Australian Dollar’s misery continues today, firstly pressured by Q3 inflation data that showed encouraging progress on disinflation. This development has strengthened the case for RBA to keep interest rates unchanged at 4.35% in its upcoming meeting next week. More importantly, a rate cut in February now appears more probable than ever.

While there are some speculations about a possible cut as early as December, persistent inflation in the services sector suggests that RBA would prefer to wait for additional data before easing monetary policy. The Commonwealth Bank, previously the only one among Australia’s big four banks forecasting a December rate cut, has today adjusted its expectation to February, aligning with Westpac, NAB, and ANZ.

Further weighing on the Aussie is ongoing weakness in Chinese and Hong Kong stock markets. Reports from Reuters yesterday indicate that China’s top legislative body may unveil a substantial CNY 10T (USD 1.4T) stimulus package next week. This announcement, timed around the US presidential election on November 5, could allow for strategic adjustments to the stimulus plan based on the election’s outcome. However, market enthusiasm has remained muted, without doubt on the details and effectiveness of the new fiscal measures.

Overall for the week so far, Aussie remains at the bottom. Yen follows as hampered by political uncertainty stemming from Japan’s recent elections, which have left the formation of a coalition government unresolved. Kiwi is also under pressure due to concerns about China’s economic outlook and speculation that RBNZ may implement a larger-than-expected rate cut at its next meeting. On the other hand, Euro and Pound are holding modest gains over Dollar at the top, but both currencies are only consolidating recent losses within tight ranges. Swiss Franc and Loonie occupy middle positions.

Looking ahead, as we move into a data-heavy session, the market is bracing for a series of key economic releases that could introduce significant volatility, including Eurozone GDP, US GDP and ADP private employment. Technically, near term outlook in EURUSD will stay bearish as long as 1.0871 resistance holds. Fall from 1.1213 is seen as the third leg of the corrective pattern from 1.1274. Sustained break of 61.8% retracement of 1.0447 to 1.1213 at 1.0740 will pave the way to 1.0601 support and below.

In Asia, at the time of writing, Nikkei is up 1.02%. Hong Kong HSI is down -1.90%. China Shanghai SSE is down -1.00%. Singapore Strait Times is down -0.87%. Japan 10-year JGB yield is down -0.0088 at 0.968. Overnight, DOW fell -0.36%. S&P 500 rose 0.16%. NASDAQ rose 0.78%. 10-year yield fell -0.004 to 4.274.

Australia’s Q3 CPI slows to 2.8% yoy, goods prices fall but services edge higher

Australia’s Q3 CPI came in softer than anticipated, with consumer prices rising just 0.2% qoq, down from 1.0% qoq in Q2 and below expectations of 0.3% qoq. This marks the lowest quarterly increase since Q2 2020.

On an annual basis, CPI slowed from 3.8% yoy to 2.8% yoy, comfortably returning to RBA’s target range of 2-3% and registering the lowest year-over-year inflation rate since Q1 2021.

Core inflation, measured by trimmed mean CPI, showed resilience with a 0.8% qoq rise, down from Q2’s 0.9% qoq, but slightly above the expected 0.7% qoq. Annually, trimmed mean CPI slowed from 3.9% yoy to 3.5% yoy, aligning with market expectations.

The breakdown shows a notable shift in price pressures: annual goods inflation dropped sharply from 3.2% yoy to 1.4% yoy, largely due to substantial declines in electricity and fuel costs. However, services inflation edged up slightly from 4.5% yoy to 4.6% yoy, driven by higher costs in rents, insurance, and child care.

September monthly CPI echoed this trend, slowing significantly from 2.7% yoy to 2.1% yoy, undershooting expectations of 2.3% and marking the smallest annual increase since July 2021.

This softer inflation data should provide the RBA with room to consider easing its policy stance in the coming months, should inflation remain within target.

BoC’s Macklem signals more rate cuts as Canada returns to low inflation

Addressing the House of Commons Standing Committee on Finance, BoC Governor Tiff Macklem explained the rationale behind last week’s 50bps rate cut, highlighting that “inflation is now back to the 2% target”. He emphasized that Canada is now in a period of “low inflation,” and the bank’s priority is to “maintain low, stable inflation” and successfully “stick the landing.”

Macklem noted that the rate cut is also intended to “contribute to a pickup in demand” in an economy that remains “soft.” Looking forward, BoC anticipates a “gradual” strengthening of the Canadian economy in 2025 and 2026, supported by lower interest rates.

If economic conditions align with the bank’s outlook, Macklem anticipates “cutting our policy rate further” to sustain demand and stabilize inflation around target.

However, he clarified that decisions on timing and scale will be data-driven, with BoC will take monetary policy decisions “one at a time”.

SNB’s Schlegel signals more rate cuts to support price stability amid muted growth outlook

SNB Chair Martin Schlegel indicated that “further interest rate reductions” might be necessary in the coming quarters to uphold “price stability” over the medium term.

At an event overnight, Schlegel highlighted that SNB’s current priority is to “normalize monetary policy” carefully, ensuring it does not become “too restrictive.”

Looking at the inflation outlook, Schlegel shared an optimistic view, noting that SNB’s forecasts show inflation remaining within “the area of price stability” in the long term. SNB projects average inflation rates of 1.2% for 2024, followed by 0.6% in 2025, and 0.7% in 2026.

However, the economic growth forecast remains modest, with Swiss GDP expected to grow about 1% this year. Schlegel cautioned that growth will likely be “muted” over the next few quarters, though he anticipates a “step-by-step improvement” in the medium term.

Looking ahead

EUrozone GDP flash is the main focus in European session. Germany CPI flash, Swiss KOF economic barometer and UBS economic expectations will also be release. Later in the day, US will publish ADP employment and Q3 GDP advance.

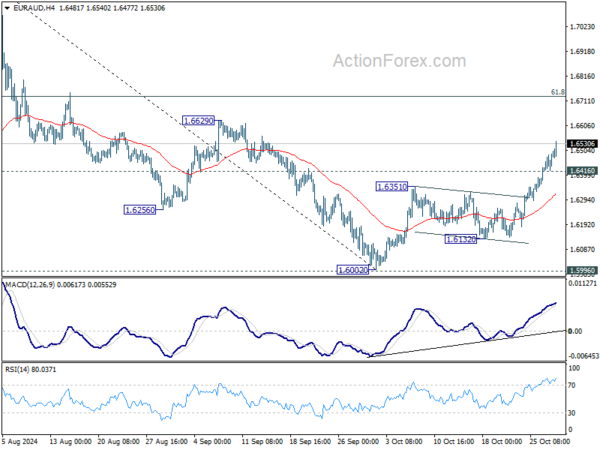

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6431; (P) 1.6466; (R1) 1.6525; More…

Intraday bias in EUR/AUD remains on the upside as rise from 1.6002 is extending. Current development suggest that fall from 1.7180 has completed with three waves down to 1.6002, after being supported by 1.5996. Further rally should be seen to 61.8% retracement of 1.7180 to 1.6002 at 1.6730 next. On the downside, below 1.6146 minor support will turn intraday bias neutral and bring consolidations first.

In the bigger picture, as long as 1.5996 cluster support holds (38.2% retracement of 1.4281 to 1.7062 (2023 high) at 1.6000), up trend from 1.4281 (2022 low) is still expected to resume at a later stage. However, decisive break of 1.5996 will argue that the medium term trend has reversed and turn outlook bearish.