The forex market continues to display a mild risk-on mood, with commodity-linked currencies Australian, New Zealand, and Canadian Dollars gaining ground. In contrast, safe-haven currencies Japanese Yen, Swiss Franc, and Dollar are under pressure.

Australian Dollar jumps earlier today following RBA’s decision to hold rates steady, combined with China’s broad stimulus package aimed at boosting its sluggish economy. Despite this, New Zealand Dollar has taken the lead as the strongest currency of the day, with Canadian Dollar following closely behind in third place.

Japanese Yen remains the weakest performer, weighed down by rising yields in both the US and Europe. BoJ Governor Kazuo Ueda also reinforced a cautious stance, signaling that the central bank is in no hurry to raise rates, which only adds to Yen’s decline. Swiss Franc, meanwhile, is the second weakest, as traders await Thursday’s SNB rate decision, with growing speculation that the central bank could opt for a larger-than-expected 50bps rate cut.

Dollar is struggling to rebound rebound but remains confined within a narrow range against Euro, suggesting no significant selling yet. Meanwhile, Euro and British Pound are hovering in the middle, with Euro managing to shrug off disappointing German Ifo report. Although there is growing chatter of an ECB rate cut in October, no clear consensus has emerged.

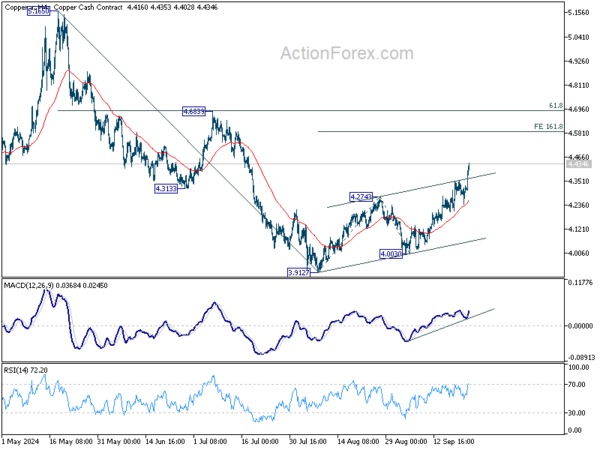

Technically, Copper surges sharply higher on news of China’s stimulus. The strong break of near term channel resistance indicates upside acceleration. Further rally should be seen to 161.8% projection of 3.9127 to 4.2743 from 4.0030 at 4.5581. But to confirm reversal of whole down trend from 5.1650, firm break of 4.6839 cluster resistance (61.8% retracement of 5.1650 to 3.9127 at 4.6866) is needed. But in either case, extended rally in Copper would give Aussie an extra lift.

In Europe, at the time of writing, FTSE is up 0.21%. DAX is up 0.50%. CAC is up 1.24%. UK 10-year yield is up 0.0870 at 4.011. Germany 10-year yield is up 0.041 at 2.197. Earlier in Asia, Nikkei rose 0.57%. Hong Kong HSI Rose 4.13%. China Shanghai SSE rose 4.15%. Singapore Strait Times fell -0.43%. Japan 10-year JGB yield fell -0.0532 to 0.811.

ECB’s Muller cautious on Oct rate decision, eyes Dec for clearer outlook

ECB Governing Council member Madis Muller struck a cautious tone in comments to Bloomberg, noting that it is “too early to express a clear position” regarding the upcoming October rate decision. While a rate cut cannot be entirely ruled out, Muller suggested that the December meeting would provide a clearer picture, supported by updated economic forecasts.

Muller emphasized that recent data signals downside risks for the Eurozone, highlighting a “weaker near-term outlook” for economic growth. He stated, “There’s a bigger probability that economic growth will be lower, not higher, than the expected number outlined in the ECB’s base-case scenario.”

Despite some positive developments, such as the recent slowdown in wage growth, Muller remained concerned about persistently high services inflation. “On the one hand, wage growth has slowed, which implies that inflationary pressures could be lower looking ahead,” he said. “On the other hand, services inflation was very fast according to the latest data. I’d like to see that slow down further.”

Germany’s Ifo falls to 85.4 as economic pressure mounts

Germany’s Ifo Business Climate Index dropped from 86.6 to 85.4 in September, falling below market expectations of 86.1. This decline signals rising concerns for the German economy as key sectors show signs of strain. Current Assessment Index also fell, from 86.5 to 84.4, missing forecasts of 86.0. However, Expectations Index, which reflects sentiment about future economic conditions, remained relatively stable, easing only slightly from 86.8 to 86.3, in line with expectations.

Sectoral data shows widespread weakness. The manufacturing sector posted a significant drop from -17.8 to -21.6, while the services sector also deteriorated, falling from -1.3 to -3.5. The trade sector saw a deeper contraction, with the index dropping from -27.4 to -29.8. On the other hand, construction provided a rare positive, showing a slight improvement from -26.8 to -25.2.

According to the Ifo Institute, “The German economy is coming under ever-increasing pressure.” With multiple sectors showing increasing strain, the data suggests the German economy could remain in a precarious position, adding to recession concerns as the Eurozone’s overall economic prospects look uncertain.

RBA holds rates at 4.35%, remains vigilant on inflation risks

RBA kept the cash rate target unchanged at 4.35% today, as widely anticipated by markets. The central bank stated that data since the August Statement on Monetary Policy have “reinforced the need to remain vigilant to upside risks to inflation.” Maintaining its stance of “not ruling anything in or out,” RBA emphasized its determination to return inflation to target levels and affirmed it will “do what is necessary.”

