Yen surges broadly today on risk aversion as global equity markets suffer heavy selloff. At the time of writing, FTSE is trading down -0.5%, DAX down -1% while CAC is down -0.5%. DOW futures also point to triple digit loss. That followed -1.57% fall in Nikkei earlier. The correction in oil price is seen as a key facto that drives stocks down. WTI crude oil is trading at around 55, after dipping to 54.97, comparing to last week’s high at 57.92. Euro remains generally firm and accelerates against Dollar, as supported by optimistic economic outlook. But the common currency is overwhelmed by Yen. Meanwhile, Aussie remains the weakest one today as weighed down by weak wage growth. Canadian Dollar follows as weighed down by oil. Dollar is trading as the third weakest, and it could try to recover on slightly higher than expected core CPI reading. But it’s not showing any strong sign of rebound yet.

Crude oil tumbles as IEA lowered demand forecast

Correction in oil price is a key factor in driving the global equity rout. The Paris-based International energy Agency (IEA) unveiled in the monthly report that it has lowered the global oil demand growth forecast, by -0.05M bpd, to 1.5M bpd for this year. For 2018, the agency projects the demand would expand 1.3M bpd, down -0.19M bpd from last months’ forecast for 2018. As a result, oil demand would reach 97.7M bpd this year and 98.9M bpd in 2018. It warned that the market might be oversupplied in 4Q17. While the market has used the downgrades as an excuse to lighten their long positions in oil and noted that the IEA has "poured cold water" on OPEC’s upgrades on oil demand, one should note that IEA’s demand forecasts for both this year and 2018 remain higher than OPEC’s (2017: 96.9M bpd; 2018: 98.5M bpd), despite the downward revisions.

US core CPI accelerated, other data mixed

US headline CPI rose 0.1% mom, 2.0% yoy in October, slowed from 0.5% mom, 2.2% yoy but met expectation. Core CPI rose 0.2% mom 1.8% yoy, up from September’s 0.1% mom 1.7% yoy. The annual reading also beat expectation at 1.7% yoy. Headline retail sales rose 0.2% in October, above expectation of 0.0%. But ex-auto sales rose 0.1%, missed expectation of 0.2%. Empire state manufacturing index dropped to 19.4 in November, below expectation of 25.0. While some Fed officials expressed concern on sluggish inflation, the pickup in core CPI should keep Fed on track for a December hike.

Fed doves showed concerns on inflation

Chicago Fed President Charles Evans expressed his concerns on inflation. He said that "when I look at the downward drift in multiple expectations measures, I find it tougher to confidently buy into the idea that inflation today is just temporarily low once again." And he urged his fellow Fed official that "our public commentary needs to acknowledge a much greater chance of inflation running at 2-1/2 percent in the coming years than I believe we have communicated in the past." Nonetheless, he remain optimistic on the economy and expects "continued solid growth" in 2018.

St. Louis Fed President James Bullard said yesterday that "inflation data during 2017 have surprised to the downside and call into question the idea that U.S. inflation is reliably returning toward target." And he warned that "the main concern I would have is that we raise rates in December and inflation expectations fall… which would in my view be a vote of no confidence from markets."

UK employment suffered worst contraction since 2015

UK claimant counts rose 1.1k in October, better than expectation at 2.4k. Claimant count rate was unchanged at 2.3%. ILO unemployment rate was unchanged at 4.3%, in line with consensus. Average weekly earnings rose 2.2% 3moy, slightly higher than expectation of 2.1% 3moy. Considering that CPI stood at 3.1% in October, real wage was indeed in decline and continued to squeeze household spending power. Overall employment dropped -14k in the three months to September. The contraction is the worst since 2015 and raised concerned that Brexit is hurting the labor market. Both job and wage data affirms the general view that BoE is no where near another rate hike and could only move a year from now.

Australian wage growth missed expectations

Australia wage price index rose 0.5% qoq in Q3, unchanged from quarter’s figure and missed expectation of 0.7% qoq. Annually, wage grew 2.0% yoy, also missed expectation of 2.2% yoy. Growth in wage was driven by end of financial year salary reviews as well as the annual minimum wage review. The 3.3% rise in minimum wage already boosted quarterly wage growth by 0.2%. Hence, considering all factors, wage growth was like non-existent in the September quarter. And that clearly support RBA’s neutral stance to divergence from global monetary tightening and stands pat ahead. Also from Australia, Westpac consume confidence dropped -1.7% in November.

Yen surges on Japan GDP miss

Japan GDP grew 0.3% qoq in Q3, below expectation of 0.4% qoq. That’s also just half of prior quarter’s 0.6% qoq. Nonetheless, that’s still the second straight quarter of growth, held by exports as global economy recovers. GDP deflator rose 0.1% yoy, in line with consensus.

