags geopolitical risks as key threat to New Zealand’s financial stability

RBNZ highlighted significant geopolitical risks as a major concern for New Zealand’s financial stability in a pre-release of findings from its upcoming Financial Stability Report. Key threats stem from global tensions involving Russia, China, and the Middle East, which RBNZ may incorporate into next year’s solvency stress test.

RBNZ noted that in some scenarios, “global supply chains were disrupted,” triggering renewed inflationary pressures and elevated interest rates. The report mentions a “more extreme scenario” involving a conflict in the Asia-Pacific region with one or more of New Zealand’s key trading partners. This may allude to risks of a major disruption if China attempts to assert territorial claims in the South China Sea or to use force in the Taiwan Strait.

Kerry Watt, RBNZ’s Director of Financial Stability Assessment & Strategy, commented on the increased “concern about geopolitical tension,” emphasizing that “as a small open economy, dependent on international trade and investment, geopolitical risks are clearly relevant to our financial system. Their potential impacts cannot be underestimated.”

EUR/USD Mid-Day Outlook

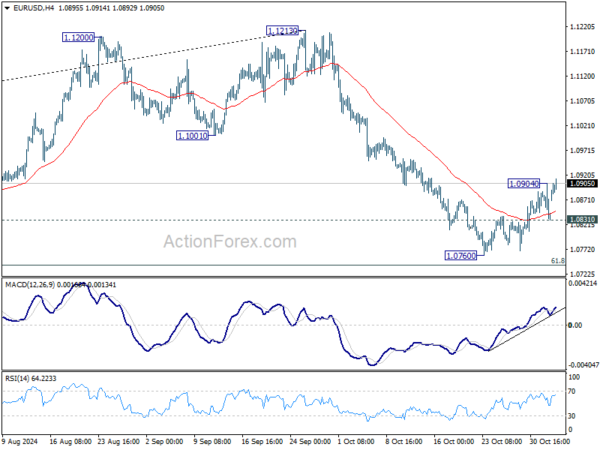

Daily Pivots: (S1) 1.0809; (P) 1.0857; (R1) 1.0883; More…

Intraday bias in EUR/USD is back on the upside as rebound from 1.0760 short term bottom resumed. Further rise would be seen to 55 D EMA (now at 1.0940). Strong resistance should be seen there to limit upside. On the downside, below 1.0831 minor support will bring retest of 1.0760 first, and then 61.8% retracement of 1.0447 to 1.1213 at 1.0740.

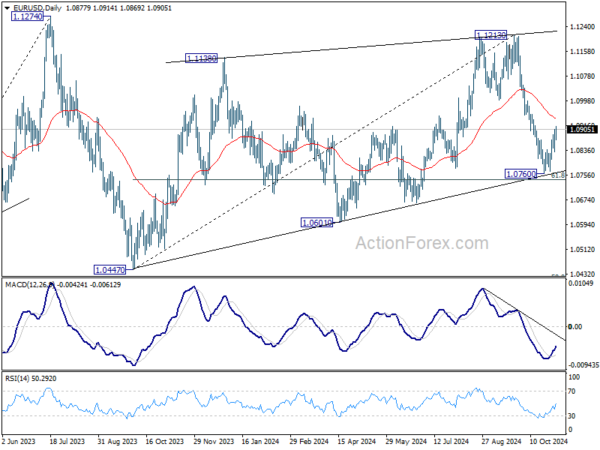

In the bigger picture, price actions from 1.1274 (2023 high) are seen as a consolidation pattern to up trend from 0.9534 (2022 low), with fall from 1.1213 as the third leg. Downside should be contained by 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404, to bring up trend resumption at a later stage.