New Zealand Dollar has taken a hit in Asian session after RBNZ delivered a widely expected 50bps rate cut. With excess capacity in the economy, further policy easing is expected, and some economists foresee an additional 50bps rate cut in November. The central bank would continue loosening in the first half of next year, though a return to a more gradual pace of policy changes is likely.

Australian Dollar is also facing pressure, as risk sentiment across the Asian markets has soured, with China at the heart of investor concerns. The Shanghai SSE index has wiped out the post-holiday gains seen yesterday, while Hong Kong equities remain near their lows following Tuesday’s selloff, which was the steepest since the 2008 financial crisis.

Investors were left disappointed by China’s National Development and Reform Commission, which offered scant new details on its highly anticipated stimulus package. Instead of fresh fiscal stimulus, the measures appeared to be part of existing plans, further frustrating market participants. China will likely need to intensify efforts to revive market confidence.

In a broader market context, this week has seen a typical “risk-off” environment unfold. Japanese Yen stands as the strongest currency so far, followed by Swiss Franc and Dollar. Meanwhile, New Zealand and Australian Dollars have slumped to the bottom, reflecting weaker risk appetite, with Canadian Dollar joining them as another underperformer. Euro and British Pound are positioned in the middle of the performance table.

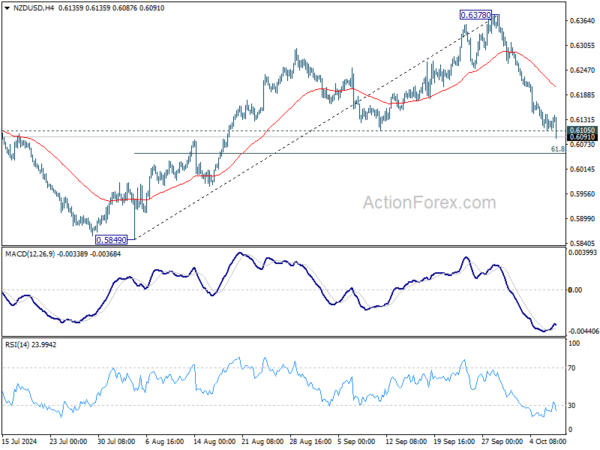

Technically, NZD/USD’s break of 0.6105 structural support indicates that rise from 0.5849 has completed at 0.6378 already. Further decline is expected as long as 55 4H EMA (now at 0.6210) holds. Sustained break of 61.8% retracement of 0.5849 to 0.6378 at 0.6051 will pave the way back to 0.5849 support. The question is whether AUD/USD would follow and break through 0.6621 (corresponding support to 0.6105 in NZD/USD) very soon.

In Asia, at the time of writing, Nikkei is up 0.72%. Hong Kong HSI is down -1.39%. China Shanghai SSE is down -5.30%. Singapore Strait Times is up 0.38%. Japan 10-year JGB yield is up 0.0086 at 0.935. Overnight, DOW rose 0.30%. S&P 500 rose 0.97%. NASDAQ Rose 1.45%. 10-year yield rose 0.007 to 4.033.

RBNZ cuts rates by 50bps, citing weak economic conditions and excess capacity

As widely expected, RBNZ cut its Official Cash Rate by 50bps to 4.75%. In its accompanying statement, the central bank emphasized that this move was deemed “appropriate” to achieve and maintain low, stable inflation while minimizing “unnecessary instability” in output, employment, interest rates, and the exchange rate.

RBNZ highlighted that economic activity in New Zealand remains “subdued,” with both business investment and consumer spending showing signs of weakness. Employment conditions are also softening, and low productivity growth is acting as a further constraint on activity.

The central bank pointed out that the economy is now in a state of “excess capacity,” which is encouraging adjustments in price- and wage-setting behavior, aligning with a low-inflation environment. Falling import prices are aiding the disinflation process.

Additionally, RBNZ noted that despite the rate cut, OCR of 4.75% is still “restrictive” and leaves monetary policy well-positioned to handle any near-term surprises.

Fed’s Jefferson: Inflation risks diminished, employment risks rising

Fed Vice Chair Philip Jefferson highlighted the shift in the balance of risks between the central bank’s two mandates: inflation and employment.

Jefferson noted at an event overnight that “risks to inflation have diminished,” while “risks to employment have risen,” bringing these factors into closer balance.

He emphasized that the robust performance of the labor market provided Fed with “headroom” to keep policy in restrictive territory for an extended period.

However, with unemployment drifting upward, now at 4.1%, and inflation closer to the 2% target, Jefferson acknowledged it was appropriate to consider “recalibrating” monetary policy.

Fed’s Bostic stays “laser-focused” on inflation

Atlanta Fed President Raphael Bostic reiterated his firm stance on inflation during remarks overnight, emphasizing that inflation remains “too high”. He added, “I want people to understand that I’m still laser-focused on the inflation target.”

Regarding the labor market, Bostic acknowledged that while it has slowed, it is not weak by any means. He said, adding that monthly job creation is still “pretty robust.” He also noted that the current unemployment rate, though slightly higher than recent lows, aligns with pre-pandemic levels of full employment.

Fed’s Collins: Further rate cuts likely, remain carefully data dependent

Boston Fed President Susan Collins highlighted yesterday that further rate cuts will “likely be needed” to support the economy. However, she emphasized that Fed’s policy decisions are not on a “pre-set path” and will remain “remain carefully data dependent”.

Collins noted that while core inflation pressures are still elevated, she is gaining confidence that inflation is gradually returning to the 2% target. She also addressed the labor market, noting that the September jobs report, which exceeded expectations, confirms her view that the job market is “in a good place” — neither too hot nor too cold. She stressed that preserving the healthy labor market conditions is crucial and will require economic activity to grow near trend, which remains her baseline outlook for the coming months.

Looking ahead

The economic calendar is rather light today, with German trade balance as the only notable feature in European session. Later in the day FOMC minutes would be the main focus while a number of Fed officials are scheduled to speak.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6720; (P) 0.6745; (R1) 0.6773; More...

Intraday bias in AUD/USD remains on the downside for the moment. Fall from 0.6941 is in progress. Sustained trading below 55 D EMA (now at 0.6744) should confirm rejection by 0.6941 fibonacci level, and bring deeper decline to 0.6621 support. On the upside, above 0.6809 minor resistance will turn intraday bias neutral first.

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern, with rise from 0.6269 as the third leg. Firm break of 100% projection of 0.6269 to 0.6870 from 0.6340 at 0.6941 will target 138.2% projection at 0.7179. However, break of 0.6621 support will argue that rise from 0.6269 has completed and bring deeper fall back to 0.6269/6348 support zone.