Dollar stabilized overnight and is attempting to regain ground following recent losses. The greenback found some support after Fed Chair Jerome Powell’s remarks, where he indicated that Fed is in no rush to implement rapid rate cuts. This has reduced market expectations for a 50bps cut at the November meeting, with the probability falling from 53.3% to 36.7%. However, Dollar’s momentum remains weak, and investors are now looking to upcoming economic data, including today’s ISM manufacturing release, for further direction.

Aussie continues to outshine other currencies this week, maintaining its position as the strongest currency so far, bolstered additionally by stronger-than-expected retail sales data. In contrast, Kiwi is losing momentum despite the sharp improvement in business confidence. Its second-place position was overtaken by Sterling.

On the weaker side, Yen is under renewed pressure, making it the weakest major currency so far this week. Diverging views within BoJ on the timing of the next rate hike, as revealed in the latest summary of opinions, are adding to the uncertainty. Compounding these concerns, Japan’s Tankan survey pointed to slowing capital investment plans, which could indicate headwinds for the country’s economic outlook.

Swiss Franc is also struggling, ranking just above Yen, followed by Euro, which is focused on today’s Eurozone inflation data. While headline CPI is expected to dip below ECB’s 2% target, elevated core inflation may keep ECB cautious about cutting rates too quickly.

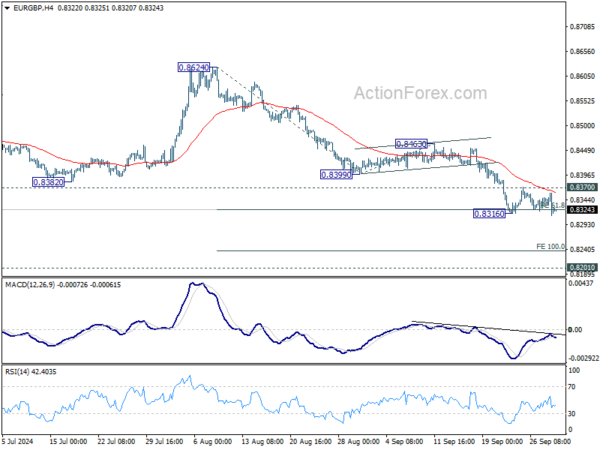

Technically, EUR/GBP is trying to resume recent decline through 0.8316 temporary low. Firm break there will path the way to 100% projection of 0.8624 to 0.8399 from 0.8463 at 0.8237, or even further to 0.8201 key support (2022 low).

In Asia, at the time of writing, Nikkei is up 1.47%. Japan 10-year JGB yield is down -0.007 at 0.850. Singapore Strait Times is down -0.22%. Hong Kong and China are on holiday. Overnight, DOW rose 0.04%. S&P 500 rose 0.42%. NASDAQ rose 0.38%. 10-year yield rose 0.053 to 3.802.

Fed’s Powell: No rush for rapid rate cuts

Fed Chair Jerome Powell made it clear during a speech at the NABE conference that FOMC is “not a committee that feels like it is in a hurry to cut rates quickly.”

Powell noted that if the economy evolves as expected, Fed could enact “two more cuts” by the end of the year, reducing the policy rate by an additional half a percentage point. He reaffirmed that the US economy is on track for a continued slowdown in inflation, which should allow the Fed to reach a neutral interest rate level “over time.”

“Disinflation has been broad-based,” Powell said, citing recent data that shows progress towards Fed’s 2% inflation target.

However, Powell stressed that Fed is “not on any preset course” and will assess risks on both sides of the economy. “We will continue to make our decisions meeting by meeting,” he added.

Fed’s Bostic sees gradual easing, possible dramatic cuts if job growth falter

In an interview with Reuters overnight, Atlanta Fed President Raphael Bostic outlined his expectations for a gradual, “orderly” easing of monetary policy over the next 15 months. His baseline scenario sees policy rate falling to a range of 3.00% to 3.25% by the end of 2025, a level he considers neutral for the economy.

However, Bostic cautioned that a “much weaker” labor market could accelerate the pace of rate cuts. He emphasized that significant job market deterioration would “add urgency” to Fed’s easing process, prompting another “dramatic move” such as the 50bps rate cut enacted in September.

Bostic also noted his close attention to job growth, stating that as long as the economy continues to produce net jobs and monthly job creation stays above 100,000, the labor market will likely remain on stable footing. This threshold, in Bostic’s view, is the minimum needed to absorb new entrants into the labor force.

Fed’s Goolsbee expects extended series of rate cuts as economy normalizes

Chicago Fed President Austan Goolsbee highlighted Fed’s outlook for an extended period of monetary easing in an interview with FOX Business overnight.

He noted, “this is a process over a year or more that we’re trying to get the rates down to normal.”

He also pointed out that the Fed’s latest forecasts suggest “a lot of cuts” ahead, with policymakers aligned on this approach.