USD/JPY Mid-Day Outlook

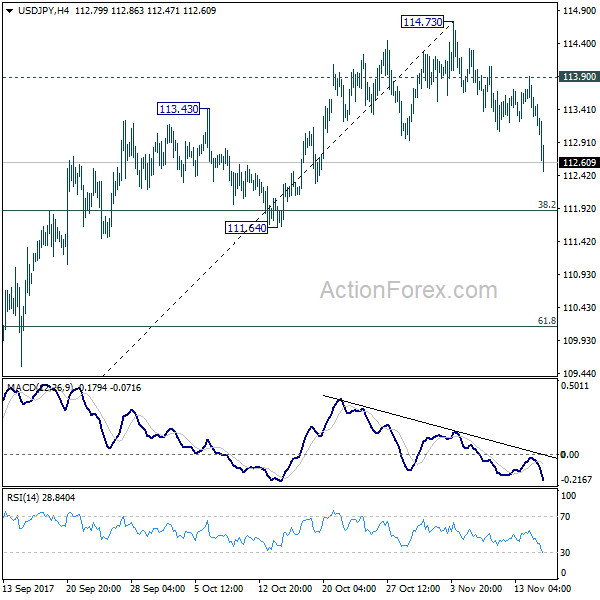

Daily Pivots: (S1) 113.19; (P) 113.55; (R1) 113.80; More…

USD/JPY’s drops to as low as 112.47 so far today. The strong break of 112.95 support should confirm rejection from 114.49 key resistance. Intraday bias is turned back to the downside for 38.2% retracement of 107.31 to 114.73 at 111.89 first. Sustained break of 111.64 support will now argue that rise from 107.31 has completed. In that case, USD/JPY should target 61.8% retracement at 101.14. On the upside, break of 113.90 resistance is needed to confirm completion of the fall. Otherwise, near term outlook will now stay cautiously bearish.

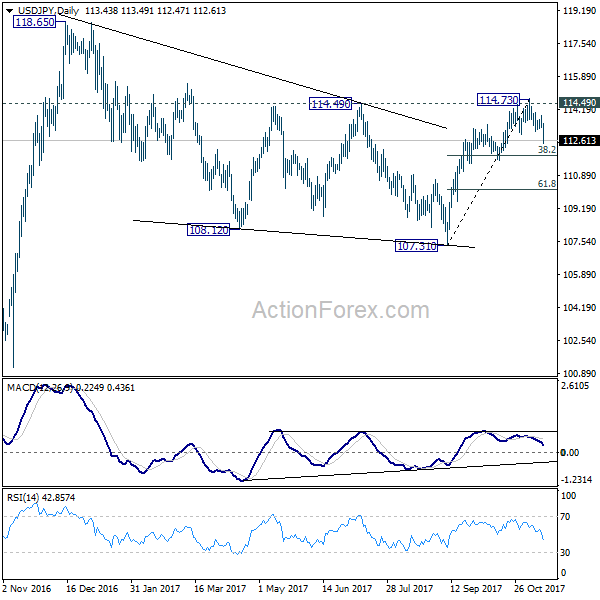

In the bigger picture, medium term rise from 98.97 (2016 low) is not completed yet. It should resume after corrective fall from 118.65 completes. Break of 114.49 resistance will likely resume the rise to 61.8% projection of 98.97 to 118.65 from 107.31 at 119.47 first. Firm break there will pave the way to 100% projection at 126.99. This will be the key level to decide whether long term up trend is resuming. However, firm break of 111.64 support will dampen this view and turn focus back to 107.31 instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Nov | -1.70% | 3.60% | ||

| 23:50 | JPY | GDP Q/Q Q3 P | 0.30% | 0.40% | 0.60% | |

| 23:50 | JPY | GDP Deflator Y/Y Q3 P | 0.10% | 0.10% | -0.40% | |

| 00:30 | AUD | Wage Price Index Q/Q Q3 | 0.50% | 0.70% | 0.50% | |

| 04:30 | JPY | Industrial Production M/M Sep F | -1.00% | -1.10% | -1.10% | |

| 09:30 | GBP | Jobless Claims Change Oct | 1.1K | 2.4K | 1.7K | 2.6K |

| 09:30 | GBP | Claimant Count Rate Oct | 2.30% | 2.30% | ||

| 09:30 | GBP | Average Weekly Earnings 3M/Y Sep | 2.20% | 2.10% | 2.20% | |

| 09:30 | GBP | ILO Unemployment Rate 3M Sep | 4.30% | 4.30% | 4.30% | |

| 09:30 | GBP | Employment Change 3M/3M Sep | -14k | 50k | 94k | |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Sep | 25.0B | 21.4B | 21.6B | 21.0B |

| 13:30 | USD | CPI M/M Oct | 0.10% | 0.10% | 0.50% | |

| 13:30 | USD | CPI Y/Y Oct | 2.00% | 2.00% | 2.20% | |

| 13:30 | USD | CPI Core M/M Oct | 0.20% | 0.20% | 0.10% | |

| 13:30 | USD | CPI Core Y/Y Oct | 1.80% | 1.70% | 1.70% | |

| 13:30 | USD | Empire State Manufacturing Nov | 19.4 | 25 | 30.2 | |

| 13:30 | USD | Advance Retail Sales M/M Oct | 0.20% | 0.00% | 1.60% | 1.90% |

| 13:30 | USD | Retail Sales Ex Auto M/M Oct | 0.10% | 0.20% | 1.00% | 1.20% |

| 15:00 | USD | Business Inventories Sep | 0.00% | 0.70% | ||

| 15:30 | USD | Crude Oil Inventories | 2.2M | |||

| 21:00 | USD | Net Long-term TIC Flows Sep | 34.6B | 67.2B |