Asian markets are maintaining a risk-on tone today, despite the lackluster US market performance overnight. Sentiment remains buoyed by China’s recent monetary stimulus measures, even as doubts linger about their overall effectiveness due to the absence of significant fiscal support. Nevertheless, stocks in Hong Kong and China continue to trade higher. In Japan, Nikkei is benefiting from Yen weakness, which further extended after BOJ minutes revealed a deeply divided board on future tightening measures.

Dollar bounced back strongly after dipping through July’s lows against Euro. However, this rebound seems driven more by quarter-end flows rather than a meaningful shift in market sentiment. Investors are also waiting on comments from key Fed officials today, including Chair Jerome Powell and New York Fed President John Williams. Yet, it’s unlikely that these speeches will offer any fresh insights into November’s rate cut plans. While today’s jobless claims and durable goods orders, along with tomorrow’s PCE inflation data, may cause minor market fluctuations, the primary focus is on next week’s non-farm payrolls report as the fourth quarter begins.

For the week so far, Loonie is leading the pack, followed by Aussie and then Kiwi. Yen remains the weakest, with Euro and Swiss Franc trailing behind. Both Dollar and British Pound are positioned in the middle. Swiss Franc merits particular attention today due to the upcoming SNB rate decision.

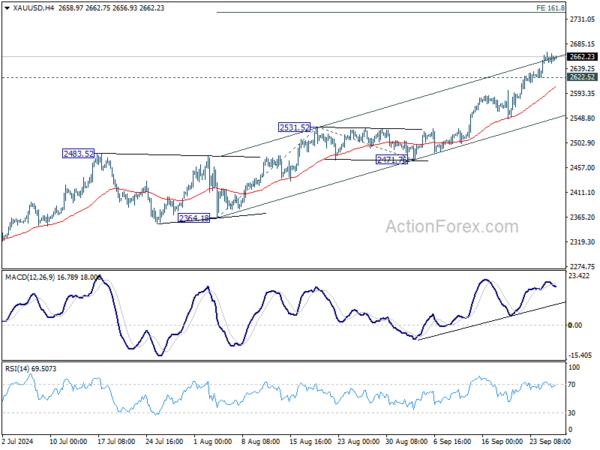

Technically, while Gold is losing some upside momentum as seen in D MACD, it’s just consolidating in tight range near the newly established record high. Outook will stay bullish as long as 2622.52 support holds. Sustained trading above near term channel resistance would prompt upside acceleration to 161.8% projection of 2364.18 to 2631.52 from 2471.76 at 2742.51 next.

In Asia, at the time of writing, Nikkei is up 2.38%. Hong Kong HSI is up 2.32%. China Shanghai SSE is up 0.64%. Singapore Strait Times is up 0.44%. Japan 10-year JGB yield is up 0.022 at 0.834. Overnight, DOW fell -0.70%. S&P 500 fell -0.19%. NASDAQ rose 0.04%. 10-year yield rose 0.045 to 3.781.

SNB Decision: Conservative 25bps cut or aggressive 50bps?

SNB is set to announce its rate decision today, and the financial markets are rife with speculation. A significant gap has emerged between market expectations and those of economists regarding the magnitude of the rate cut. While a majority of economists are forecasting a 25 bps cut, market pricing suggests a nearly even split between the likelihood of a 25 bps cut and a more aggressive 50 bps reduction.

Several compelling arguments support the case for SNB to “front-load” its policy easing with a larger cut. First and foremost is the sharp decline in inflation. Last month, inflation dropped to 1.1%, well below the SNB’s estimate of 1.5% for Q3, and far below the upper limit of its 0-2% target range. The government projects inflation to drop further to just 0.7% next year, suggesting that inflationary pressures are diminishing faster than anticipated. This may compel SNB to act decisively to counter deflationary risks.

