Risk-on sentiment continues to dominate global financial markets today, driven by widespread monetary easing and a significant boost from China’s latest stimulus measures. US equities finished strong overnight, with all major indexes posting gains. S&P 500 hit a fresh record for the third consecutive time this week. Meanwhile, Germany’s DAX also surged to an all-time high.

In Asia, stocks in Hong Kong and mainland China skyrocketed as China’s stimulus measures began to take effect. The injection of liquidity and supportive policies have renewed confidence among investors, leading to significant rallies in these markets.

The currency markets mirror this risk-on environment. Kiwi and Aussie are the week’s biggest winners so far, followed by Loonie. On the opposite end of the spectrum, Japanese Yen has been the weakest, followed by Dollar and Euro. Swiss Franc and British Pound are trading in mixed in the middle. Today’s releases of Canadian GDP and US PCE inflation data are not expected to significantly alter these standings.

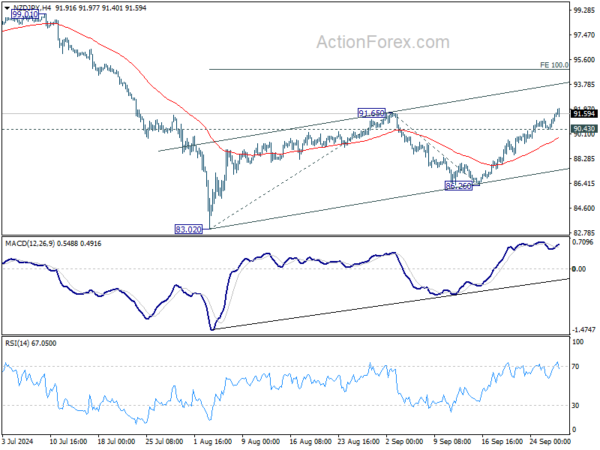

Among key currency pairs, NZD/JPY and AUD/JPY are vying for the top spot this week. NZD/JPY has a slight edge, gaining close to 2% for the week. Technically, NZD/JPY’s breach of 91.65 resistance today indicates resumption of whole rally from 83.02. This rise is seen as the second leg of the corrective pattern from 99.01 high. Further rally is now expected as long as 90.43 minor support holds. Next target is 100% projection of 83.02 to 91.65 from 86.26 at 94.89.

In Asia, at the time of writing, Nikkei is up 0.30%. Hong Kong HSI is up 3.90%. China Shanghai SSE is up 2.14%. Singapore Strait Times is down -0.39%. Japan 10-year JGB yield is down -0.0138 at 0.817. Overnight, DOW rose 0.62%. S&P 500 rose 0.40%. NASDAQ rose 0.60%. 10-year yield rose 0.010 to 3.791.

Japan’s Tokyo core inflation slows to 2%, supporting BoJ’s cautious approach

Japan’s Tokyo CPI core (excluding fresh food) slowed from 2.4% yoy to 2.0% yoy in September, aligning with expectations and marking its lowest level since May. Headline CPI dropped to 2.2% yoy from 2.6% yoy , while CPI core-core (excluding food and energy) remained stable at 1.6% yoy.

The primary driver of the deceleration in inflation was reduction in electricity and gas prices, influenced by government energy subsidies reintroduced by outgoing Prime Minister Fumio Kishida. These subsidies helped alleviate the impact of a particularly hot summer, shaving 0.5 percentage points off overall inflation.

This data, especially the stable core-core inflation, supports BoJ’s cautious stance regarding more tightening. BoJ Governor Kazuo Ueda recently noted that inflationary risks have diminished, particularly with Yen’s recent gains. BoJ is likely to remain on hold during its upcoming policy meeting on October 31.

PBoC cuts RRR and repo rate

In a follow-up to Governor Pan Gongsheng’s earlier remarks this week, the People’s Bank of China announced today a 50bps cut in the reserve requirement ratio and a 20bps reduction in the seven-day reverse repurchase rate.

This move is intended to release approximately CNY 1T in long-term liquidity, enabling banks to lend more and increase purchases of government bonds aimed at funding infrastructure projects. With the cut, the weighted average RRR will drop to around 6.6%. The central bank also lowered the seven-day reverse repo rate from 1.7% to 1.5%.

Further fiscal measures are anticipated before China’s National Day holiday on October 1, as the Politburo has signaled a heightened focus on addressing economic pressures.

Reports indicate that the government will raise CNY 1T via special bonds, which will fund consumer goods subsidies, upgrades to business equipment, and provide a monthly allowance of CNY 800 yuan per child for households with multiple children. Additionally, another CNY 1T in special sovereign debt could be issued to help local governments manage their mounting debt burdens.