Fed has already begun easing, cutting its policy rate by 50bps at last meeting, bringing it to the 4.75%-5.00%.

Goolsbee refrained from committing to a specific rate cut size at the upcoming November meeting, stressing that the overall process of returning rates to more “normal” levels is the focus.

Additionally, Goolsbee noted cautionary signals in the labor market, though he remarked that the current unemployment rate of 4.2% appears to be at a sustainable level.

BoJ opinions highlight divergence over timing of future rate hikes

The Summary of Opinions from BoJ’s meeting on September 19 and 20 acknowledged that while outlook for Japan’s economic activity and inflation will guide future changes in monetary accommodation, policymakers remain vigilant about developments in overseas economies, particularly the US, and their potential impact on Japan’s financial markets and price stability.

With Yen’s depreciation retracing and import price pressures easing, one view noted that BoJ has “enough time to assess the situation”. Another opinion stressed that Japan’s economy is not at risk of “falling behind the curve” if interest rates are not raised swiftly. BoJ should not raise interest rate when “financial and capital markets are unstable”.

Another member suggested that while price stability has not yet been achieved and uncertainties persist, a shift to “full-fledged monetary tightening” would be undesirable at this stage.

However, a contrasting opinion within the BoJ indicated that if economic conditions remain stable and the outlook is confirmed, it would be preferable for the bank to raise rates “without taking too much time.”

This divergence highlights the ongoing debate within BoJ about the timing of future rate hikes.

Japan’s Q3 Tankan shows stability in manufacturing, slight gains in non-manufacturing

Japan’s Q3 Tankan Large Manufacturing Index remained steady at 13, unchanged from Q2 and in line with market expectations, indicating stability in the country’s manufacturing sector. Manufacturers’ outlook for the next three months improved slightly to 14, signaling cautious optimism about future business conditions.

Large Non-Manufacturers Index showed a modest rise to 34, up from 33 in June, surpassing expectations of 32. However, the outlook for non-manufacturers over the next three months dipped to 28, reflecting some uncertainty in the service and retail sectors.

Capital spending plans by big companies were revised down, with firms now expecting a 10.6% increase for the fiscal year ending in March 2025. This is below the median forecast of an 11.9% rise and down from an 11.1% forecast three months ago, suggesting some cooling in business investment intentions.

The Tankan survey results will be closely monitored by BoJ as it prepares for its monetary policy meeting on October 30-31, where it will set new growth and inflation forecasts.

Japan’s PMI manufacturing PMI finalized at 49.7, output and new orders in contraction

Japan’s Manufacturing PMI for September was finalized at 49.7, marginally lower than August’s reading of 49.8, signaling continued contraction in the sector.

According to Usamah Bhatti from S&P Global Market Intelligence, the data reflected “muted trends” in Japan’s manufacturing industry. Both output and new orders remained in negative territory, while the rate of job creation “slowed to a crawl.”

While businesses expressed optimism about output growth over the next 12 months, the level of optimism softened, marking the weakest positive outlook since the end of 2022. Some manufacturers highlighted concerns over the “timing of a demand recovery,” reflecting cautiousness in the face of global and domestic uncertainties.

Australia’s retail sales rises 0.7% mom in Aug, driven by record warm weather

Australia’s retail sales turnover increased by 0.7% mom in August, surpassing the expected rise of 0.4% mom. On a year-over-year basis, retail sales were up 3.1%. This stronger-than-expected growth was largely attributed to unusually warm weather, which boosted spending on items typically associated with spring.

Robert Ewing, head of business statistics at the Australian Bureau of Statistics (ABS), explained that “this year was the warmest August on record since 1910, which saw more spending on items typically purchased in spring.” Categories that saw increased demand included summer clothing, liquor, outdoor dining, hardware, gardening supplies, camping gear, and outdoor equipment.

NZ business confidence surges as firms anticipate more RBNZ rate cuts

NZIER Quarterly Survey of Business Opinion reveals significant improvement in business confidence in New Zealand during Q3. A net 5% of firms now expect deterioration in general economic conditions, a stark improvement from the net 40% expressing pessimism in the June quarter.

Firms are still facing challenges in demand. A net 31% of businesses reported weaker trading activity. However, looking ahead, only a net 2% of firms expect activity to decline in the next quarter.

This shift in sentiment comes as firms anticipate more supportive economic conditions following RNBZ’s decision to begin cutting interest rates in August, with expectations of further reductions in the coming year.

Cost pressures remained present, with a slight increase in the proportion of firms reporting higher costs. However, pricing power has diminished significantly, with only a net 3% of firms able to pass on these costs to consumers, compared to 23% in the previous quarter.

Looking ahead

Swiss retail sales and PMI manufacutring; Eurozone CPI and PMI manufacturing final; UK PMI manufacturing final will be released in European sesison. Later in the day, US ISM manufacturing will be the main focus.