Additionally, weak economic performance in the Eurozone, compounded by the strength of the Swiss Franc, is placing considerable strain on Swiss industries. The poor performance of Eurozone purchasing managers’ indices adds weight to the argument for a 50 bps cut to support economic activity in Switzerland.

However, SNB faces constraints. With policy rate currently at 1.25%, there is limited room for rate cuts before reaching zero. Some economists argue that SNB should hold back some policy measures for future flexibility.

According to a Bloomberg survey, only one out of 32 economists expects a 50 bps cut, while two predict no change. The remaining 29 economists anticipate a 25 bps reduction to bring the rate to 1.00%. Similarly, a Reuters poll found that 30 out of 32 economists expect a 25 bps cut, with one forecasting a 50 bps reduction and another expecting rates to hold steady. Looking ahead to the end of the year, opinions are split: 16 economists believe the rate will be at 1.00%, 15 predict it will drop to 0.75%, and one expects it to remain at 1.25%.

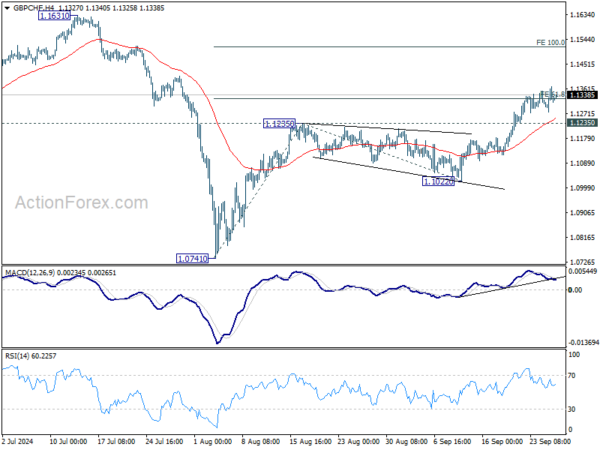

Technically, GBP/CHF’s rally stalled after hitting 61.8% projection of 1.0741 to 1.1235 from 1.1022 at 1.1327. But further is expected as long as 1.1235 resistance turned support holds. Sustained trading above 1.1327 will pave the way to 100% projection at 1.1516 next.

BoJ minutes show divided views on rate hike timing

Minutes from BoJ’s July meeting reveal a split among policymakers on the pace of future rate hikes. While BOJ raised its short-term interest rate to 0.25% by a 7-2 vote, differing opinions emerged on how quickly further increases should occur.

One member argued that if price trends follow the bank’s outlook, it would be “necessary” to proceed with further tightening. Another suggested that with inflation projected to reach its target by H2 of fiscal 2025, the policy rate should gradually rise toward the neutral rate, estimated at around 1%. This member cautioned against rapid rate increases and favored a “timely and gradual” approach to avoid shocks to the economy.

However, some members expressed concerns about the risks of moving too quickly. One warned that monetary policy normalization should not be an end in itself and urged caution in monitoring the risks tied to policy shifts. Another highlighted that inflation expectations were “not being anchored at 2 percent”, suggesting the need to avoid excessive market speculation about future rate hikes.

The minutes also reflect “high uncertainties regarding the level of the neutral interest rate” about Japan’s neutral interest rate, given the long period without rate hikes. One member noted the difficulty of setting policy based on estimates of the neutral rate, calling for flexibility in adjusting policy based on evolving economic conditions.

Fed’s Kugler backs more rate cuts as focus shifts to employment

Fed Governor Adriana Kugler expressed “strong” support for last week’s 50bps rate cut, signaling her inclination toward “additional cuts” in the federal funds rate.

In her speech overnight, Kugler emphasized that while the focus remains on bringing inflation down to the 2% target, attention should now begin to “shift attention to the maximum-employment side” Fed’s dual mandate.

The labor market “remains resilient,” she noted, but stressed that FOMC must now carefully balance its objectives. Fed should aim to maintain progress on disinflation while avoiding “unnecessary pain and weakness” in the broader economy.