Regarding the inflation outlook, RBA noted that headline inflation is expected to “fall further temporarily” due to federal and state cost-of-living relief measures. However, it does not foresee inflation returning sustainably to the 2–3% target range until 2026. This suggests that while short-term relief is expected, underlying inflationary pressures remain a concern over the medium term.

BoJ’s Ueda signals no rush to hike rates amid global uncertainties

In a speech today, BoJ Governor emphasized that the central bank will need to thoroughly assess factors such as financial and capital market developments both domestically and internationally, as well as the broader global economic environment. Importantly, Ueda indicated that there is “enough time” to make these evaluations, suggesting that BoJ is not in a hurry to raise interest rates again.

Ueda reaffirmed BoJ’s commitment to adjusting its policy based on its economic and inflation outlook, stating that if the projections in the Outlook Report are met, the BoJ would indeed raise the policy interest rate. However, he also stressed the unpredictability of the current environment.

“Given the high uncertainties surrounding economic activity and prices, unexpected situations may occur,” Ueda noted, adding that policy actions will need to be timely and flexible rather than adhering to any “fixed schedule.”

Ueda further commented on Yen, noting that the recent one-sided depreciation has been partially retraced since August. This, along with a slowdown in the rise of import prices, has reduced the upside risk to inflation driven by higher import costs.

Japan’s PMI manufacturing dips to 49.6, services rises to 53.9

Japan’s PMI manufacturing index ticked down from 49.8 to 49.6, marking its third consecutive month in negative territory. On the other hand, services sector offered some relief as its PMI edged higher, rising from 53.7 to 53.9. Composite PMI slipped from 52.9 to 52.5, indicating a slight softening in growth momentum.

Usamah Bhatti, Economist at S&P Global Market Intelligence, noted that Japan’s private sector expansion carried on through Q3, though at a slower pace. The expansion remained services-led, with the sector showing its strongest growth in five months, while manufacturing output fell back into contraction for the second time in three months.

Bhatti also highlighted that input cost inflation has eased to a six-month low, with both manufacturing and services firms reporting softer cost pressures. However, service providers are increasingly passing higher costs onto customers, as output price inflation ticked up slightly in September. Confidence in the future remains positive, but the overall sentiment has weakened to its lowest level since April 2022.

AUD/USD Mid-Day Report

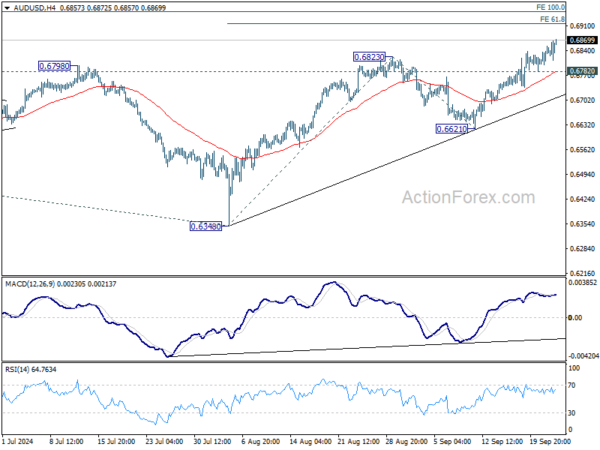

Daily Pivots: (S1) 0.6806; (P) 0.6830; (R1) 0.6862; More...

AUD/USD’s rally is still in progress and intraday bias remains on the upside for 61.8% projection of 0.6348 to 0.6823 from 0.6621 at 0.6915. On the downside, below 0.6736 minor support will turn intraday bias neutral first. But outlook will remain cautiously bullish as long as 0.6621 support holds, in case of retreat.

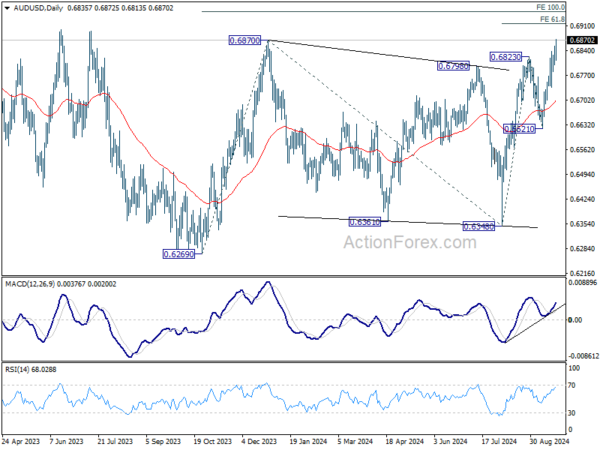

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern, with rise from 0.6269 as the third leg. Firm break of 6870 resistance will target 100% projection of 0.6269 to 0.6870 from 0.6340 at 0.6941. In case of another fall, strong support should be seen from 0.6169/6348 to bring rebound.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 00:30 | JPY | Manufacturing PMI Sep P | 49.6 | 49.9 | 49.8 | |

| 00:30 | JPY | Services PMI Sep P | 53.9 | 53.7 | ||

| 04:30 | AUD | RBA Interest Rate Decision | 4.35% | 4.35% | 4.35% | |

| 05:30 | AUD | RBA Press Conference | ||||

| 08:00 | EUR | Germany IFO Business Climate Sep | 85.4 | 86.1 | 86.6 | |

| 08:00 | EUR | Germany IFO Current Assessment Sep | 84.4 | 86 | 86.5 | |

| 08:00 | EUR | Germany IFO Expectations Sep | 86.3 | 86.3 | 86.8 | |

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Jul | 5.90% | 5.90% | 6.50% | |

| 13:00 | USD | Housing Price Index M/M Jul | 0.10% | 0.20% | -0.10% | 0.00% |

| 14:00 | USD | Consumer Confidence Sep | 103.5 | 103.3 |