USD/JPY Daily Outlook

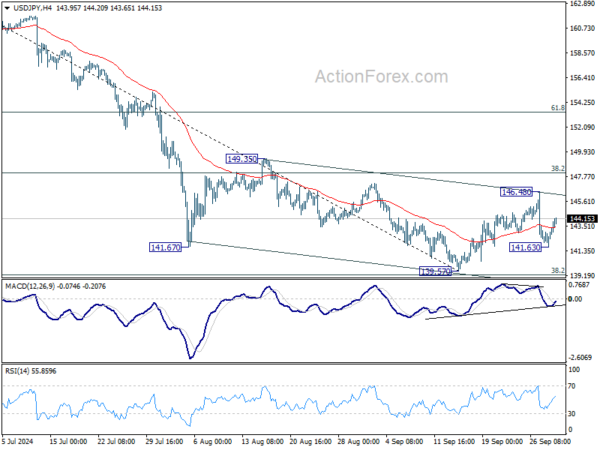

Daily Pivots: (S1) 142.21; (P) 143.07; (R1) 144.48; More…

Intraday bias in USD/JPY is turned neutral as recovery from 141.63 extends. On the downside, below 141.63 will target 139.57 low. But strong support could be seen again from 139.26 fibonacci level to bring rebound. On the upside, above 146.48 will resume the rebound from 139.57 to 38.2% retracement of 161.94 to 139.57 at 148.11. However, firm break of 139.26 will carry larger bearish implications.

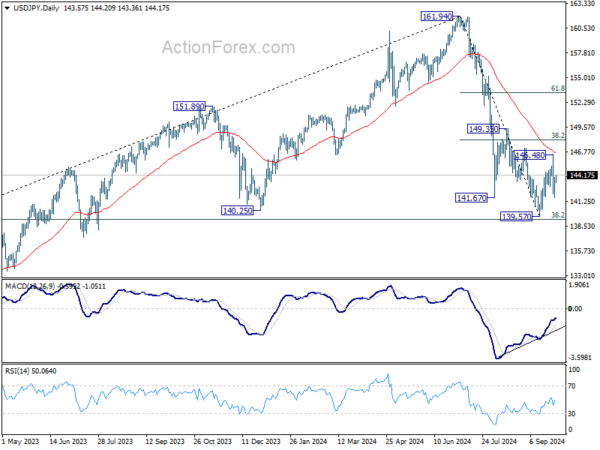

In the bigger picture, fall from 161.94 medium term top is seen as correcting whole up trend from 102.58 (2021 low). Strong support could be seen from 38.2% retracement of 102.58 to 161.94 at 139.26 to contain downside, at least on first attempt. But in any case, risk will stay on the downside as long as 149.35 resistance holds. Sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Aug | -5.30% | 26.20% | 26.40% | |

| 22:00 | NZD | NZIER Business Confidence Q3 | -1 | -44 | ||

| 23:30 | JPY | Unemployment Rate Aug | 2.50% | 2.60% | 2.70% | |

| 23:50 | JPY | Tankan Large Manufacturing Index Q3 | 13 | 13 | 13 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q3 | 14 | 14 | ||

| 23:50 | JPY | Tankan Non – Manufacturing Index Q3 | 34 | 32 | 33 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q3 | 28 | 27 | ||

| 23:50 | JPY | Tankan Large All Industry Capex Q3 | 10.60% | 11.90% | 11.10% | |

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 00:30 | JPY | Manufacturing PMI Sep F | 49.7 | 49.6 | 49.6 | |

| 00:30 | AUD | Retail Sales M/M Aug | 0.70% | 0.40% | 0.00% | 0.10% |

| 00:30 | AUD | Building Permits M/M Aug | -6.10% | -4.30% | 10.40% | 11.00% |

| 06:30 | CHF | Real Retail Sales Y/Y Aug | 2.60% | 2.70% | ||

| 07:30 | CHF | Manufacturing PMI Sep | 48.2 | 49 | ||

| 07:45 | EUR | Italy Manufacturing PMI Sep | 49.4 | 49.4 | ||

| 07:50 | EUR | France Manufacturing PMI Sep F | 44 | 44 | ||

| 07:55 | EUR | Germany Manufacturing PMI Sep F | 40.3 | 40.3 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Sep F | 44.8 | 44.8 | ||

| 08:30 | GBP | Manufacturing PMI Sep F | 51.5 | 51.5 | ||

| 09:00 | EUR | Eurozone CPI Y/Y Sep P | 1.90% | 2.20% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Sep P | 2.70% | 2.80% | ||

| 13:30 | CAD | Manufacturing PMI Sep | 49.5 | |||

| 13:45 | USD | Manufacturing PMI Sep F | 47 | 47 | ||

| 14:00 | USD | ISM Manufacturing PMI Sep | 47.8 | 47.2 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Sep | 55 | 54 | ||

| 14:00 | USD | Construction Spending M/M Aug | 0.20% | -0.30% |