Looking ahead

While SNB rate decision is the main even in European session, Germany will release Gfk consumer sentiment and EUrozone will publish M3 money supply. Later in the day, US will release GDP final, durable goods orders, jobless claims, and pending home sales.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6791; (P) 0.6850; (R1) 0.6881; More...

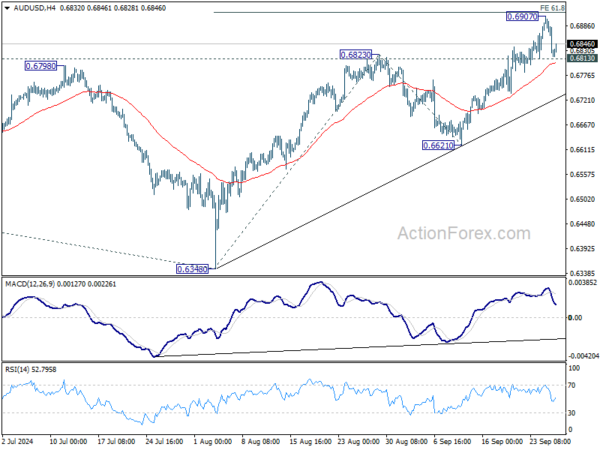

With current retreat, a temporary top is in place at 0.6907 in AUD/USD, just ahead of 61.8% projection of 0.6348 to 0.6823 from 0.6621 at 0.6915. Intraday bias is turned neutral for consolidations first. While deeper retreat cannot be ruled out, outlook will stay bullish as long as 0.6221 support holds. Sustained break of 0.6915 will pave the way to 100% projection at 0.7096 next.

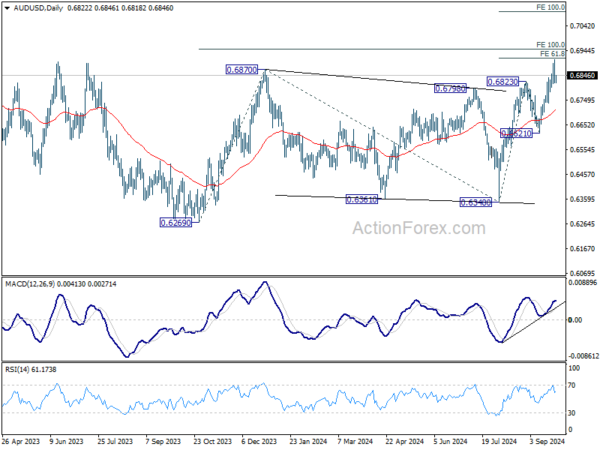

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern, with rise from 0.6269 as the third leg. Firm break of 0.6870 resistance will target 100% projection of 0.6269 to 0.6870 from 0.6340 at 0.6941, and then 138.2% projection at 0.7179. This will now remain the favored case as long as 0.6621 support holds.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Minutes | ||||

| 06:00 | EUR | Germany GfK Consumer Sentiment Oct | -21 | -22 | ||

| 07:30 | CHF | SNB Interest Rate Decision | 1.00% | 1.25% | ||

| 08:00 | CHF | SNB Press Conference | ||||

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Aug | 2.50% | 2.30% | ||

| 12:30 | USD | Initial Jobless Claims (Sep 20) | 226K | 219K | ||

| 12:30 | USD | GDP Annualized Q2 F | 3.00% | 3.00% | ||

| 12:30 | USD | GDP Price Index Q2 F | 2.50% | 2.50% | ||

| 12:30 | USD | Durable Goods Orders Aug | -2.80% | 9.80% | ||

| 12:30 | USD | Durable Goods Orders ex Transport Aug | 0.10% | -0.20% | ||

| 14:00 | USD | Pending Home Sales M/M Aug | 0.90% | -5.50% | ||

| 14:30 | USD | Natural Gas Storage | 52B | 58B |