Dollar has started to ease after a strong rally this week, alongside US Treasury yields. While the greenback is consolidating gains against European majors and Yen, there’s little indication of a substantial pullback for now. Against commodity currencies, Dollar still holds potential for additional gains. Still, traders may avoid large moves ahead of the weekly close, aiming to lock in recent gains.

For the week so far, Dollar is maintaining its lead as the strongest currency, trailed by Swiss Franc and Canadian Dollar. Meanwhile, Yen remains under pressure, particularly with no strong signs of a bounce back before Japan’s snap elections on Sunday. New Zealand and Australian Dollars have also struggled amid weaker risk sentiment, and both may face further downside. Euro and Pound maintain middle-ground performance.

Technically, Gold’s up trend stalled after hitting 100% projection of 1984.05 to 2449.83 from 2293.45 at 2759.23. Break of 2685.43 resistance turned support will confirm short term topping, and bring pullback towards 55 D EMA (now at 2596.31). Nevertheless, sustained break of 2759.23 will pave the way to 161.8% projection at 3047.82.

In Asia, at the time of writing, Nikkei is down -0.95%. Hong Kong HSI is up 1.10%. China Shanghai SSE is up 0.75%. Singapore Strait Times is down -0.60%. Japan 10-year JGB yield is down -0.0065 at 0.951. Overnight, DOW fell -0.33%. S&P 500 rose 0.21%. NASDAQ rose 0.76%. 10-year yield fell -0.0420 to 4.200.

BoJ’s Ueda signals no immediate rate hike

BoJ Governor Kazuo Ueda indicated that the central bank is not in a hurry to adjust its monetary policy, stating after the G20 meeting in Washington, “I believe we have enough time” to make a decision. This suggests that BoJ will refrain from hiking interest rates in its upcoming meeting next week.

Ueda emphasized the importance of considering the broader economic context, including the effects of the weak Yen and uncertainties surrounding the US economy, which may be influenced by the upcoming US presidential election.

During the same press conference, Japan’s Finance Minister Katsunobu Kato reiterated concerns over Yen’s high volatility. He highlighted the need for close attention to fluctuations in the foreign exchange market.

Tokyo CPI core dips to 1.8% in Oct on lower energy prices

Japan’s Tokyo CPI core (excluding food) dropped from 2.0% yoy to 1.8% yoy in October, slightly above market expectations of 1.7%. This marks the first time in five months that inflation has dipped below BoJ’s 2% target. Headline CPI also slowed from 2.1% yoy to 1.8% yoy.

The deceleration was largely driven by a slowdown in energy prices, with government subsidies for energy costs contributing to a 0.51 percentage point reduction in the overall index.

Despite this, underlying inflationary momentum ticked up, as core-core CPI (excluding food and energy) rose from 1.6% yoy to 1.8% yoy. Services prices also saw an uptick, increasing by 0.8% yoy compared to 0.6% yoy in the prior month.

Looking ahead

German Ifo business climate is the main feature in European session, while Eurozone will release M3 money supply. Later in the day, Canada will publish retail sales and new housing price index. US will release durable goods orders.

AUD/USD Daily Report

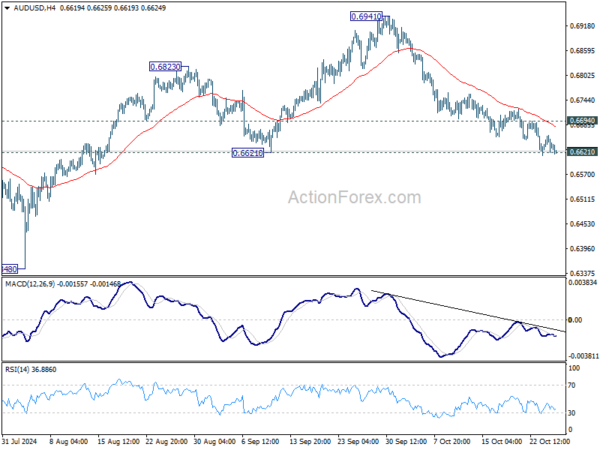

Daily Pivots: (S1) 0.6620; (P) 0.6641; (R1) 0.6660; More...

Intraday bias in AUD/USD remains on the downside for the moment. Firm break of 0.6621 support should confirm near term bearish reversal after topping at 0.6941. Deeper decline should then be seen to 0.6348 support next. On the upside, above 0.6694 minor resistance will turn intraday bias neutral first.

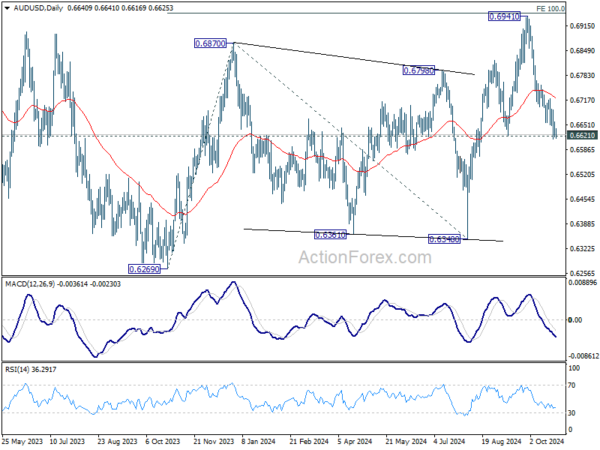

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern, with rise from 0.6269 as the third leg. Firm break of 100% projection of 0.6269 to 0.6870 from 0.6340 at 0.6941 will target 138.2% projection at 0.7179. However, sustained break of 0.6621 support will argue that rise from 0.6269 has completed and bring deeper fall back to 0.6269/6348 support zone.