Australian dollar tumbles broadly today as wage growth data disappoints. That also add to case for RBA to divergence from global tightening and stand pat ahead. Yen surges broadly as GDP miss pressures Nikkei. But Yen is outperformed by Euro, which surges this week on strong German GDP data. Euro is firm in Asian session and is on course for further rally. More important economic data will be released today. Sterling will look into employment data for some support. Meanwhile, Dollar will look into CPI and retail sales to solidify the case for a December Fed hike.

Australian wage growth missed expectations

Australia wage price index rose 0.5% qoq in Q3, unchanged from quarter’s figure and missed expectation of 0.7% qoq. Annually, wage grew 2.0% yoy, also missed expectation of 2.2% yoy. Growth in wage was driven by end of financial year salary reviews as well as the annual minimum wage review. The 3.3% rise in minimum wage already boosted quarterly wage growth by 0.2%. Hence, considering all factors, wage growth was like non-existent in the September quarter. And that clearly support RBA’s neutral stance to divergence from global monetary tightening and stands pat ahead. Also from Australia, Westpac consume confidence dropped -1.7% in November.

Yen surges on Japan GDP miss

Japan GDP grew 0.3% qoq in Q3, below expectation of 0.4% qoq. That’s also just half of prior quarter’s 0.6% qoq. Nonetheless, that’s still the second straight quarter of growth, held by exports as global economy recovers. GDP deflator rose 0.1% yoy, in line with consensus. Japanese markets respond quite negatively to the data as Nikkei stays weak after the release and is losing -200 pts, or -0.9% at the time of writing. Yen trades inversely proportional to Nikkei and surges higher.

AUD/JPY heading back to 81.34/48 key medium term support

The sharp decline in AUD/JPY this week affirms the case that medium term rebound form 72.39 has completed at 90.29 already, on bearish divergence condition in weekly MACD. Near term outlook will now stay bearish as long as 88.09 resistance holds. Sustained break of 55 week EMA (now at 85.59) will pave the way to key cluster support at 81.48 (50% retracement of 72.39 to 90.29 at 81.34.

St Louis Fed Bullard concerned with Fed hike

St Louis Fed President James Bullard said yesterday that "inflation data during 2017 have surprised to the downside and call into question the idea that U.S. inflation is reliably returning toward target." And he warned that "the main concern I would have is that we raise rates in December and inflation expectations fall… which would in my view be a vote of no confidence from markets."

Currently, fed fund futures are pricing in 96.7% chance another rate hike by Fed in December to 1.25-1.50%. The CPI data to be released today will be a key to solidify this case for the Fed.

News regarding tax plan will also be crucial for the Dollar. It’s reported that Senate Republicans would include a repeal of the Obamacare individual mandate with their version of the tax bill. Such an act could complicate the efforts to rush to pass the reconciled bill in both chambers. But it’s also seen as a move that can help to pay for the proposed tax cuts by slashing more than USD 300b in government spending over 10 years. Senate Majority Leader Mitch McConnell expressed his confidence that "we’re optimistic that inserting the individual mandate repeal would be helpful."

Looking ahead

The economic calendar is full of key data today. UK job data will be a major focus in European session. Sterling is trading as the weakest European and will need to draw support from very solid data. Eurozone will also release trade balance.

Later in the day, US CPI and retail sales will be the main feature. Empire state manufacturing index and business inventories will also be featured.

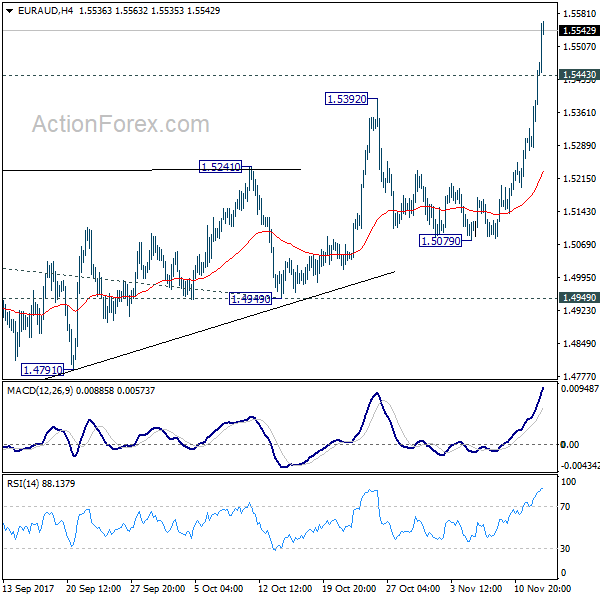

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5332; (P) 1.5402; (R1) 1.5525; More….

EUR/AUD’s strong break of 1.5392 resistance confirms resumption of medium term rally from 1.3624. Intraday bias stays on the upside for 61.8% projection of 1.3624 to 1.5226 from 1.4949 at 1.5939 first. Break will target 100% projection at 1.6551, which is close to 1.6587 key resistance. On the downside, below 1.5443 minor support will turn intraday bias neutral and bring consolidations before staging another rally.

In the bigger picture, we’re holding on to the view that corrective decline from 1.6587 medium term top (2015 high) has completed at 1.3624. Rise from 1.3624 is expected to extend to retest 1.6587. We’ll hold on to this bullish view as long as 1.5226 resistance turned support holds. Firm break of 1.6587 will resume long term rise from 1.1602 (2012 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Nov | -1.70% | 3.60% | ||

| 23:50 | JPY | GDP Q/Q Q3 P | 0.30% | 0.40% | 0.60% | |

| 23:50 | JPY | GDP Deflator Y/Y Q3 P | 0.10% | 0.10% | -0.40% | |

| 00:30 | AUD | Wage Price Index Q/Q Q3 | 0.50% | 0.70% | 0.50% | |

| 04:30 | JPY | Industrial Production M/M Sep F | -1.10% | -1.10% | ||

| 09:30 | GBP | Jobless Claims Change Oct | 2.4K | 1.7K | ||

| 09:30 | GBP | Claimant Count Rate Oct | 2.30% | |||

| 09:30 | GBP | Average Weekly Earnings 3M/Y Sep | 2.10% | 2.20% | ||

| 09:30 | GBP | ILO Unemployment Rate 3M Sep | 4.30% | 4.30% | ||

| 09:30 | GBP | Employment Change 3M/3M Sep | 50k | 94k | ||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Sep | 21.4B | 21.6B | ||

| 13:30 | USD | CPI M/M Oct | 0.10% | 0.50% | ||

| 13:30 | USD | CPI Y/Y Oct | 2.00% | 2.20% | ||

| 13:30 | USD | CPI Core M/M Oct | 0.20% | 0.10% | ||

| 13:30 | USD | CPI Core Y/Y Oct | 1.70% | 1.70% | ||

| 13:30 | USD | Empire State Manufacturing Nov | 25 | 30.2 | ||

| 13:30 | USD | Advance Retail Sales M/M Oct | 0.00% | 1.60% | ||

| 13:30 | USD | Retail Sales Ex Auto M/M Oct | 0.20% | 1.00% | ||

| 15:00 | USD | Business Inventories Sep | 0.00% | 0.70% | ||

| 15:30 | USD | Crude Oil Inventories | 2.2M | |||

| 21:00 | USD | Net Long-term TIC Flows Sep | 34.6B | 67.2B |