US equities closed mixed overnight as markets await president-elect Donald Trump’s first post election press conference. DJIA continued to struggle in tight range below 20000 handle and closed down -31.85 pts, or -0.16%, at 19855.53. S&P 500 closed completely flat for the first time in 9 years, at 2268.9. On the other hand, NASDAQ closed at 4th straight record at 5551.82, up 20 pts, or 0.36%. 10 year yield was relatively unchanged, closed up 0.003 at 2.379. Dollar index is trying to recover and is back above 102, comparing to last week’s low at 101.30, but lacks momentum. In other markets, gold is staying firm as recent rebound is still in progress and is pressing 1190 handle. WTI crude oil dropped sharply overnight to as low as 50.71 and is trying to defend 50 handle.

Trump will hold the long awaited press conference at 11am eastern time today in New York today. It should be noted against the rallies in stocks, yield and Dollar after US election were built on expectation on Trump’s expansive policies. But it’s clear that markets turned cautious since the start of the year as his inauguration on January 20 approaches. There have been continuous bits of comments, including his tweets, relevant or irrelevant to the economy. But Trump has yet deliver any clear picture on what he will exactly as he takes office. Reactions in the market could be strong if he delivers any surprises today.

Elsewhere, Japan leading index rose to 102.7 in November, above expectation of 102.6. UK data will be the main focus in the calendar today. Trade balance, industrial and manufacturing production, construction output and NIESR GDP estimate will be released.

USD/CHF Daily Outlook

Daily Pivots: (S1) 1.0125; (P) 1.0151; (R1) 1.0192; More…..

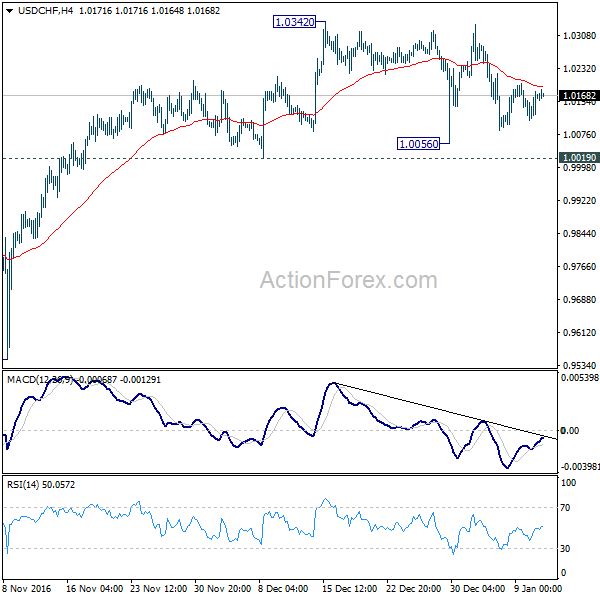

USD/CHF is still bounded in consolidation from 1.0342 and intraday bias stays neutral. Another fall cannot be ruled out. But in that case, we’d expect strong support from 1.0019 to contain downside and bring rally resumption. Firm break of 1.0342 will confirm up trend resumption. However, sustained break of 1.0019 will indicate near term reversal and could bring deeper fall bring to 0.9443/9548 support zone.

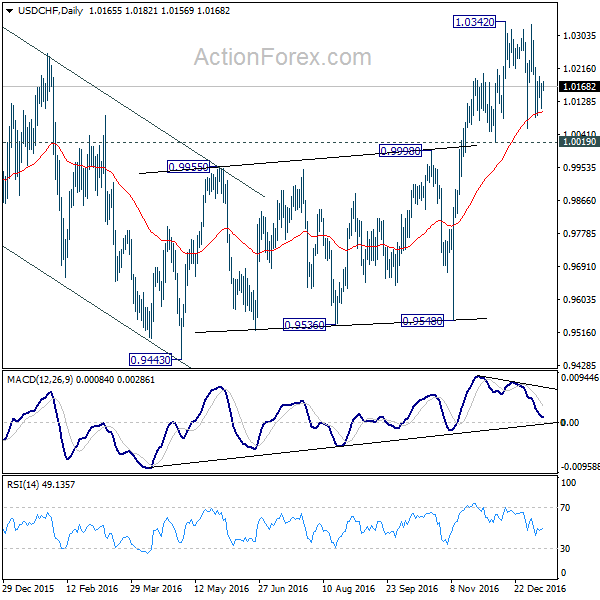

In the bigger picture, the corrective fall from 1.0327 should have completed at 0.9443 already. Rise from 0.9443 could be resuming the long term rally from 2011 low at 0.7065. But decisive break of 1.0327 is needed to confirm. In that case, next medium term upside target will be 38.2% retracement of 1.8305 to 0.7065 at 1.1359. Rejection from 1.0327 will extend the sideway pattern with another fall back to 0.9443/9548 support zone.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 5:00 | JPY | Leading Index Nov P | 102.7 | 102.6 | 100.8 | |

| 9:30 | GBP | Visible Trade Balance (GBP) Nov | -11.2B | -9.7B | ||

| 9:30 | GBP | Industrial Production M/M Nov | 0.90% | -1.30% | ||

| 9:30 | GBP | Industrial Production Y/Y Nov | 0.60% | -1.10% | ||

| 9:30 | GBP | Manufacturing Production M/M Nov | 0.50% | -0.90% | ||

| 9:30 | GBP | Manufacturing Production Y/Y Nov | 0.40% | -0.40% | ||

| 9:30 | GBP | Construction Output M/M Nov | 0.30% | -0.60% | ||

| 15:00 | GBP | NIESR GDP Estimate Dec | 0.50% | 0.40% | ||

| 15:30 | USD | Crude Oil Inventories | -7.1M |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box