Fed’s Cook reaffirms support for 50bps rate cut

Fed Governor Lisa Cook said she “whole heartedly” supported last week’s 50bps rate cut, emphasizing that it was a reflection of “growing confidence” in Fed’s ability to balance a solid labor market with moderate economic growth.

Cook noted in a speech overnight that the cut aligns with the ongoing progress towards bringing inflation back down to 2% target.

Looking ahead, Cook stressed the importance of “carefully assessing incoming data” and weighing risks as Fed considers further policy actions.

She highlighted the return to balance in the labor market and inflation as a sign of the economy’s “normalization” post-pandemic, adding that such balance is critical to sustaining long-term labor-market strength.

The normalization of inflation is particularly encouraging, Cook added, as it provides the foundation for maintaining a resilient job market. This balance between supply and demand will be central to future Fed decisions.

Looking ahead

France consumer spending, Germany unemployment, and Eurozone economic sentiment will be released in European session. Later in the day, Canada will publish monthly GDP. US personal income and spending, PCE inflation, and goods trade balance will be featured too.

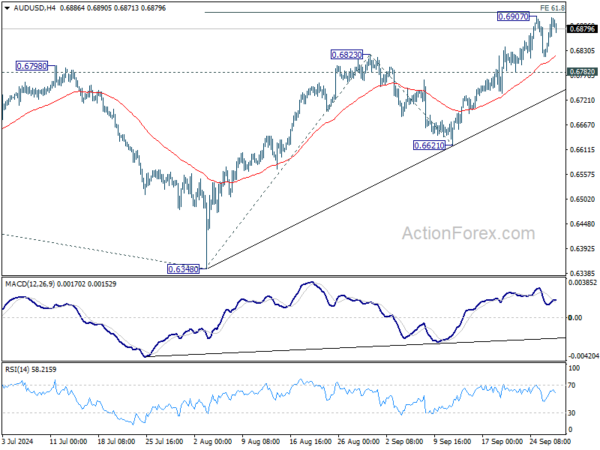

AUD/USD Daily Report

Daily Pivots: (S1) 0.6841; (P) 0.6873; (R1) 0.6927; More...

Intraday bias n AUD/USD remains neutral for the moment, and more consolidations could be seen below 0.6907. But further rally is expected as long as 0.6782 support holds. Firm break of 61.8% projection of 0.6348 to 0.6823 from 0.6621 at 0.6915 will extend the rise from 0.6348 to 100% projection at 0.7096 next.

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern, with rise from 0.6269 as the third leg. Firm break of 0.6870 resistance will target 100% projection of 0.6269 to 0.6870 from 0.6340 at 0.6941, and then 138.2% projection at 0.7179. This will now remain the favored case as long as 0.6621 support holds.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Sep | 2.20% | 2.60% | ||

| 23:30 | JPY | Tokyo CPI Core Y/Y Sep | 2.00% | 2.00% | 2.40% | |

| 23:30 | JPY | Tokyo CPI Core-Core Y/Y Sep | 1.60% | 1.60% | ||

| 06:45 | EUR | France Consumer Spending M/M Aug | -0.10% | 0.30% | ||

| 07:55 | EUR | Germany Unemployment Rate Sep | 6% | 6% | ||

| 07:55 | EUR | Germany Unemployment Change Sep | 9K | 2K | ||

| 09:00 | EUR | Eurozone Economic Sentiment Sep | 96.5 | 96.6 | ||

| 09:00 | EUR | Eurozone Industrial Confidence Sep | -9.8 | -9.7 | ||

| 09:00 | EUR | Eurozone Services Sentiment Sep | 5.6 | 6.3 | ||

| 09:00 | EUR | Eurozone Consumer Confidence Sep F | -12.9 | -12.9 | ||

| 12:30 | CAD | GDP M/M Jul | 0.10% | 0.00% | ||

| 12:30 | USD | Personal Income M/M Aug | 0.40% | 0.30% | ||

| 12:30 | USD | Personal Spending Aug | 0.30% | 0.50% | ||

| 12:30 | USD | PCE Price Index M/M Aug | 0.20% | 0.20% | ||

| 12:30 | USD | PCE Price Index Y/Y Aug | 2.30% | 2.50% | ||

| 12:30 | USD | Core PCE Price Index M/M Aug | 0.20% | 0.20% | ||

| 12:30 | USD | Core PCE Price Index Y/Y Aug | 2.70% | 2.60% | ||

| 12:30 | USD | Goods Trade Balance (USD) Aug P | -100.6B | -102.7B | ||

| 12:30 | USD | Wholesale Inventories Aug P | 0.20% | 0.20% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Sep F | 69 | 69 |